[ad_1]

Australian Dollar Forecast: Bearish

Recommended by Daniel McCarthy

Forex for Beginners

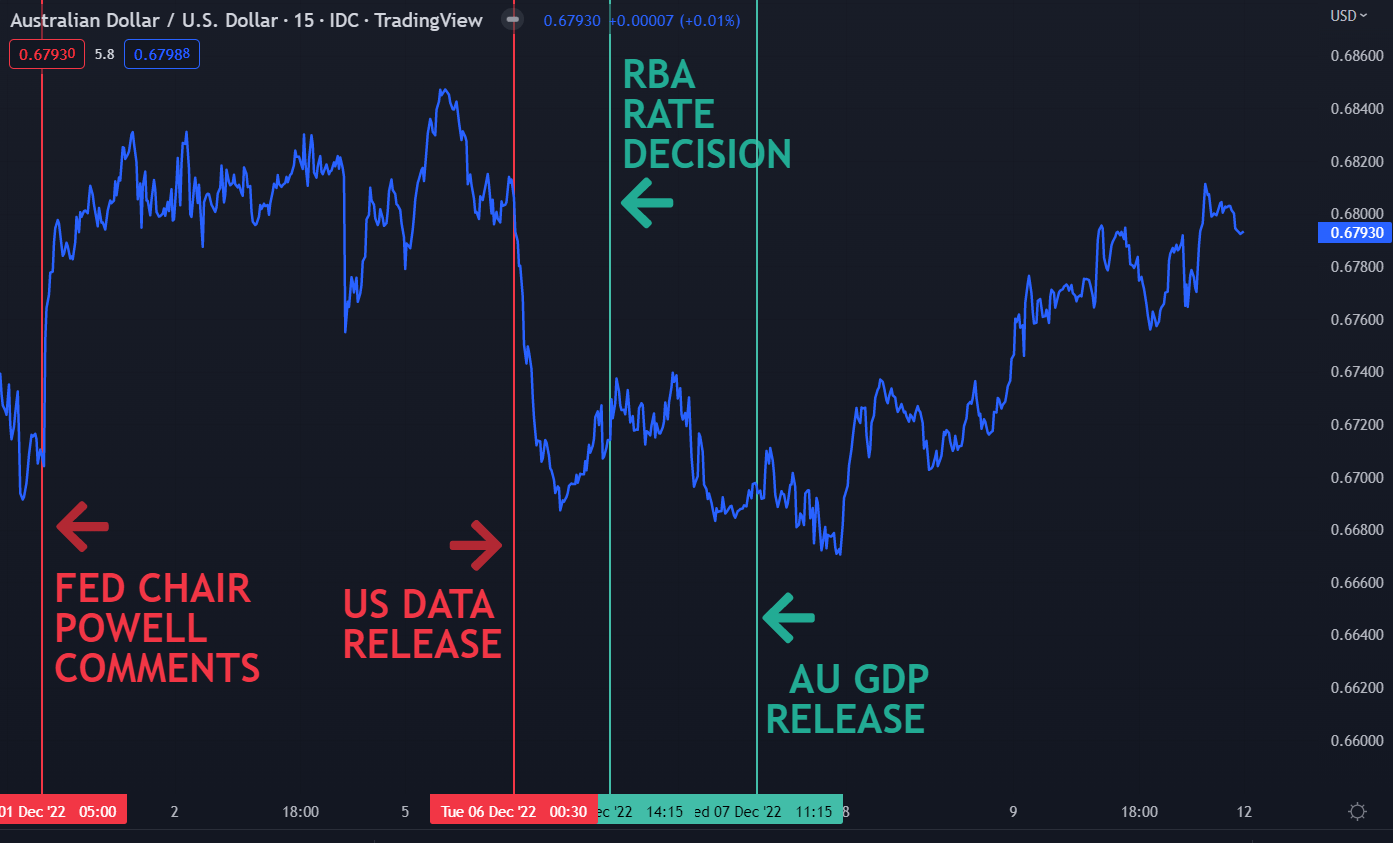

The Australian Dollar tumbled through the first few days of last week before steadying going into the weekend on a run up toward 68 cents.

The RBA rate decision had little impact on the currency but the Federal Reserve’s decision this week could play a bigger role,

The initial sell-off in AUD/USD was a result of the US Dollar launching higher in the aftermath of strong US data reminding markets that the Fed might have some more heavy lifting to do to rein in inflation.

The RBA hiked by 25 basis points on Tuesday, but the market hardly blinked at the move as it was mostly expected. This brings the monetary policy tightening total for this cycle to 300 basis points (bps) since May.

The accompanying statement maintained the course that the bank has made clear for some time now. That is, the jobs market is tight, growth is solid, inflation is anticipated to peak at 8% before easing and a wage-price spiral is to be avoided.

Recommended by Daniel McCarthy

How to Trade AUD/USD

Mainstream media has been putting the boot into the central bank recently, with some commentators seemingly forgetting the damage that high and unstable price increases can wreak on an economy.

While their audience is feeling the stress of increased mortgage repayments, untamed inflation has the potential to destroy wealth for decades, rather than a year or two.

The RBA made a subtle reference to this in their statement when they said, “High inflation damages our economy and makes life more difficult for people.”

The economic benefit to Australian society of a mandated inflation-targeted monetary policy regime appears to have gotten lost in the race to populist and sensationalist commentary. Some economists and politicians need to re-assess their knowledge of how macroeconomics work.

If they understood some of the basic principles, they would not be making the statements that they are. It is easy to sit on the sidelines when rates are coming down, but it takes fortitude and foresight to make the right decisions that need to be made now to control inflation.

The psychology of many Australians toward a mentality that property prices must always go up is fundamentally flawed. True economic benefits are only delivered by productivity gains. It’s time for the adults in the room to make their voices heard.

The Federal Open Market Committee (FOMC) will be deciding on the target cash rate early Friday morning Australian Eastern Standard Time (AEST). A 50 bp hike is widely anticipated.

The accompanying comments from Fed Chari Powell will be scrutinised for the rate path ahead and could be the driver of direction for the Aussie Dollar.

Comparing the Fed to the RBA, one can’t help but ponder that if there wasn’t so much domestic pressure on the RBA, the local cash rate might be higher by now.

AUD/USD CHART

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

[ad_2]