[ad_1]

EURUSD, S&P 500 Futures, VIX, NZDUSD and Liquidity Talking Points:

- The Market Perspective: EURUSD Bearish Below 1.0550; GBPUSD Bearish Below 1.2100

- There has been extraordinary volatility in risk-leaning assets like the S&P 500, pushing many assets to test major technical levels and a search for ‘explanations’

- Liquidity conditions remains the most important aspect of market conditions, and the weekend drain is inevitable…but can EURUSD get a break before the lights go out?

Recommended by John Kicklighter

Get Your Free Top Trading Opportunities Forecast

We are in the final 24 hours of the second-to-last week of the year. Going on the expectations of historical norms, markets should be slowly closing up shop with the Santa Claus rally in full swing. What we are witnessing, however, is the opposite of that convenient slide into the calm speculative surf. Thinned liquidity has sharply amplified volatility this past session. The S&P 500 index put in for its biggest daily range since December 13th – an extremely active day that resulted from the charge and ultimate reversal following the November CPI release. Technically, emini futures more than covered the full range of the week and even pressured the technical support bounds that many technicians likely believed would hold us through the end of the week – if not the end of the year. In reality, the floor still stands – for now – but it didn’t stop the probe lower. In illiquid market conditions, the rigidity of technical barriers weakens due to the lack of depth to hold back runs or bid expected turns in the vicinity. By the end of the trading day, the S&P 500’s (index0 rebound from lows left the largest ‘lower wick’ on a daily candle in six weeks. Also, not the restriction on volume through all of this tumult.

Chart of the S&P 500 Emini Futures with Volume and Wicks (Daily)

Chart Created on Tradingview Platform

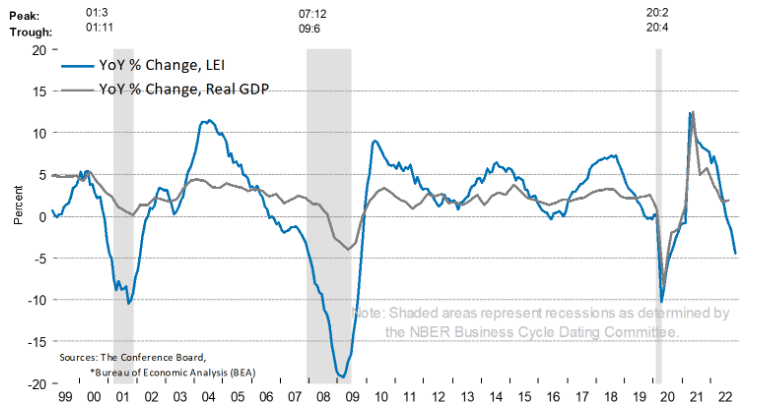

With such a significant downdraft from a risk benchmark like the S&P 500, defying conventional wisdom of liquidity and seasonal direction (the ‘Santa Claus rally’), it is natural for the investors to find a ‘reason’. There were a few fundamental events that could be ascribed the responsibility of sinking the markets. Headlines around China’s unofficial struggle with Covid cases following the reversal of its quarantine protocols have raised concern about economic activity similar to how its aggressive lockdown procedures were troubling the outlook. The Shanghai Composite sunk and USDCNH rose above 7.0000, but it doesn’t seem to have the capacity to be a ‘confirmable’ black swan to upend the financial system. Similarly, the US Leading Economic Indicator from the Conference Board extended its slide into contractionary territory. This is yet another ‘recession’ warning for the world’s largest economy, but there have been no shortage of these signals from far more renowned series with very limited market response.

Chart of the Conference Board’s Leading Economic Index Overlaid with Real GDP (Daily)

