US Dollar, USD, DXY Index, Treasury Yields, SVB, US CPI, Crude Oil, Gold – Talking Points

- The US Dollar took a breather today as uncertainty swirls around banks

- Treasury yields have had a wild ride but have managed to recover somewhat today

- If US CPI is outside of expectations, will it move the dial on the Fed rate hike path?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

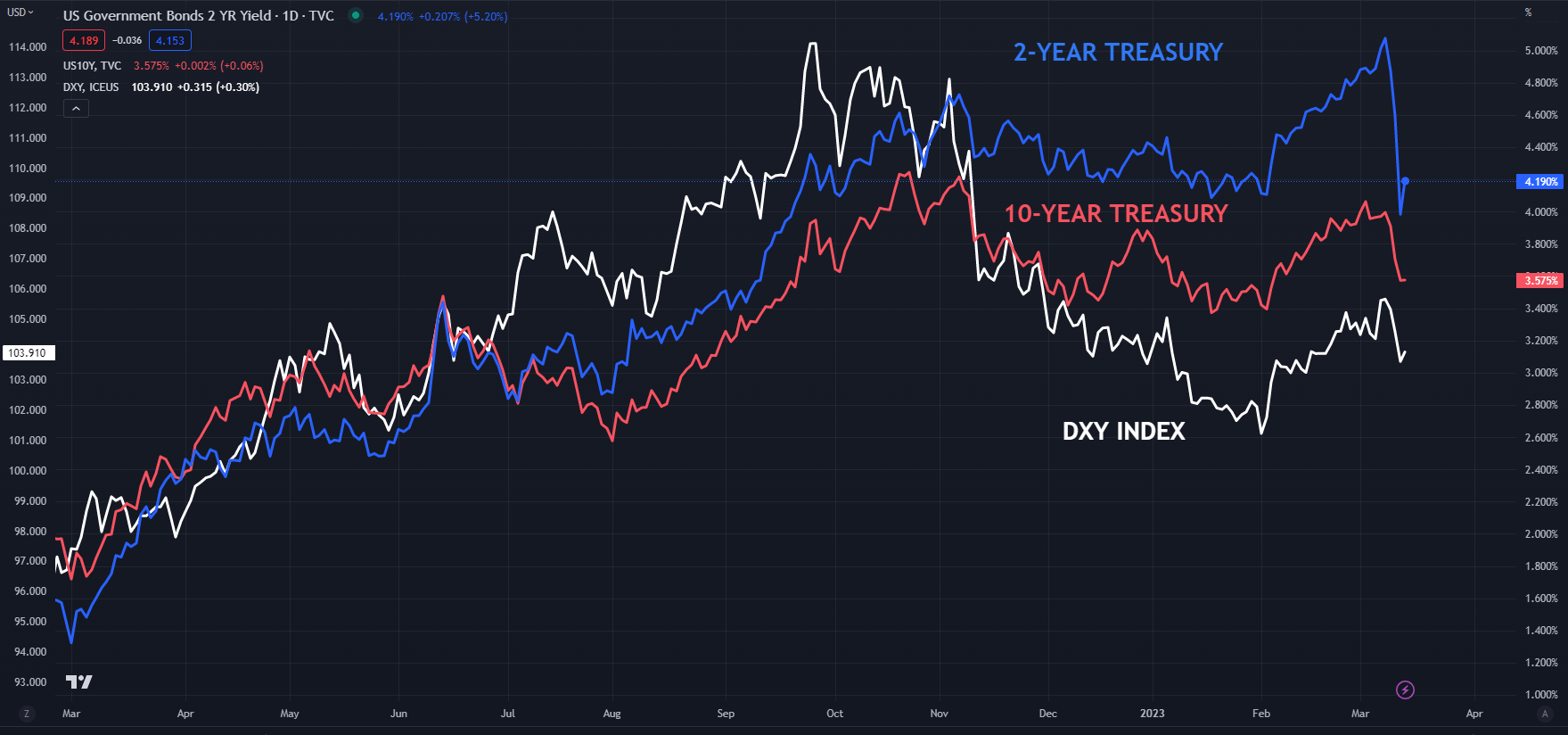

The US Dollar descent has paused so far today after a torrid start to the week. Treasury yields have climbed across the curve, but they remain a long way from the heights seen last week.

The benchmark 2-year note nudged 4.20% in the Asian day after having dipped to 3.94% overnight, well below 5% plus this time last week.

The repercussions of the failure of SVB and Signature Bank are still playing out. The stock prices of US regional banks are seeing enormous losses, but the large-cap banks are holding up relatively well, although still in the red.

Regardless the KBW bank index, an index of 23 listed banking names in the US, is down from nearly 116 at the start of this month to trade below 80 overnight.

Broader Wall Street steadied in the Monday cash session and futures are so far pointing toward a positive start to their day ahead.

APAC equity indices are all underwater with Japan leading the way lower. Sharp declines in banking stocks there dragged the TOPIX index down over 3% at one stage.

Given the pressure on the technology sector, it is no surprise that Korea’s KOSDAQ index is also notably lower, down over 2.5%.

Recommended by Daniel McCarthy

How to Trade EUR/USD

In all the turmoil, gold has held onto recent gains as a combination of collapsing real yields, USD weakness and a run to perceived safety appear to have boosted the precious metal.

Crude oil dipped lower in the North American session before recovering into the close. It has slipped a touch going into the European session with the WTI futures contract near US$ 74 bbl while the Brent contract was around US$ 80 bbl at the time of going to print.

This brings into focus today’s US CPI number and its consequences for the Federal Open Market Committee (FOMC) meeting next week. No matter what the print is, uncertainty appears to be the only certainty. A Bloomberg survey of economists is anticipating a 0.4% month-on-month CPI increase for February.

Pan-European inflation figures will continue to come through today and tomorrow ahead of the European Central Bank’s (ECB) meeting on Thursday.

The full economic calendar can be viewed here.

DXY (USD) INDEX AGAINST TREASURY 2- AND 10-YEAR

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter