[ad_1]

S&P 500, Nasdaq News and Analysis

- US banks band together in display of confidence in the banking sector

- Risks of contagion remain in Europe: Credit Suisse

- S&P 500 and Nasdaq technical levels analysed ahead of crucial FOMC next week

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

How to Trade FX with Your Stock Trading Strategy

US Banks Band Together in Display of Confidence in the Banking Sector

The biggest banks in the US placed $30 billion in deposits at struggling First Republic Bank in the wake of increased withdrawals from nervous customers at midsized US banks. The first domino to fall was Silicon Valley Bank, followed by Silvergate Bank and Signature Bank.

While the treasury department assures the public that American banks are sufficiently capitalized, declining sentiment and faith in the overall banking sector has dragged down the share prices of even the largest, more highly regulated US banks.

In a show of confidence, 11 of the country’s biggest banks, under consultation with the US Treasury Secretary Janet Yellen and regulators in Washington, placed $30 billion worth of deposits with First Republic Bank – something that markets have responded to in a positive light. The larger banks have seen an uptick in deposits as they have been seen as safer alternatives to the midsized banks whose depositor profiles are heavily concentrated in the tech or crypto sectors.

The size of each individual bank’s deposits are well in excess of the FDIC insured limit in the event of a failure, meaning the large banks are sending a message to the public that the banking system is resilient and stable.

Risks of Contagion Remain in Europe

Elsewhere, the negative sentiment that has been following Credit Suisse around prior to the recent banking developments was further exacerbated when its main shareholder, the Saudi National Bank, publicly stated it cannot be relied upon for more financial support. Yesterday, news of a CHF 50 billion loan from the Swiss National Bank and an announcement that the bank looks to reduce some of its senior debt sent the share price up as much as 33% in the premarket. The 50 basis point hike by the ECB despite the turmoil suggests the central bank has complete faith in its tools that can be deployed should they need to, mainly via the Transmission Protection Instrument.

Technical Rebounds in US Equities as Markets Digest Fed, Bank Reassurances

The $30 billion show of support as well as various assurances by the US Federal Reserve Bank such as buying bonds from banks at par value led a resurgence in US equities

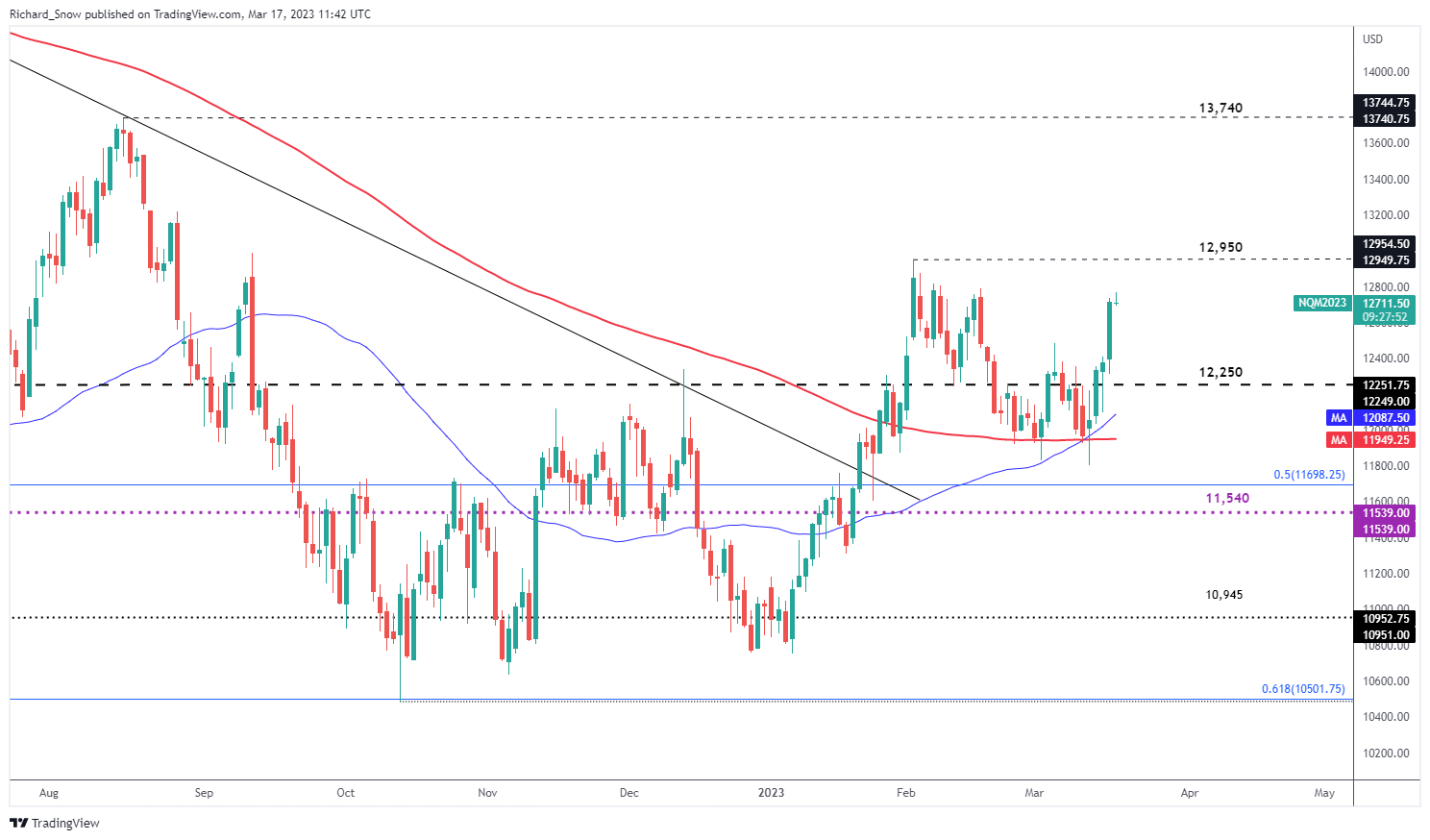

The Nasdaq chart below (e-mini futures) shows the golden cross (crossing of the 50 SMA over the 200 SMA), typically a bullish signal. The tech concentrated index responded well to recent assurances, trading above 12,250, now eyeing the Feb swing high of 12,950.

