[ad_1]

KEY POINTS:

Recommended by Zain Vawda

Get Your Free Oil Forecast

Most Read: The Importance of Liquidity in Forex Trading

WTI FUNDAMENTAL OUTLOOK

Crude Oil declined around 2.5% in the Asian session as markets fear a rise of Covid cases following China’s relaxation of its Covid zero policies. The European session did bring some respite with a modest bounce from Asian session lows around $76.78 a barrel to trade around $77.80 a barrel.

China’s relaxation of Covid zero policies saw oil prices rally significantly over the past few weeks but the recent rise in cases had seen concern grow globally. The fear is that Covid could began to spread once more with certain countries already announcing special requirements for Chinese travelers. Countries like Italy, United States, India, Malaysia and Italy have announced different measures for Chinese travelers including negative Covid tests with other countries still discussing potential controls. This has added further uncertainty around the potential for a demand recovery from China for WTI heading into 2023 further weighing on oil prices.

Recommended by Zain Vawda

How to Trade Oil

Vladimir Putin announced a price cap of $60 a barrel on Russian oil supply to G7 countries and the European Union. I did expect to see a bit of a jump in oil prices following the announcement due to the risk of lower supply and constant demand. The Kremlin confirmed that Russia did not consult OPEC+ over the price cap.

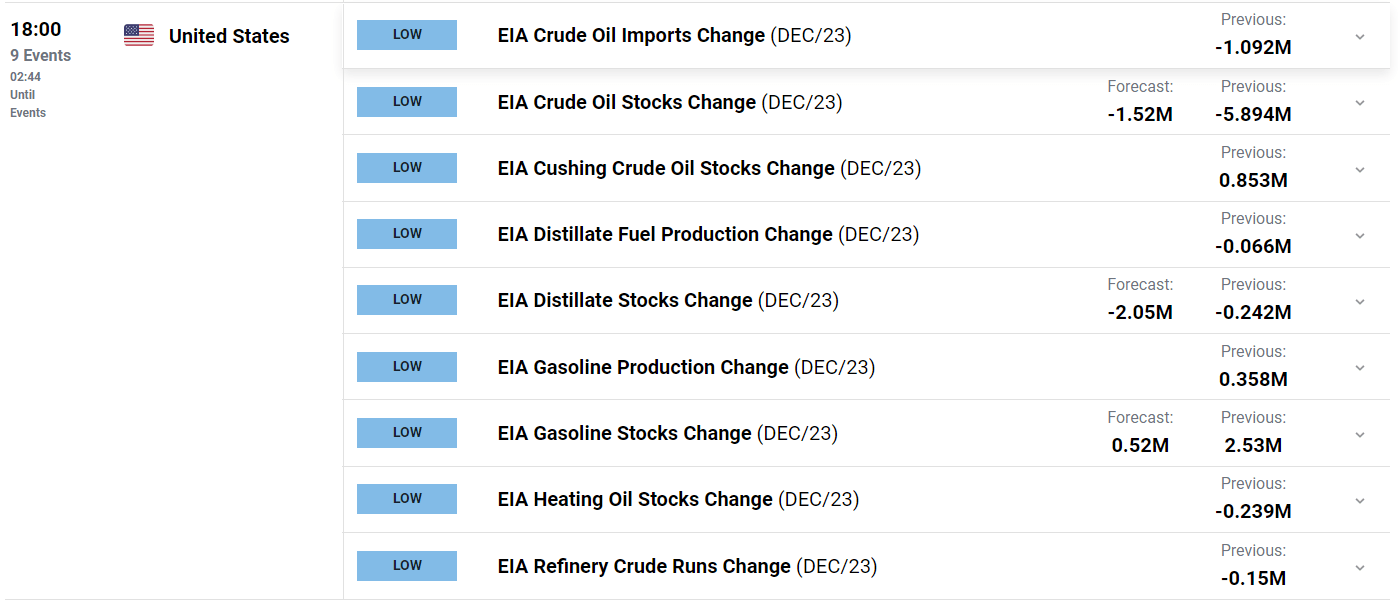

Looking ahead to the rest of the day we have a host of Crude EIA Oil data. The data may add some volatility with consensus currently seeing a drop of around 1.52 million barrels. A drop in inventories could see a jump in oil prices and give it a push toward the $80 a barrel handle.

