US INFLATION EXPECTATIONS KEY POINTS:

- New York Fed one-year consumer inflation expectations remain unchanged at 5.0%, while the three-year-ahead gauge eases to 2.7% from 2.9%. For its part, the five-year outlook ticks up modestly to 2.5% from 2.4%

- Today’s benign survey’s data fail to spark a significant market reaction as traders await the latest CPI report

- January headline inflation is seen clocking in at 0.5% m-o-m and 6.2% y-o-y. Elsewhere, the core measure is expected to print at 0.4% on a seasonally adjusted basis and 5.5% in the last 12-months

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: US Dollar Forecast – US Inflation Data to Guide Bond Yields, Fed Tightening Path

U.S. households’ outlook for inflation was little changed at several time horizons, according to a monthly survey released this morning by the Federal Reserve of New York. The data showed that inflation expectations for the year ahead remained unchanged at 5.0%, whereas the three-year gauge fell modestly to 2.7% from 2.9%. Meanwhile, the five-year outlook inched higher to 2.5% from 2.4% previously.

Today’s results did not trigger significant volatility as traders continue to await the latest consumer price index report to make a more informed assessment of the inflation trajectory, with January’s figures due to be released on Tuesday morning.

Headline CPI is forecast to have risen 0.5% on a seasonally adjusted basis at the outset of the year, bringing the annual rate to 6.2% from 6.5%. The core measure, for its part, is seen clocking in at 0.4% month-over-month, in line with December’s reading. This would bring the year-on-year print to 5.5% from 5.7%, a small but welcome directional improvement.

Any upside surprise in tomorrow’s report will be beneficial for the U.S. dollar and add momentum to its recovery seen in recent weeks. On the flip side, if inflationary pressures abate more than anticipated, the greenback is likely to sell off as Wall Street reprices lower the path of FOMC hikes.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Related Reading: US Bond Yields Rally Further Ahead of a Major US Inflation Report

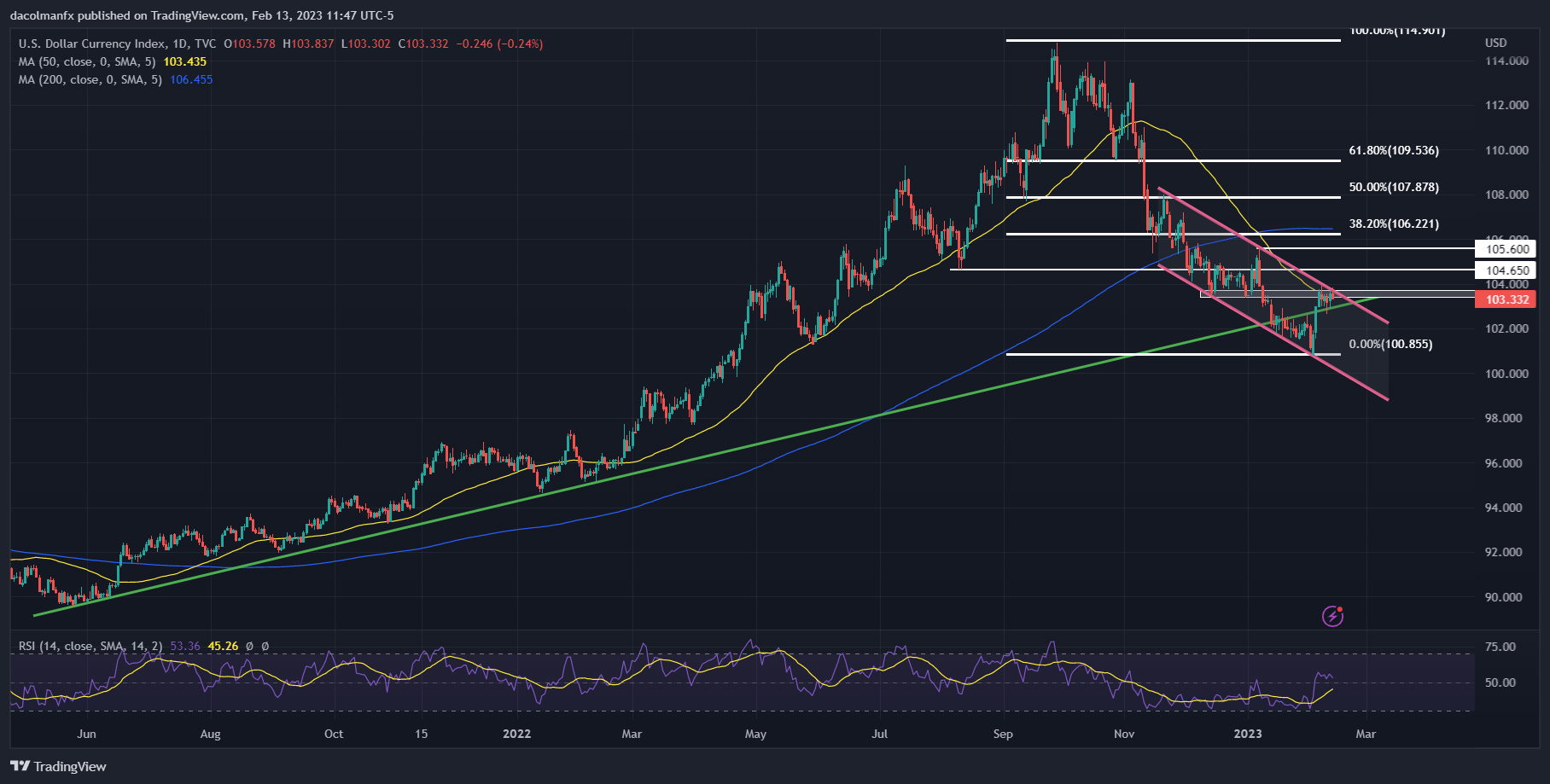

In terms of technical analysis, the DXY index appears to be consolidating slightly below channel resistance near 103.80/104.00. Traders should watch this region carefully in the coming sessions. If bulls manage to trigger a breakout, we could see a move towards 104.65, followed by a retest of January’s high.

On the flip side, if prices are rejected from current levels, the first support to keep an eye on rests near the 103.00-handle, a floor created by a long-term ascending trendline. Below this area, the focus shifts to the 2023 lows.