With the Fed still due to decide whether it will even hike rates next week, there remains a fair amount of risk to the downside. Although, the Fed are further down the road in the fight against inflation and potentially has more leeway to discuss possibly holding rates unchanged next week. Prior resistance becomes support at 12,250, followed by the 50 SMA (blue).

Nasdaq (NQ1!) Futures Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Improve your trading with IG Client Sentiment Data

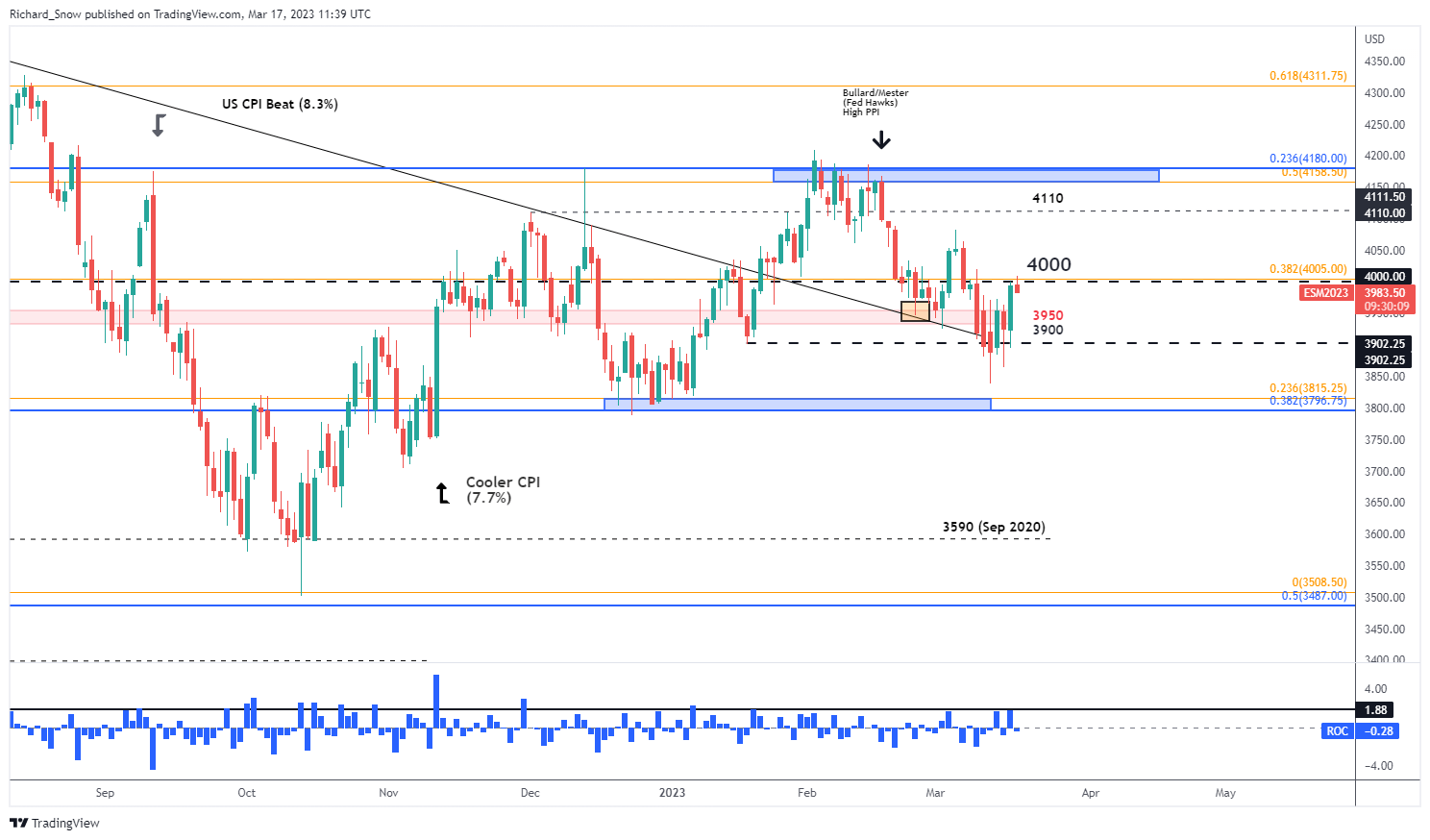

The S&P 500 via the continuous e-mini futures chart also shows a recovery in price and sentiment towards the psychological 4000 mark. The recent bullish bounce back remains within the 3900 – 4000 channel where the potential for another leg lower remains a possibility. The rate of change indicator at the bottom of the chart revealed that yesterday’s sizeable move was the largest single day gain since early January.

S&P 500 (ES1!) Futures Daily Chart

Source: TradingView, prepared by Richard Snow

| Change in | Longs | Shorts | OI |

| Daily | -7% | 16% | 3% |

| Weekly | -11% | 22% | 3% |

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]