For all market-moving economic releases and events, see the DailyFX Calendar

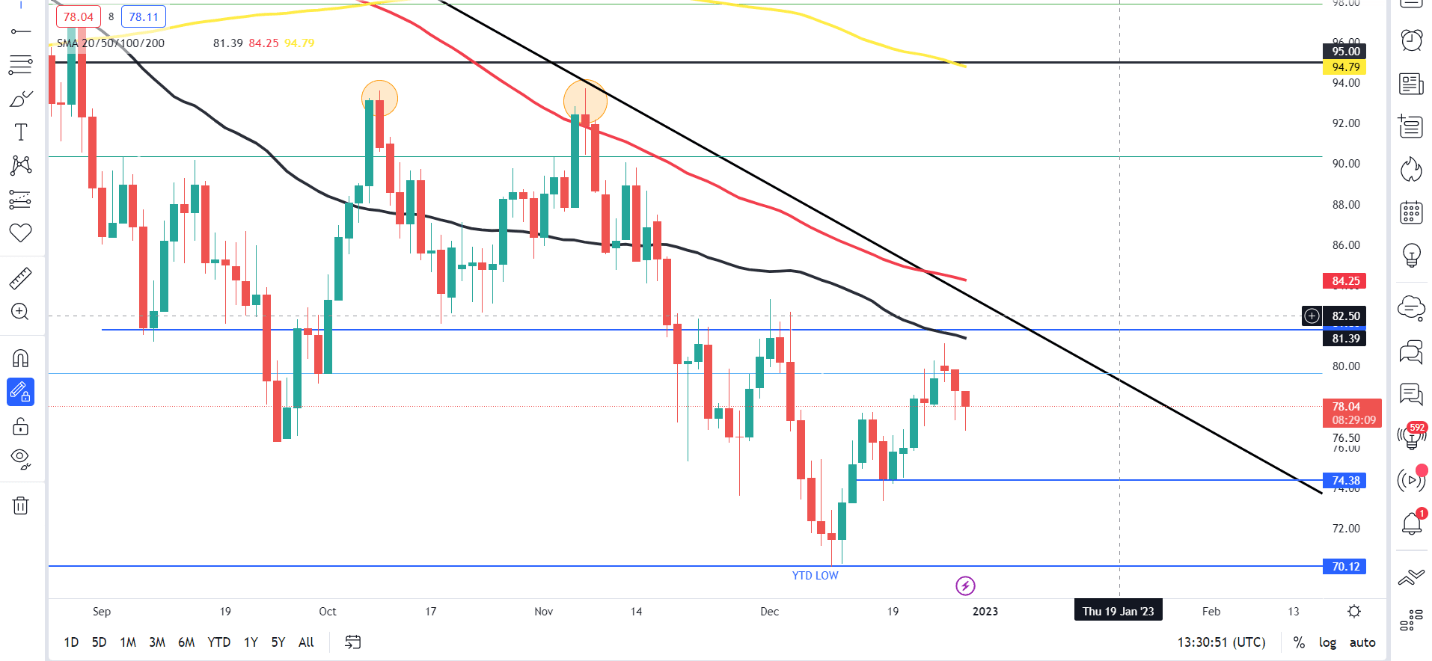

From a technical perspective, WTI is on course for its third consecutive days of losses. The $80 a barrel mark remains a key level with the 50-day MA resting around the $81.39 a barrel which could provide resistance should price push higher. Price action continues to print higher highs and higher lows since printing its YTD low on December 9. A daily candle close below $74.38 is needed to invalidate the bullish trend and given the thin liquidity I don’t see this happening before the weekend.

WTI Crude Oil Daily Chart – December 29, 2022

Source: TradingView

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently Long on Crude Oil, with 66% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are long suggests that Crude Oil may continue to fall.

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]