[ad_1]

USDCAD, Interest Rates and FOMC Rate Decision Talking Points:

- The Market Perspective: USDCAD Bullish Above 1.3200

- The top event risk for Wednesday, and arguably the entire week, is the FOMC rate decision. Though, as much volatility as it can generate, trend development will be troubled

- There is plenty of additional US event risk after the Fed and a number of currency crosses (eg EURUSD) have event risk from peers; but USDCAD is far less encumbered

Recommended by John Kicklighter

Trading Forex News: The Strategy

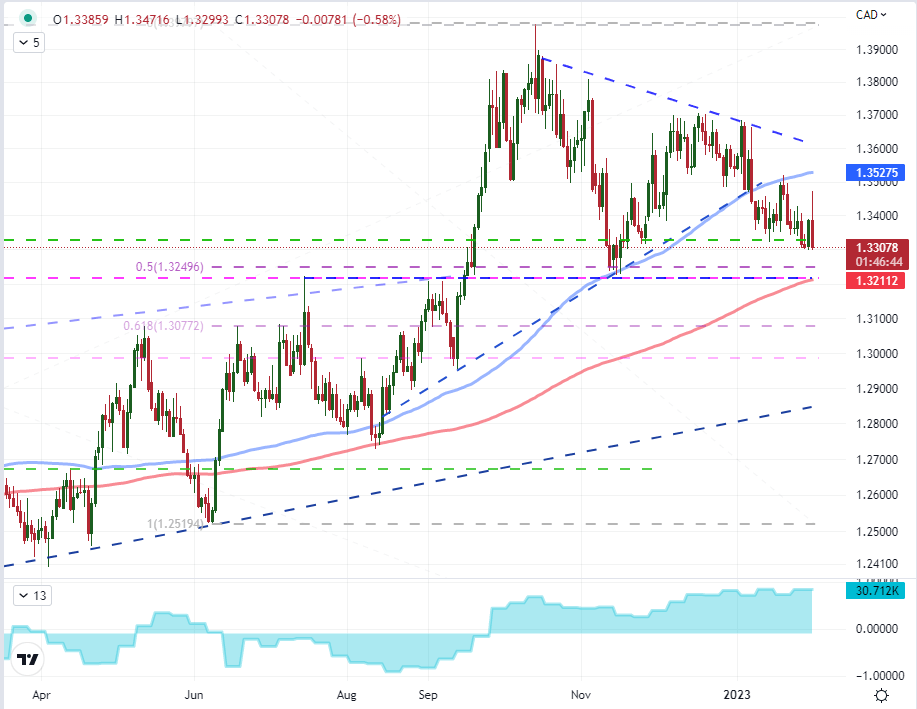

We are moving head-long into a critical fundamental event that can generate serious volatility across the financial system and substantially alter the course of trends for the major currency crosses. The FOMC (Federal Open Market Committee) policy decision due Wednesday at 19:00 GMT will tap into the market’s unrelenting focus around monetary policy trends and what it means to the backdrop of financial health and growth potential. While this is a US-specific event, it carries serious influence over the perception of monetary policy for the developed world at large. In turn, the scope and potential of this particular event can create significant complications for those sorting through scenario analysis. One pair that isn’t likely at the top of most traders’ FX list, but which can avoid a number of crosswinds that larger counterparts will face, is the USDCAD. Before running down the fundamental backdrop, a look to the charts. USDCAD has switched to a familiar chop with well established technicals presenting layers of boundaries. With today’s volatility generating the largest daily range in three weeks under a large intraday reversal, we remain stationed in the middle of a the 100 and 200-day simple moving averages (SMAs) around 1.3525 and 1.3215 respectively. Another interesting point, net speculative futures positioning via the CFTC’s Commitment of Traders report shows traders in that product are essentially sporting their heaviest net long exposure since August 2020.

| Change in | Longs | Shorts | OI |

| Daily | -6% | -11% | -8% |

| Weekly | -17% | -4% | -12% |

Chart of USDCAD with 100 and 200-Day SMAs, COT Net Speculative Futures Positioning (Daily)

