[ad_1]

USD/ZAR Talking Points:

Recommended by Tammy Da Costa

Forex for Beginners

USD/ZAR extends losses ahead of FOMC as Fed decision looms

USD/ZAR is heading towards another zone of critical support ahead of the last FOMC meeting for 2022. With recent US CPI suggesting that inflation could be on track to continue to decline, focus has shifted to the economic projections.

DailyFX Economic Calendar

While investors continue to look for signs of when the Federal Reserve could end its restrictive tightening regime, a resilient Rand has benefited from a weaker greenback. As the EM (emerging market) currency falls to a daily low of 17.062, this layer of support could be key for the short-term move.

USD/ZAR Technical Analysis

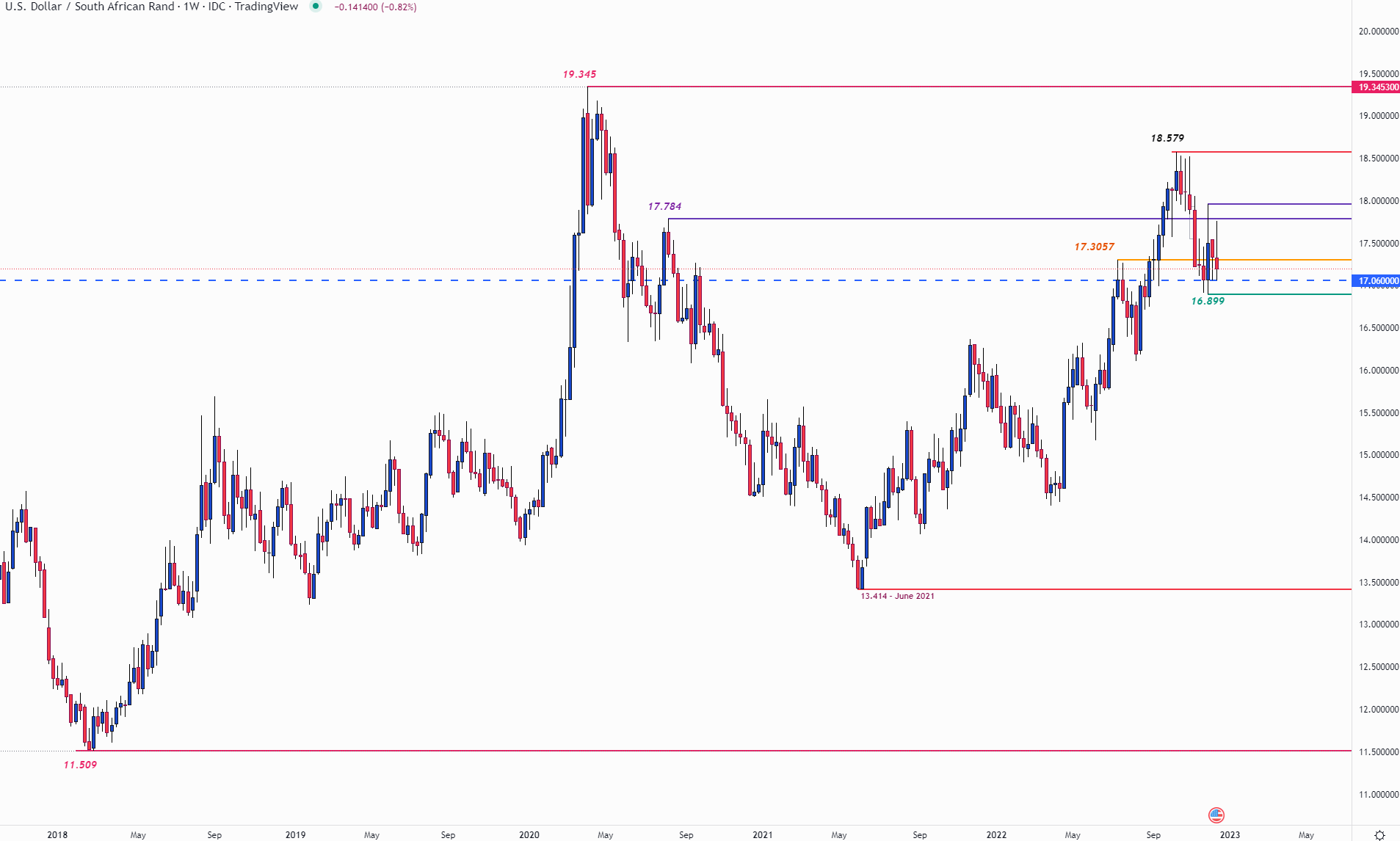

After rising to a fresh yearly high of 18.579 in October, USD/ZAR experienced a steep decline before stabilizing around 16.899. Although the Phala phala farm scandal placed pressure on the volatile Rand earlier this month, a temporary retest of 17.957 was met with swift retaliation from bears.

