[ad_1]

Dow, Dollar, CPI Inflation and USDJPY Talking Points:

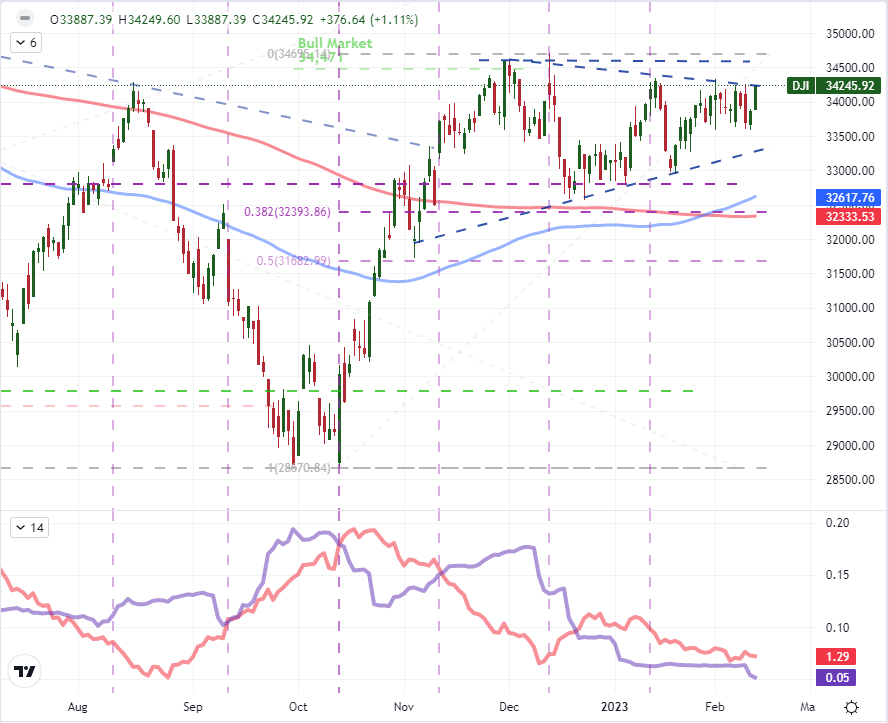

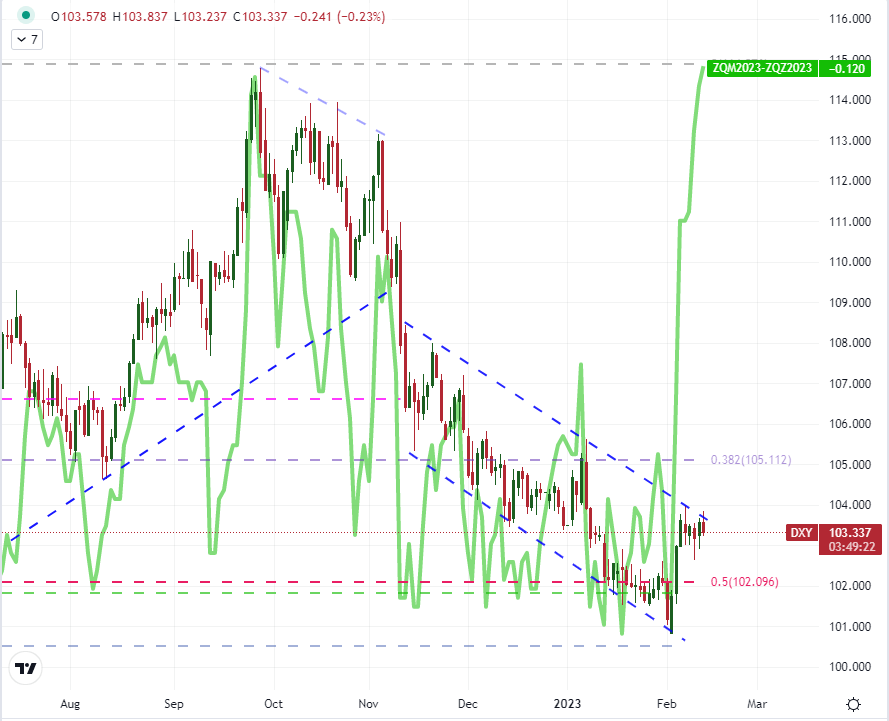

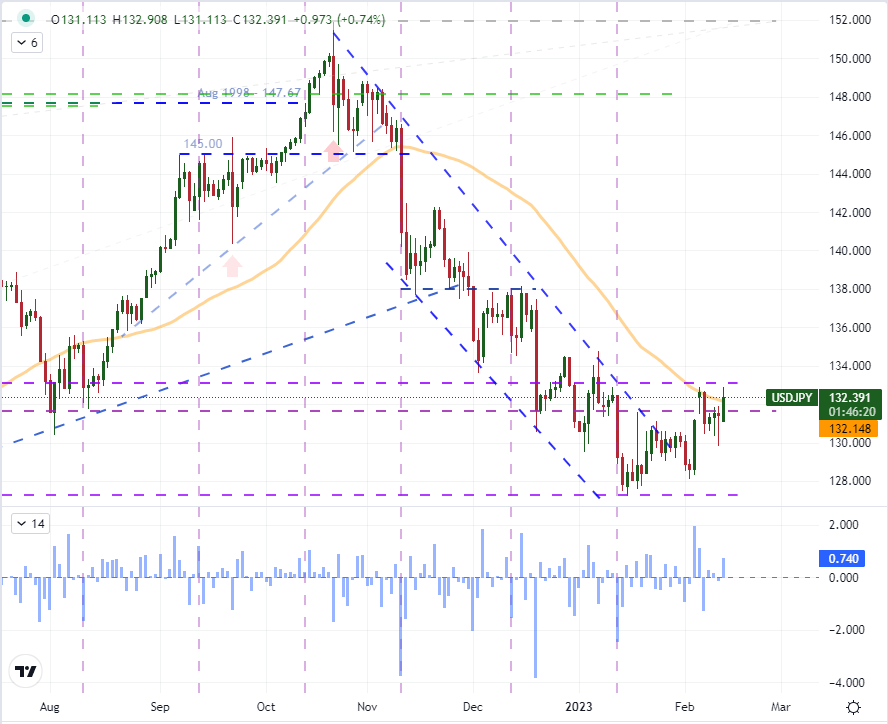

- The Market Perspective: EURUSD Bearish Below 1.08; Dow Range Between 34,200 and 33,200; USDJPY Bullish Above 133

- The Dow Jones Industrial Average closed out Monday at the top of its multi-month wedge around 34,250 while the DXY Dollar Index bounced from its own 103.75 channel ceiling

- Market’s are awaiting release of the US CPI update for January given the data series’ ability to charge serious volatility with previous updates

Recommended by John Kicklighter

Get Your Free Top Trading Opportunities Forecast

The market’s risk appetite to start this new trading week skewed positive Monday, but there was seemingly little intent behind the move. There is very little tangible fundamental traction to speak of when projecting a bullish view on capital market benchmarks like the Dow Jones Industrial Average, but there is speculative potential through one of the most market-moving data series of the past three-to-six months. The US consumer price index (CPI) update for January is due before the next US session open. Referencing the recent run of updates from this event series, the ‘relief’ seen in price pressures hitting four-decade highs has generated at least a temporary – but strong – bullish lift for this and other risk-leaning assets. It is perhaps not a surprise then that the market would stage for a similar outcome and response in the lead up to the most recent release. Notably, that starting position a measure like the Dow at the threshold of its multi-month congestion pattern. What’s more, such a lift may also reflect a fundamental skew which could discount the impact of an ‘encouraging’ outcome. With the exception of the September CPI release which started the trend of inflation relief in earnest, there has been very little follow through to speak of after the inflation reports. A false break reversal at this juncture could build upon a well-worn range.