Chart Created on Tradingview Platform

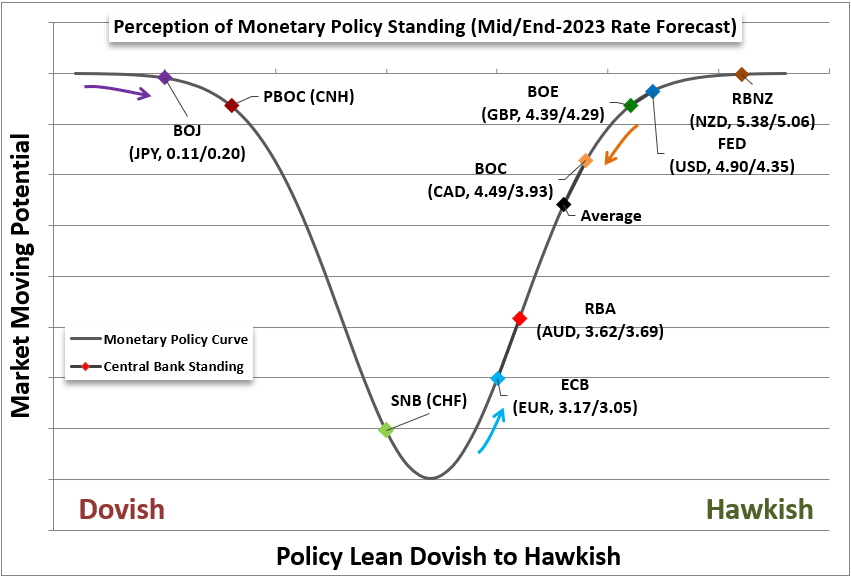

With a known volatility catalyst ahead, it is important to evaluate different possible outcomes and likely market responses. The FOMC decision itself faces a number of possible interpretations depending on the outcome. That is difficult enough to evaluate for Dollar-based pairs. For a number of the more liquid majors, the complications are particularly problematic. Take the EURUSD and GBPUSD as prime candidates for trouble. The European Central Bank (ECB) and Bank of England (BOE) are due to announce their own policy updates the day after the Fed. Not only would follow through for the Dollar be complicated in these crosses with another important event risk so soon after, the range of potential outcomes grows significantly more complex. Yet, looking to the Canadian docket, there is little in the way of key data for the Loonie. What’s more, the speculation that will engulf the US monetary policy course will find little-to-no skew from its Canadian counterpart. That is because the BOC this past week announced its clear intention to hold interest rate indefinitely until the data necessitates a shift from neutral. That is a clean contrast for any change the Fed offers.