Chart from The Conference Board LEI Report

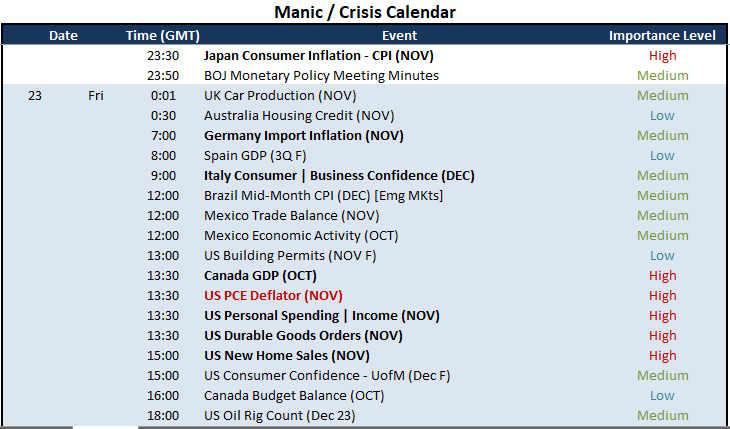

Looking out through the end of the week before liquidity fully drains for the holiday weekend, there is one remaining high-profile event on tap: the PCE deflator. Though it doesn’t have the volatility credentials of its cousin the CPI report, the PCE is the Fed’s favorite inflation measure. Given how much volatility we have seen follow speculation around US and global monetary policy, there is genuine fundamental merit behind this report. That said, it will still be an uphill battle for this release to spur more than just a brief bout of exceptional volatility. Even triggering a sharp move in these thinned conditions will likely prove difficult, but the ‘proper’ surprise could urge a final burst of volatility. For risk-leaning assets that are already unnerved by the activity of the past 24 hours, a significant upside surprise (higher inflation reading) could add to the market’s pressure. Such an outcome could also do more to hasten the Dollar’s otherwise-slow drift higher for some key pairs. The alternative, a significant weakening, could also cater to the S&P 500’s recovery swing into Thursday’s close, but it would likely struggle to inspire a serious bearish run for the Greenback.

Top Macro Economic Event Risk Through Week’s End

Calendar Created by John Kicklighter

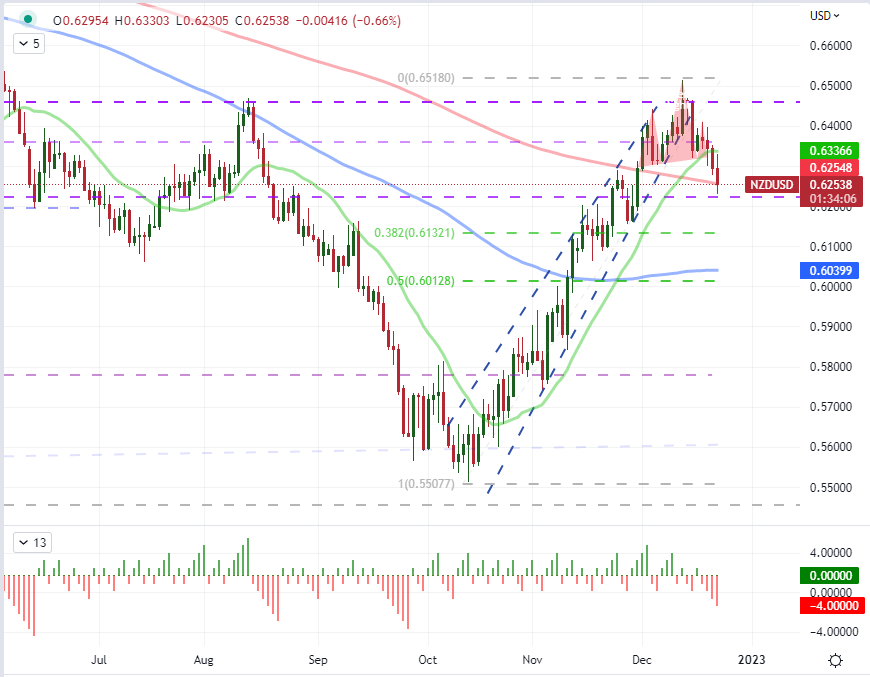

Taking stock of the Dollar’s technical position, I see the scope for technical provocation. The DXY Dollar index has slowly recovered some ground this past week following two months of productive retreat – a move that has certainly undermined the view that the general trend behind the US currency is definitively bullish. However, the congestion that we have seen develop into provocative patterns hasn’t exactly generated the kind of resolution many technical traders seek out. NZDUSD and GBPUSD for example have both developed head-and-shoulders patterns that have only recently broken at the ‘neckline’. Yet the follow through that is discussed in the textbooks as ‘trend turns to congestion turns to reversal’, has been severely restricted. It is worth watching the progress of these turns as they could also potentially find traction through the view that they are following the ‘path of least resistance’ moving back into past months’ range.

| Change in | Longs | Shorts | OI |

| Daily | -4% | 5% | 1% |

| Weekly | 5% | 28% | 16% |

Chart of the NZDUSD with 20, 100 and 200-Day SMAs, Consecutive Candle Count (Daily)

Chart Created on Tradingview Platform

Finally, it is worth highlighting EURUSD specifically. Where there has been exceptional volatility from benchmarks like the S&P 500 and the Dollar has generally defaulted to a slow drift higher, this top FX cross has worked its way deeper into an extremely restrictive range. The past five-day range from EURUSD is the smallest that we have seen since December 28th, 2021. This would naturally align to the previous holiday grind, but we are also seen the surrounding environment now is very different than what we witnessed last year. This is the sort of extreme that I would consider prone to ‘revision to a mean’ through activity, but the absolute close of the markets for the weekend is imminently at hand (the horizontal line). This is a great example whereby any breaks one my expect should immediately raise questions of follow through from even the most enthusiastic trader.

| Change in | Longs | Shorts | OI |

| Daily | 8% | 1% | 4% |

| Weekly | 23% | -3% | 8% |

Chart of the EURUSD with 20 and 100-Day SMAs, 5-Day Historical Range (Daily)

Chart Created on Tradingview Platform

[ad_2]