Chart of Dow Jones Industrial Average with 100 and 200-Day SMA, 20-Day ATR, 40-Day Range (Daily)

Chart Created on Tradingview Platform

When it comes to the US inflation report, the fundamental connection to the US Dollar would seem to carry greater weight than anything on the more speculative side. However, the level of volatility with the lack of follow through in trend would suggest that the deeper currents are not particularly free-flowing. In fact, when it comes to the Greenback, the direct fundamental implications of a change in price pressures on monetary policy potential has come upon a very significant in carry over influence. In the past few weeks, we have seen a significant upswing in the market’s forecast for the Federal Reserve’s ‘terminal rate’ such that the popular consensus now matches the central bank’s own projection from December at approximately 5.1 percent. The unwinding of that discount earned the DXY a bounce from multi-month lows; but now that the gap is closed, where will the subsequent charge come through? There was still a notable dovish wind behind the market’s views in speculating on a rate hike/s in the second half of the year, but that expectation has very noticeably retreated more recently. Despite that more recent adjustment, the Dollar has refused to leverage the news to critical gains. It would seem that a different theme is necessary to carry us to the next leg – perhaps risk aversion to cater to its ‘safe haven’ status.

Chart of DXY Dollar Index Overlaid with Market Implied Fed Cuts in 2H 2023 (Daily)

Chart Created on Tradingview Platform

Looking to a specific Dollar-based cross, there are a range of interesting technical pictures. EURUSD’s retreat this month is provocative but breaking 1.07 support looks less than direct. GBPUSD between the 1.2450 and 1.2000 wedge is interesting, but there is event risk on tap from the Sterling side which can make for a more complex set of scenarios that we would need to traverse in order to form a clear trend. One of the most interesting in both a technical and fundamental perspective for me is USDJPY. The break of the descending channel from October through January – which retraced half a nearly two-year bull run in the span of just a few months – was cleared at the start of February but traction has been very short in supply. While there are complications like the insinuation that the newly incoming BOJ Governor Kazuo Ueda will end the extremely accommodative monetary policy at the central bank, that hasn’t exactly garnered traction just yet. As such, the focus remains on the disparity between quantifiable monetary policy differentials and the reflection of risk trends. As I mentioned above, the Fed forecast seems as if it would be difficult to bolster much further than it already is; but if possible, this would be the pair to do it. Alternatively, there is a distinct positive correlation between USDJPY and the VIX as a ‘risk off’ measure. Watch for any downdrafts in capital markets.

| Change in | Longs | Shorts | OI |

| Daily | 0% | 32% | 17% |

| Weekly | -2% | 0% | -1% |

Chart of USDJPY with 50-Day SMA and 1-Day Rate of Change, Days of ‘CPI’ Release (Daily)

Chart Created on Tradingview Platform

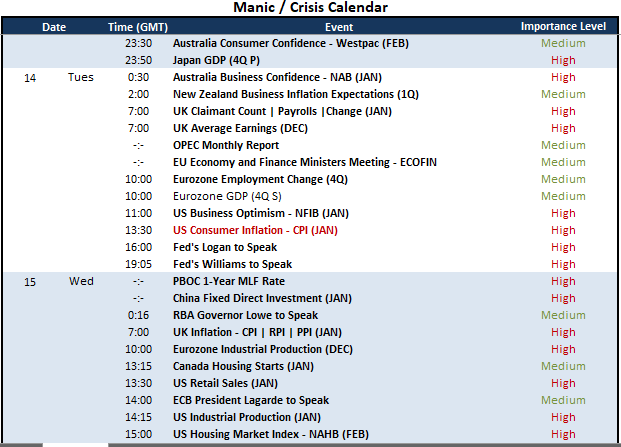

From a review of the economic landscape, the US CPI for January is clearly my top event risk for volatility potential – and even worming into more systemic matters. However, it is far from the only event that we should map on our radars through the immediate future. Speaking of the Japanese Yen, the first read of 4Q GDP out of the world’s third largest economy is an important global macro event – though it hasn’t had a good track record for moving the Yen or the Nikkei 225. Before Wednesday’s UK inflation stats release, the country will report January payrolls and December earnings. You may recall members of the BOE suggested Brits stop asking for raises to counteract inflation as a method to contain price growth – which didn’t go over well. From China, the 1-year MLF rate will be updated by the PBOC Wednesday which follows last week’s liquidity infusion which helped push USDCNH back up to the midpoint of its past 12-month range. Also on the US calendar, we have US business sentiment from the NFIB and Fed speak which deserves a close review for interpretations of the CPI.

Top Global Macro Economic Event Risk for the Next 48 Hours

Calendar Created by John Kicklighter

Discover what kind of forex trader you are

[ad_2]