With the long-wicked candlesticks on the weekly chart highlighting key zones of support and resistance, technical levels have provided an additional catalyst for price action.

USD/ZAR Weekly Chart

Chart prepared by Tammy Da Costa using TradingView

Recommended by Tammy Da Costa

Building Confidence in Trading

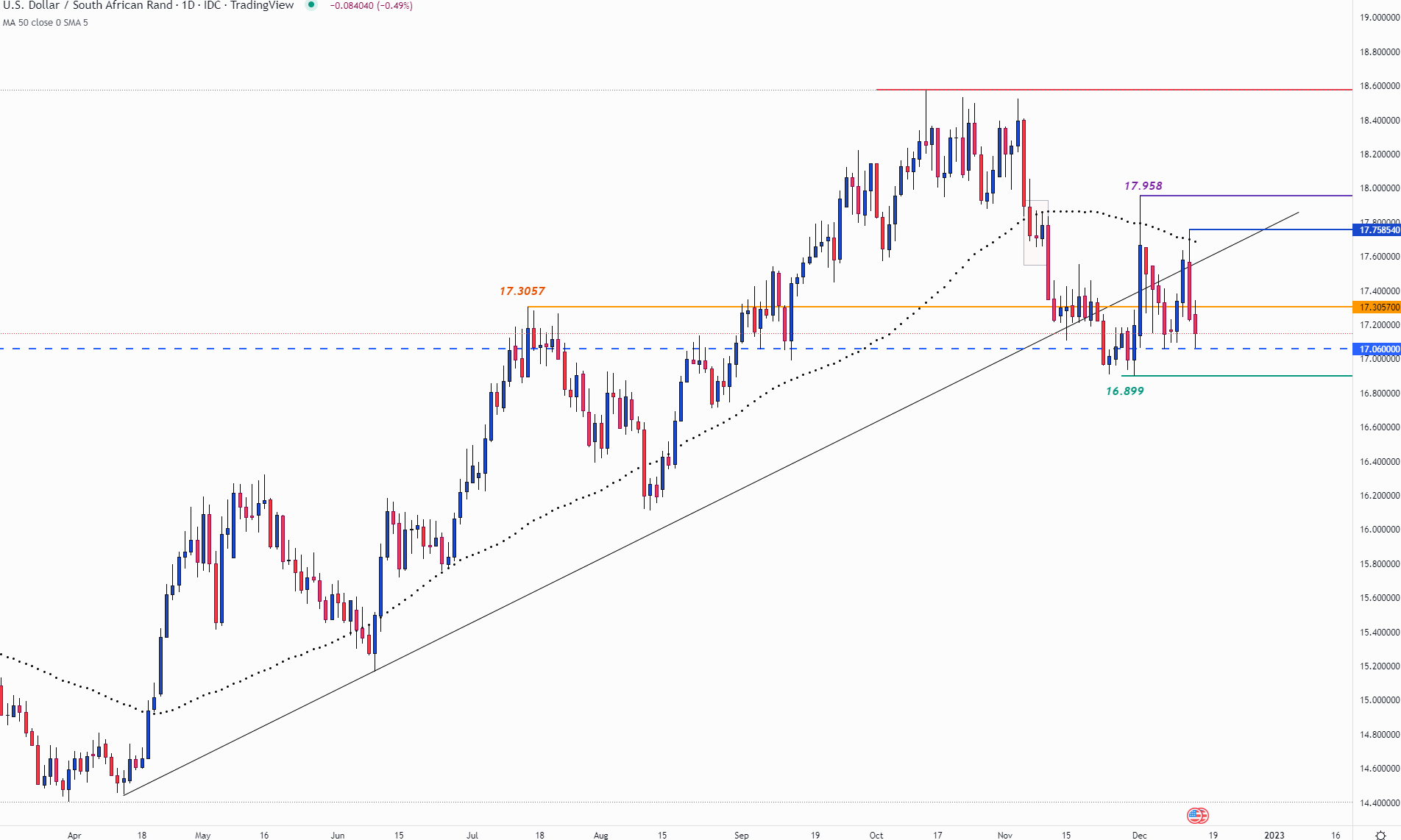

At the time of writing, USD/ZAR is trading around the 17.200 handle with the July high providing resistance at 17.0357. With the 17.500 psychological handle up ahead, the 50-day MA (moving average) is forming an additional barrier around 17.700.

USD/ZAR Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Meanwhile, for bearish momentum to gain, a break of 17.06 and 17.00 is required with a move below the November low of 16.899 opening the door for further declines.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]