CANADIAN DOLLAR OUTLOOK:

- USD/CAD deepens pullback as market mood improves and oil extends its recovery

- The Canadian dollar retains a constructive technical outlook for now

- High-beta currencies, however, remain in a vulnerable position and sensitive to changes in global sentiment following the recent turmoil in the U.S. banking sector

| Change in | Longs | Shorts | OI |

| Daily | 19% | -14% | 1% |

| Weekly | 50% | -28% | 0% |

Most Read: US Dollar Outlook: Path of Least Resistance is Lower after Fed Ditches Hawkish View

The Canadian dollar has strengthened against the U.S. dollar in recent days amid improving mood and a dovish repricing of the Fed’s monetary policy outlook following the fallout from the turmoil in the U.S. banking sector, which led to the failure of two mid-sized regional lenders earlier this month (SVB and SBNY).

The loonie has also benefited from the recovery in energy markets, with crude oil up around 15% from its March 20 lows in response to supply disruption risks in the Middle East. Canada is a major hydrocarbon exporter, so the country’s currency tends to appreciate when fossil fuel prices rise due to better terms of trade.

Against this backdrop, USD/CAD has fallen more than 1.2% this week and currently trades near the 1.3575 level, with the exchange rate exhibiting a modest bearish tone on Wednesday amid risk-on bias on Wall Street.

With demand for safe-haven assets waning and key commodities rebounding, the Canadian dollar may have more upside in the near term, but the broader high-beta FX space will remain in a vulnerable position and sensitive to changes in global sentiment, which could sour in the blink of an eye.

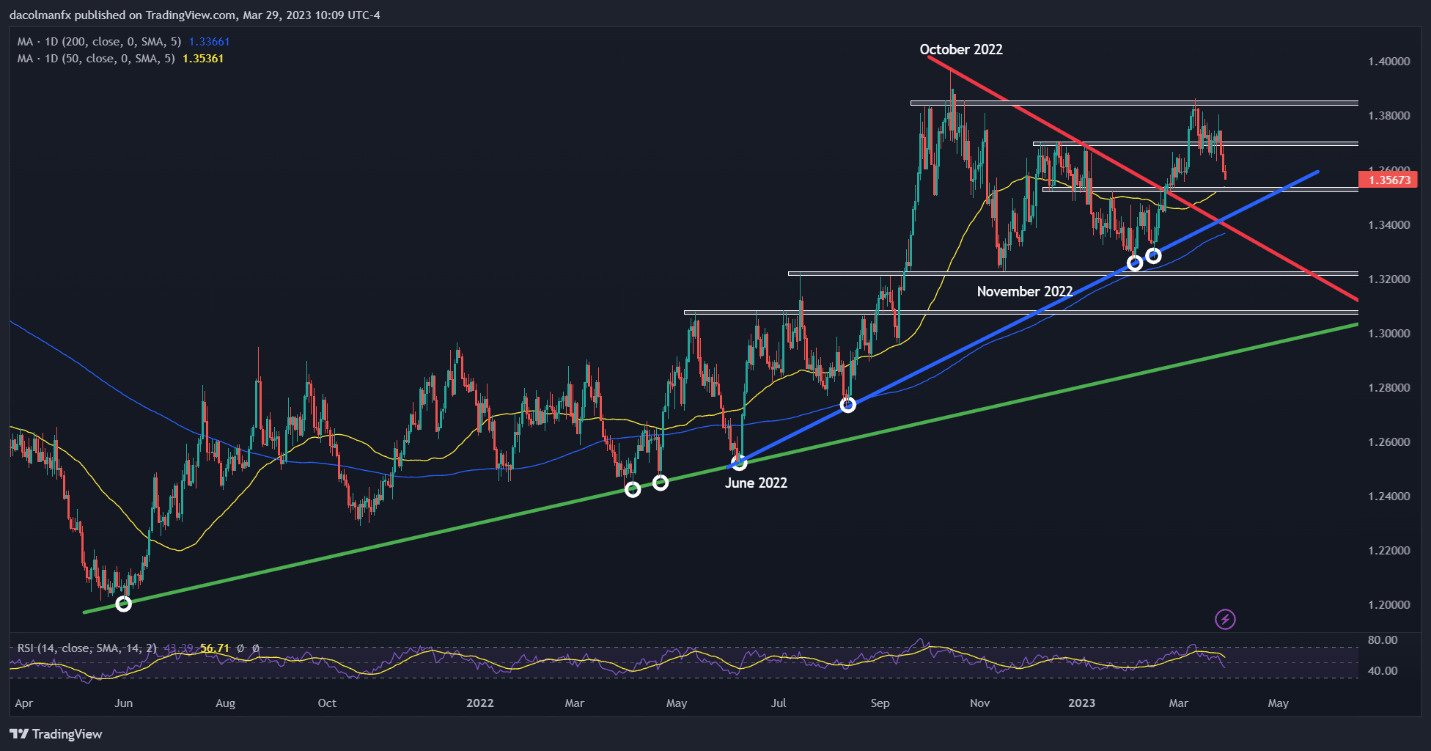

From a technical perspective, USD/CAD has been retreating towards a key floor in the 1.3540-1.3520 area near the 50-day simple moving average. If sellers manage to push the pair below this region and achieve a decisive breakdown, selling momentum could accelerate, paving the way for a drop toward trendline support at 1.3430.

On the flip side, if buyers regain control of the market and spark a meaningful bullish reversal, initial resistance rests around the psychological 1.3700 handle. On a topside breakout, the focus shifts to the 2023 high just a touch below 1.3865.

Recommended by Diego Colman

Forex for Beginners