[ad_1]

US Dollar, DXY Index, USD, FOMC, USD/KRW, AUD/USD, China – Talking Points

- US Dollar weakened in Asia after a stellar run in the New York close

- Korea left rates unchanged, while the Aussie Dollar got a boost on solid data

- The Fed reminded markets of their intention. Will it send USD higher?

Recommended by Daniel McCarthy

Traits of Successful Traders

The US Dollar pulled back from overnight gains posted after the Federal Open Market Committee (FOMC) meeting minutes revealed a united board that supported the 25 basis point move at the gathering earlier month

The minutes reinforced the notion that the Fed is determined to get inflation under control and that any rate cuts are a long way off. This is something that they have verbalised on many occasions but perhaps has not been fully comprehended by markets.

The interest rate swap and futures markets now have 25 bp hikes for the next three FOMC meetings in March, May and June. Treasury yields are slightly softer with the hope that the Fed will get inflation under control further down the track.

New York Fed President John Williams was also on the wires yesterday and reiterated his hawkish stance as he emphasised the need to get price pressures under control.

In an interview on Bloomberg television, Band of International Settlements (BIS) Settlements CEO Augustin Carstens said that fiat currencies have won the battle over cryptocurrencies. Bitcoin remains below USD 25,000, trading near USD 24,600 at the time of going to print.

The Bank of Korea (BoK) left rates unchanged at 3.50% despite CPI currently running at 5.2% y/y. BoK Governor Rhee Chang-yong said in the post-decision press conference that more hikes can still happen despite the pause. Nonetheless, USD/KRW dipped under 1300.00.

The Australian Dollar has been the best-performing currency today after private capital expenditure data showed growth of 2.2% q/q over 4Q 2022 rather than the 1.0% forecast. The prior quarter was also revised up to 0.6% from -0.6%

Crude oil steadied after heavy losses yesterday with the WTI futures contract back above US$ 74 bbl and the Brent contract nudging US$ 81 bbl.

APAC equities have had a quiet day with Japan on holiday and futures are indicating a solid start to the Wall Street session later today.

Elsewhere, China instructed state-owned enterprises to stop using the top 4 auditing firms Deloitte, EY, KPMG and PWC.

The directive comes after Beijing agreed to auditors examining the books of Chinese firms listed on US exchanges last year. This action prevented these companies from being kicked out of the US.

Looking ahead, after Euro-wide CPI, US GDP data will be keenly watched by the market.

The full economic calendar can be viewed here.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

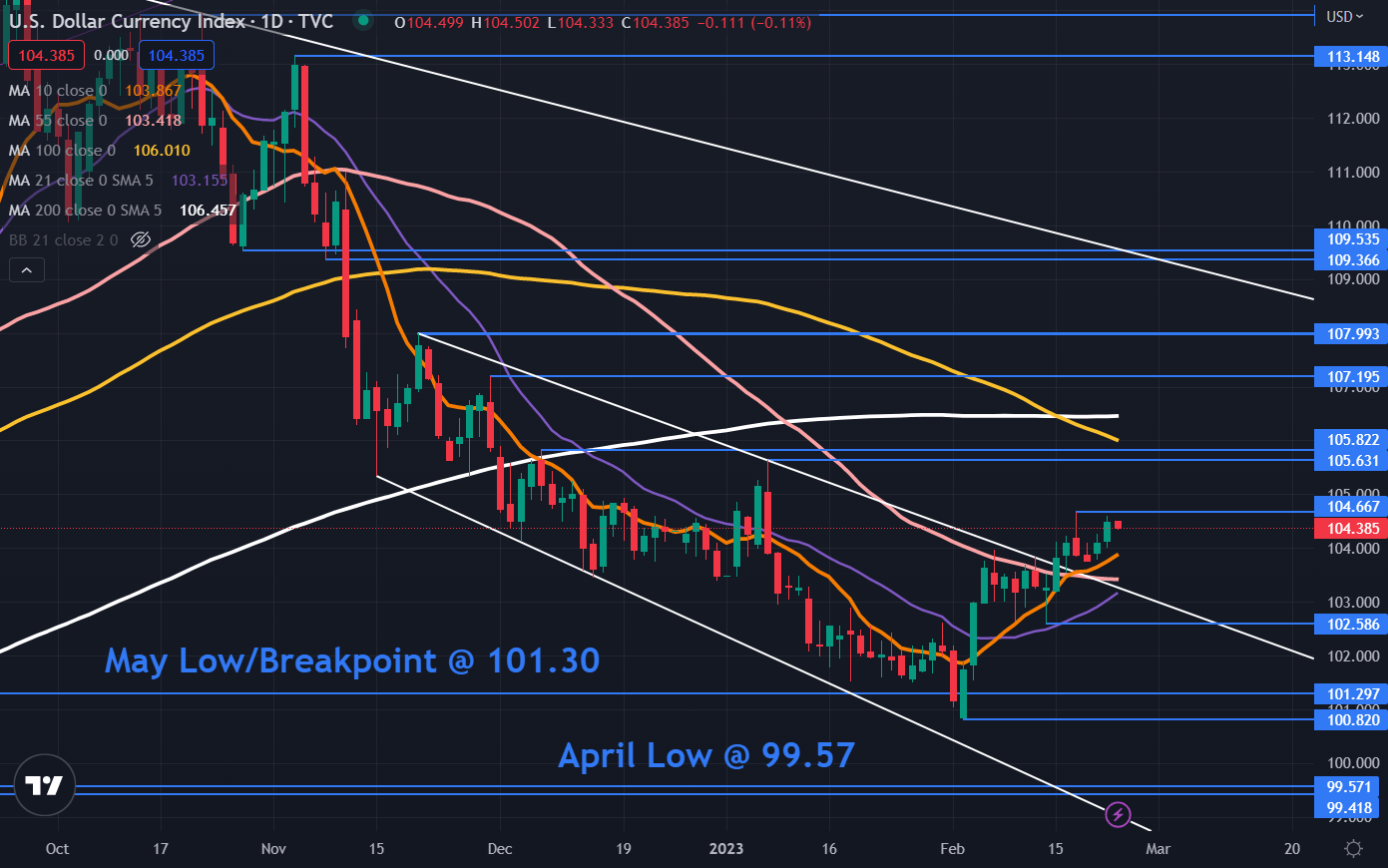

DXY (USD) INDEX TECHNICAL ANALYSIS

The DXY index broke above a descending trend channel and has consolidated above it, which might suggest that the bearish trend could be pausing or might be over.

Fortifying the break, the price also moved above 10-, 21- and 55-day simple moving averages (SMA). This could suggest that bullish short and medium term is potentially evolving.

The longer-term 100- and 200-day SMAs hang above the price and a move above these may confirm unfolding bullish and that a new is possibly emerging.

Resistance might be at the prior peaks of 104.67, 105.63 and 105.82. On the downside, support could be at the previous lows and breakpoints of 102.58, 101.30 and 100.82.

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

[ad_2]