Table of Relative Monetary Policy Standing

Table Made by John Kicklighter

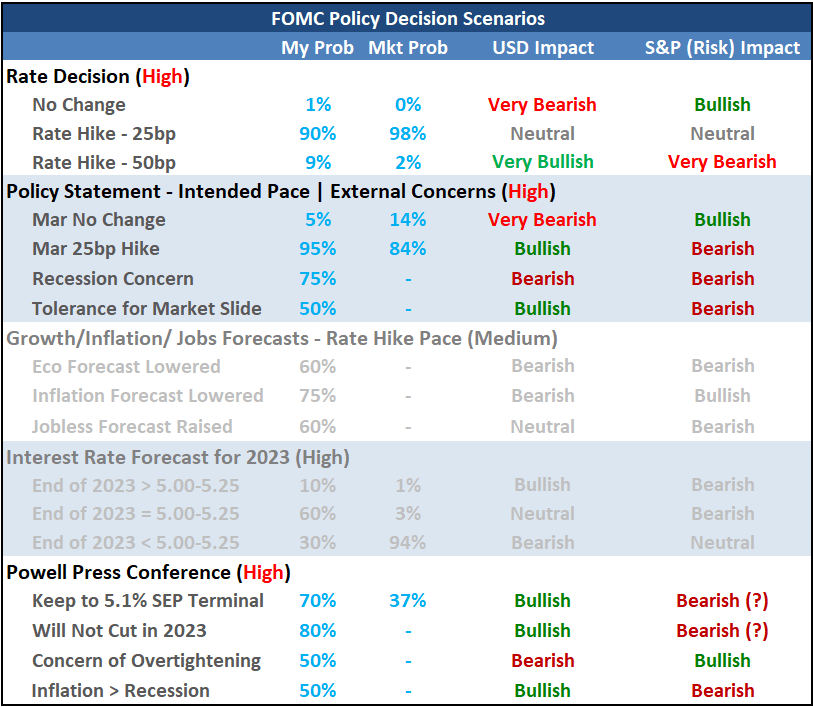

When it comes to the Federal Reserve’s monetary policy influence, the US central bank has made a serious effort to shape the market’s expectations for policy ahead. Unfortunately for policymakers, the market has projected serious skepticism over the veracity of their stated course – or they more simply believe the Fed’s underlying projections are off (wouldn’t be the first time). The consensus forecast for this meeting is for a 25 basis point rate hike that lifts the range to 4.50 – 4.75 percent. That is a progressive slowdown from December’s 50bp and the previous meetings 75bp clip. It’s possible that the Fed presents another 50bp hike, but that would render a serious market response (which they are no doubt aware) which they would likely have to mollify the market by stating that there are no further hikes penciled in until data changes their mind (which would leave us below the 5.1 percent peak rate that they issued just last month). Realistically, the real speculation will unfold around expected next moves with how long and how high they continue tightening. Given that we will need to draw this out of the monetary policy statement and Chairman Powell’s press conference remarks, it will be rife with speculative interpretation.

FOMC Scenario Table

Table Made by John Kicklighter

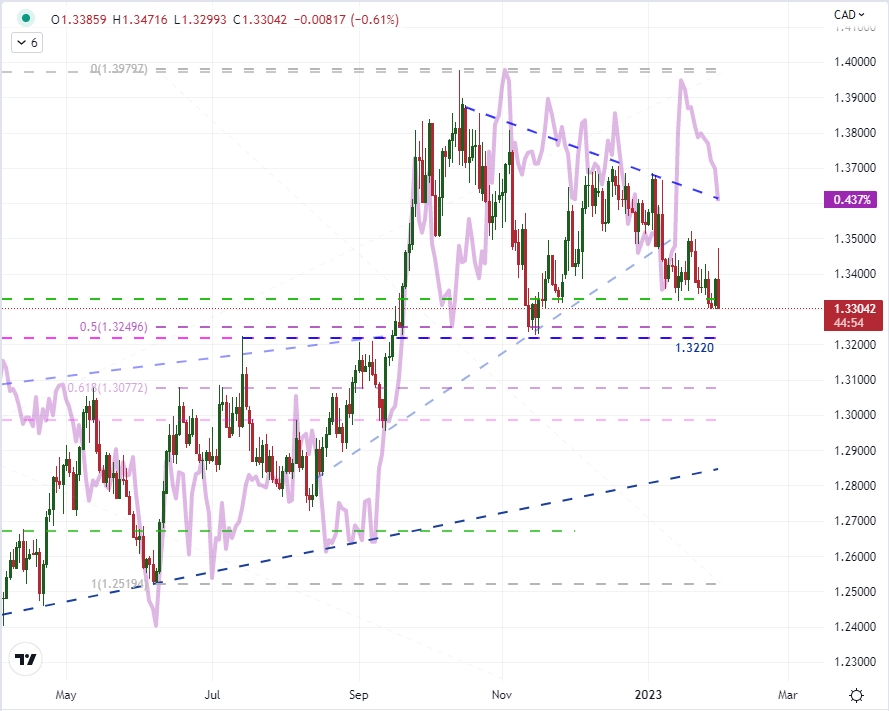

Taking into consideration the more restrained monetary policy dynamic behind USDCAD, the a good fundamental measure to put into the charts is an overlay of the US-Canadian 2-year government bond yield spread. For the Fed and other Western central banks, their time frame for directing monetary policy is often defined as ‘medium-term’ which more distinctly translate into a rough 2-year time frame. As such, this is the maturity I refer to when looking at the market’s general view of rate expectations. Notably, the yield spread has dropped sharply from a spike in early January which distinctly deviated from USDCAD price action. The correlation between these two measures has been notably volatile. An event like this could clarify the price relationship and help support the development of an earnest trend – something absent for some time.

Chart of USDCAD with 100 and 200-Day SMAs, COT Net Speculative Futures Positioning (Daily)

Chart Created on Tradingview Platform

[ad_2]