[ad_1]

US CONSUMER CONFIDENCE KEY POINTS:

- February U.S. consumer confidence slumps for the second month in a row, missing expectations calling for a rebound to 108.5

- The large decline in the headline index can be attributed to sharp pullback in the survey’s expectations component

- The U.S. dollar retains a negative bias after sentiment data cross the wires

Recommended by Diego Colman

Get Your Free USD Forecast

Read More: British Pound Holds the Bounce as US Dollar Pauses with Fed Firm on 2% Inflation Goal

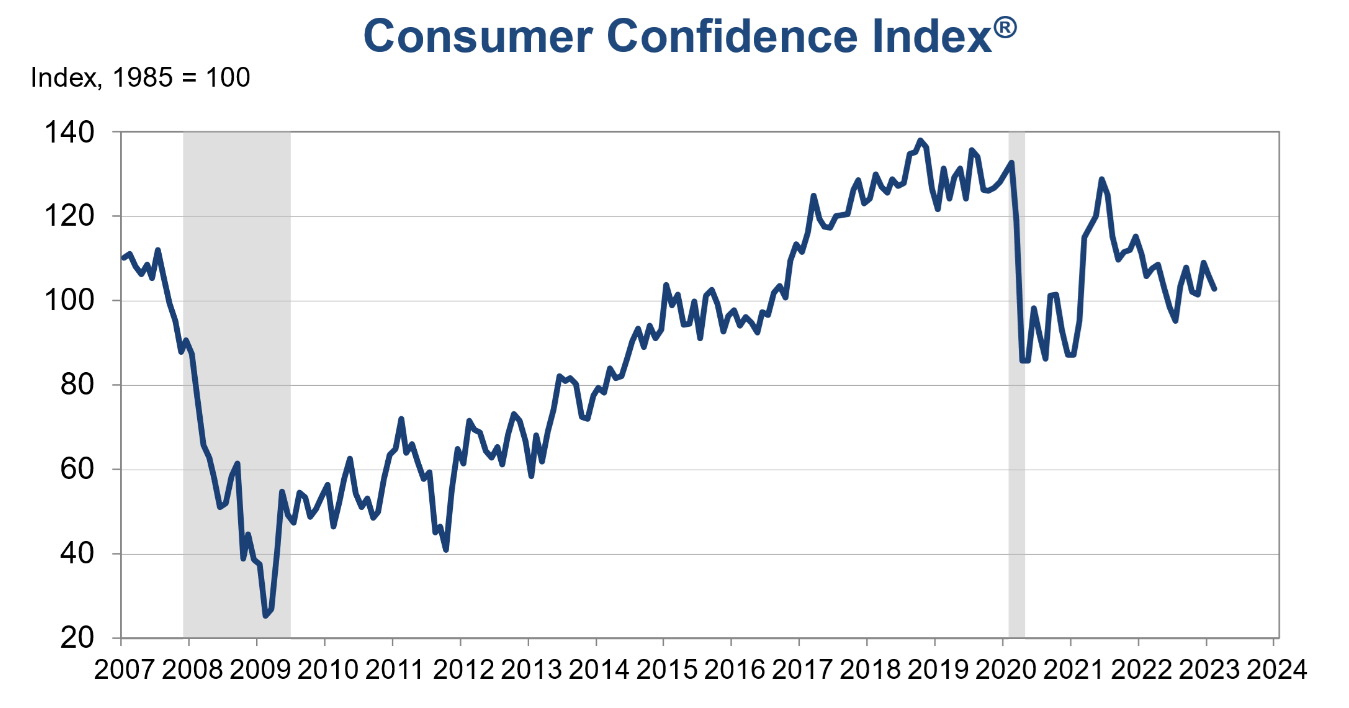

A popular gauge of U.S. consumer attitudes deteriorated significantly in February, worsening for the second month in a row, a sign that Americans are becoming more pessimistic about the economic outlook amid persistently high inflation and rapidly rising interest rates.

According to the Conference Board, consumer confidence fell to 102.90 this month from a downwardly revised figure of 106.00 in January, missing consensus estimates calling for a modest recovery to 108.5 and hitting its lowest level since November 2022.

Looking at survey’s individual components, the present situation index, based on the assessment of business and jobs market conditions, increased to 152.8 from 151.1, but the expectations indicator, which tracks short-term prospects for income, the business environment, and employment opportunities, took a nosedive, plunging to 69.7 from 76.00 previously.

