[ad_1]

US Dollar (DXY) Price and Chart Analysis

- US dollar using prior resistance as a new base.

- US PMIs are expected to pick up but remain in contraction territory.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

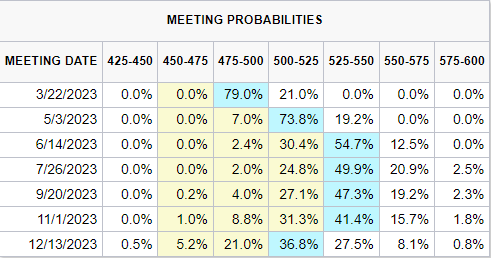

The US dollar is back in action after a three-day weekend and is moving modestly higher in early European turnover. The greenback has been pushing higher of late, aided by higher US Treasury yields, as investors continue to price in higher for longer interest rates. The terminal rate in the US – a rate seen as neither restrictive nor accommodative – is now seen at 5.29%, suggesting a 5.25%-5.50% Fed Fund rate. The current FF rate is 4.50% to 4.75%.

Recommended by Nick Cawley

Building Confidence in Trading

US PMIs May Add Market Context

Later today the latest US PMIs will be released, a forward-looking indicator followed by many in the market. The S&P global composite PMI is expected to move higher to 47.5 from 46.8 in January. A reading above 50 indicates expansion while a reading below 50 points to economic contraction. While today’s PMIs – released 14:45 GMT – will garner market interest, tomorrow’s FOMC minutes will likely be more influential, especially after the constant hawkish rhetoric heard over the last two weeks. If the minutes show that some Fed members had pushed for a 50 basis point rate, then the market may re-price their terminal rate projections even higher.

For all market-moving data releases and economic events see the real-time DailyFX Calendar.

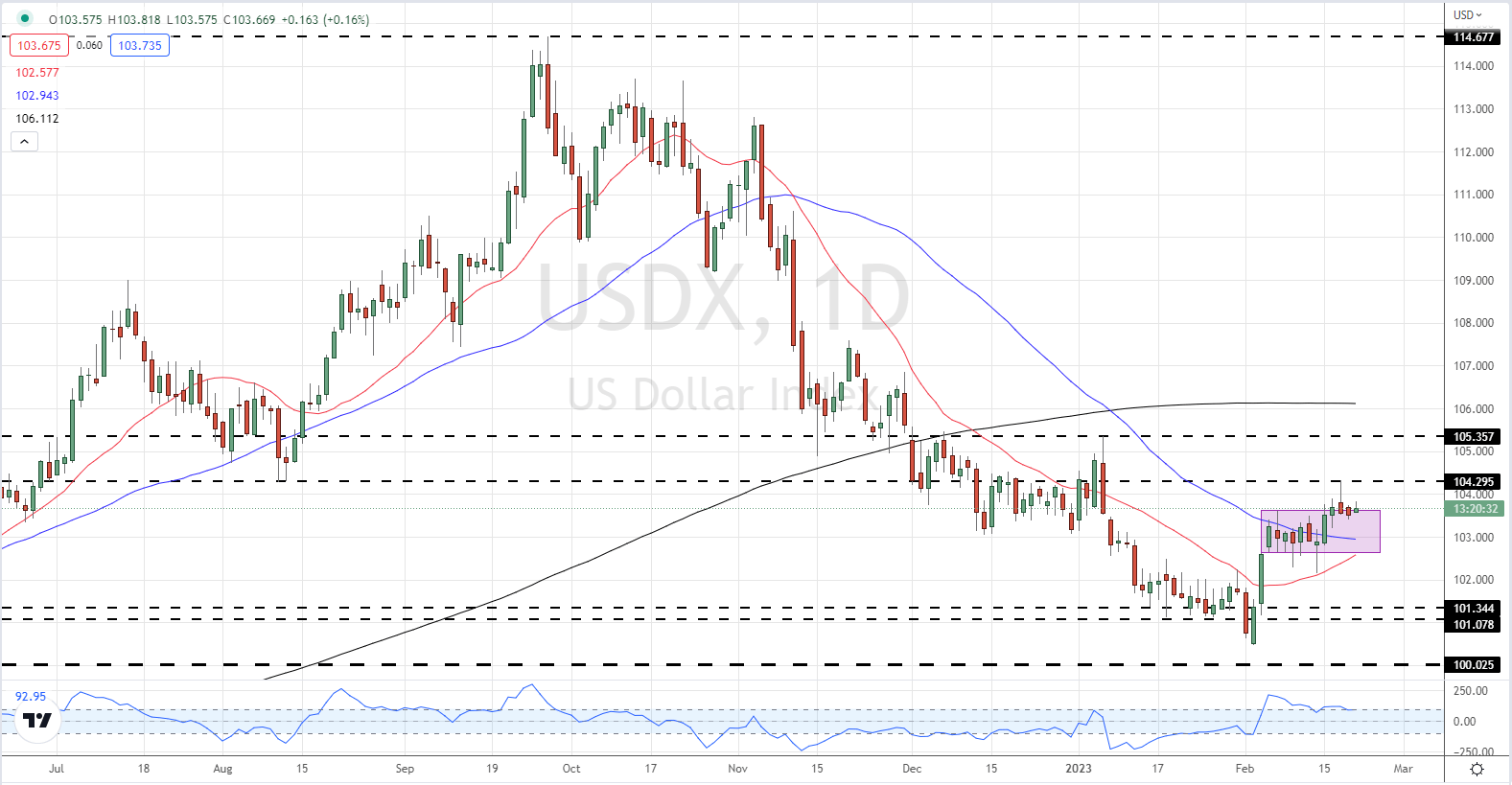

The hawkish Fed talk and the re-pricing of US interest rate expectations can be seen clearly in the US dollar index (DXY). The greenback halted a longer-term sell-off at the start of February and turned sharply higher post-US NFPs. The USD now trades comfortably above both the 20- and 50-day moving averages and is now using a prior area of resistance as a new area of support. The next level of resistance is situated at 104.30 while there is a small zone of support all the way down to 102.94 (20-dma) that should hold in the current environment.

US Dollar (DXY) February 21, 2023

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]