[ad_1]

Japanese Yen (USD/JPY) Price and Chart Analysis

- USD/JPY moves higher as banking fears calm.

- New BoJ deputy governor mulls yield curve control tweaks.

Recommended by Nick Cawley

How to Trade USD/JPY

For all market-moving data releases and economic events see the real-time DailyFX Calendar.

The Japanese Yen, one of a handful of global safe-haven assets, is drifting lower against the US dollar as fears of further banking failures abate. The swift action taken by governments and central banks alike, and the provision of near-unlimited liquidity, has helped to restore faith in the banking sector, for now at least, leaving safe-haven assets at risk. The move lower in the Japanese Yen is fairly limited and will likely remain that way in the short- to medium-term term until the banking sector gets the all-clear.

New Bank of Japan deputy governor Shinichi Uchida spoke Wednesday and said that the central bank would look at the current loose monetary policy, including yield curve control, and amend it if necessary.

“If various conditions fall in place, some sort of change to yield curve control may become necessary. If conditions turn positive, (a tweak) will undoubtedly become a possibility,” Mr. Uchida said.

The BoJ has kept Japanese bond yields at ultra-low levels since 2016 in an effort to achieve sustainable and stable inflation of 2%. While inflation in Japan is currently running hot around 4%, the central bank see inflation falling back below target (2%) this year.

Japanese PM Talks Wage Hikes

Earlier today, Japanese Prime Minister Fumio Kishida said that the government wanted to reduce the wage gap between Japan and overseas. Mr. Kishida said that ‘wage hikes will be one of the three pillars of new capitalism’ and that his government is ‘aiming to draw up guidelines for steps including wage hikes’. Higher wages in Japan will help fuel more persistent inflation and may see the BoJ tightening monetary policy, including reining in yield curve controls.

Recommended by Nick Cawley

Trading Forex News: The Strategy

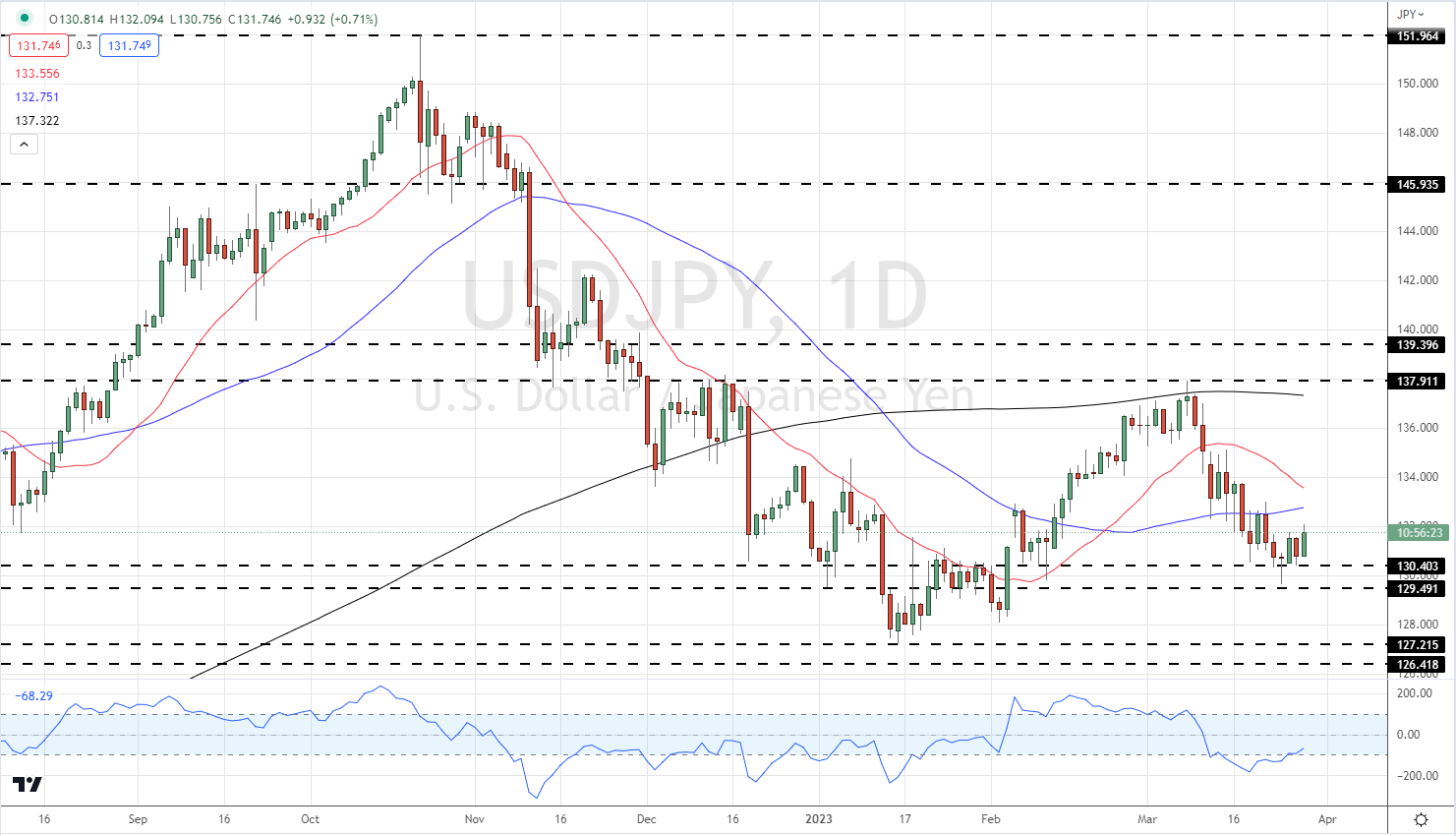

USD/JPY remains under pressure for now with the pair trading below all three moving averages, a negative set-up. A move higher would find initial resistance around 132.55 before 132.75 and 133.00 come into focus, while a recent cluster of lows on either side of 130.45 will provide initial support.

USD/JPY Daily Price Chart

Charts via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 3% | 5% | 4% |

| Weekly | 8% | 1% | 5% |

Retail trader data shows 47.76% of traders are net-long with the ratio of traders short to long at 1.09 to 1.The number of traders net-long is 6.89% lower than yesterday and 6.91% higher from last week, while the number of traders net-short is 1.32% lower than yesterday and 3.41% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed USD/JPY trading bias.

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]