US CONSUMER CONFIDENCE CHART

Source: Conference Board

Worse-than-anticipated sentiment numbers suggest that consumer spending could begin weakening at a moment’s notice, increasing the likelihood of a downturn, as household consumption accounts for the largest share of U.S. GDP.

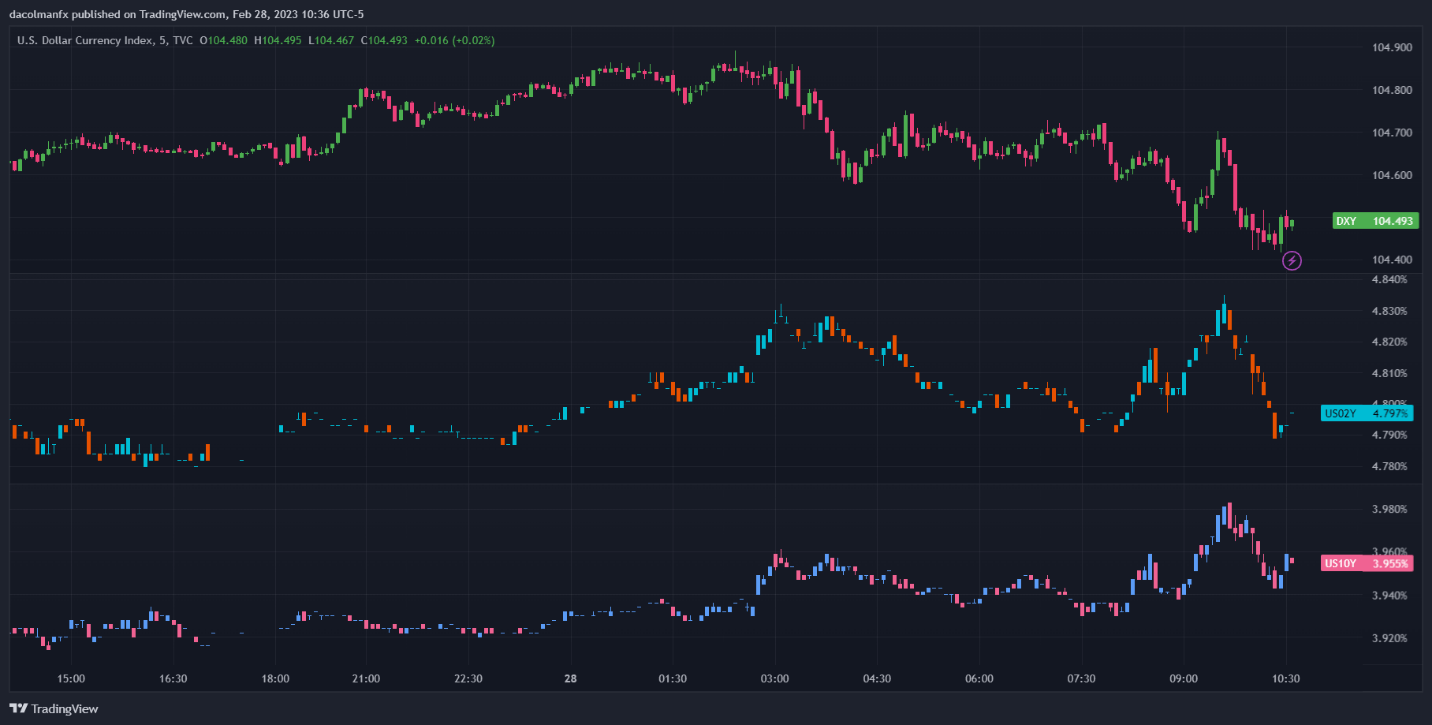

The U.S. dollar, as measured by the DXY index, extended losses after the survey’s results crossed the wires as U.S. Treasury yields pared their session’s gains. Over the past few weeks, markets repriced higher the path of the Fed’s monetary policy outlook on account of resilient economic data, but expectations could soon change if the slump in confidence led to a significant pullback in consumer spending. Why? Because this could lead to softer demand and receding inflationary pressures.

Recommended by Diego Colman

Trading Forex News: The Strategy

US DOLLAR VERSUS TREASURY YIELDS

Source: TradingView

[ad_2]