[ad_1]

GOLD OUTLOOK & ANALYSIS

- Federal Reserve implied rate probabilities are becoming increasingly more responsive to inflation and labor data showing market indecision ahead of the Fed’s March meeting.

- US economic data the focus for next week.

- Technical analysis on weekly and daily charts favor bulls.

Recommended by Warren Venketas

Get Your Free Gold Forecast

XAU/USD FUNDAMENTAL FORECAST: BULLISH

Where to begin with Gold prices? A rollercoaster ride last week saw the yellow metal close significantly higher on the back of US Non-Farm Payroll (NFP) data. Markets honed in on the higher unemployment and declining wage data rather than the headline NFP release. This mixed bag of data will place greater emphasis on the upcoming US CPI report (see economic calendar below) for guidance.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

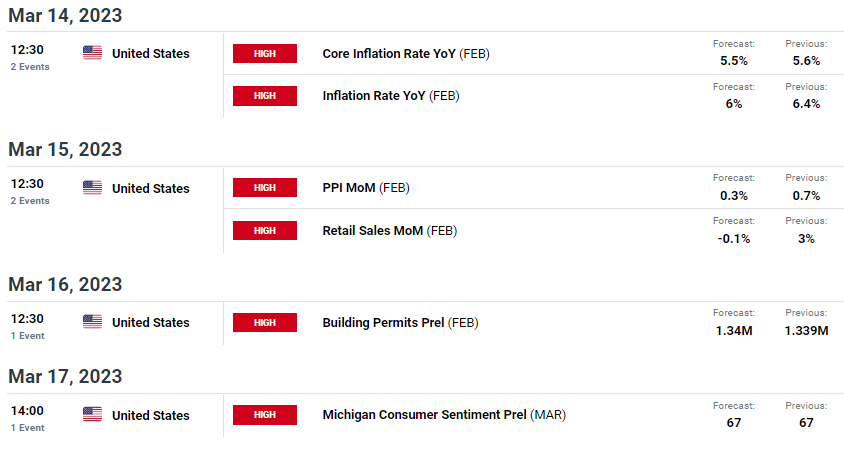

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

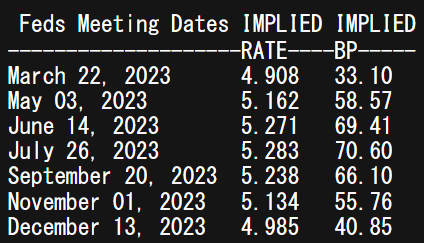

The impact on interest rate forecasts has been dramatically reduced to a terminal rate of 5.283% at the time of writing – refer to table below. The debate over whether the Fed will opt for 25bps or 50bps increment is now skewed towards the former unless next week’s inflation figure shows elevated pressures. It is worth mentioning the issue of the distress in the banking sector after Silicon Valley Bank (SVB) saga, in that the high interest rate environment (tight monetary policy) is starting to uncover the fragilities in certain sectors of global financial markets and may prompt the Fed to proceed with caution.

Foundational Trading Knowledge

Macro Fundamentals

Recommended by Warren Venketas

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

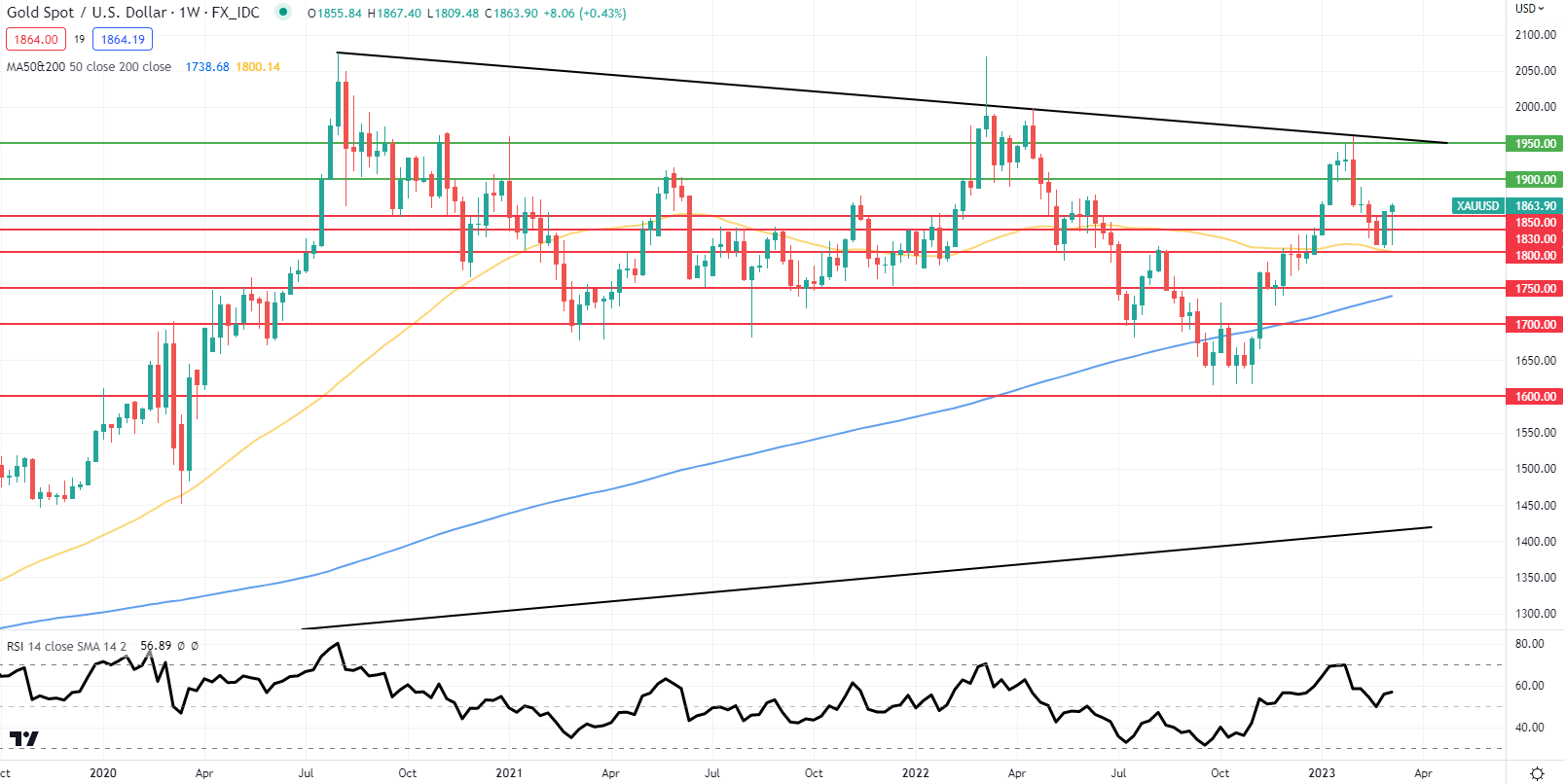

GOLD PRICE WEEKLY CHART

Chart prepared by Warren Venketas, IG

The weekly gold chart above may be indicative of a bullish extension of the current move by way of the last week’s long lower wick, leaving room for bulls to sustain the recent upside rally.

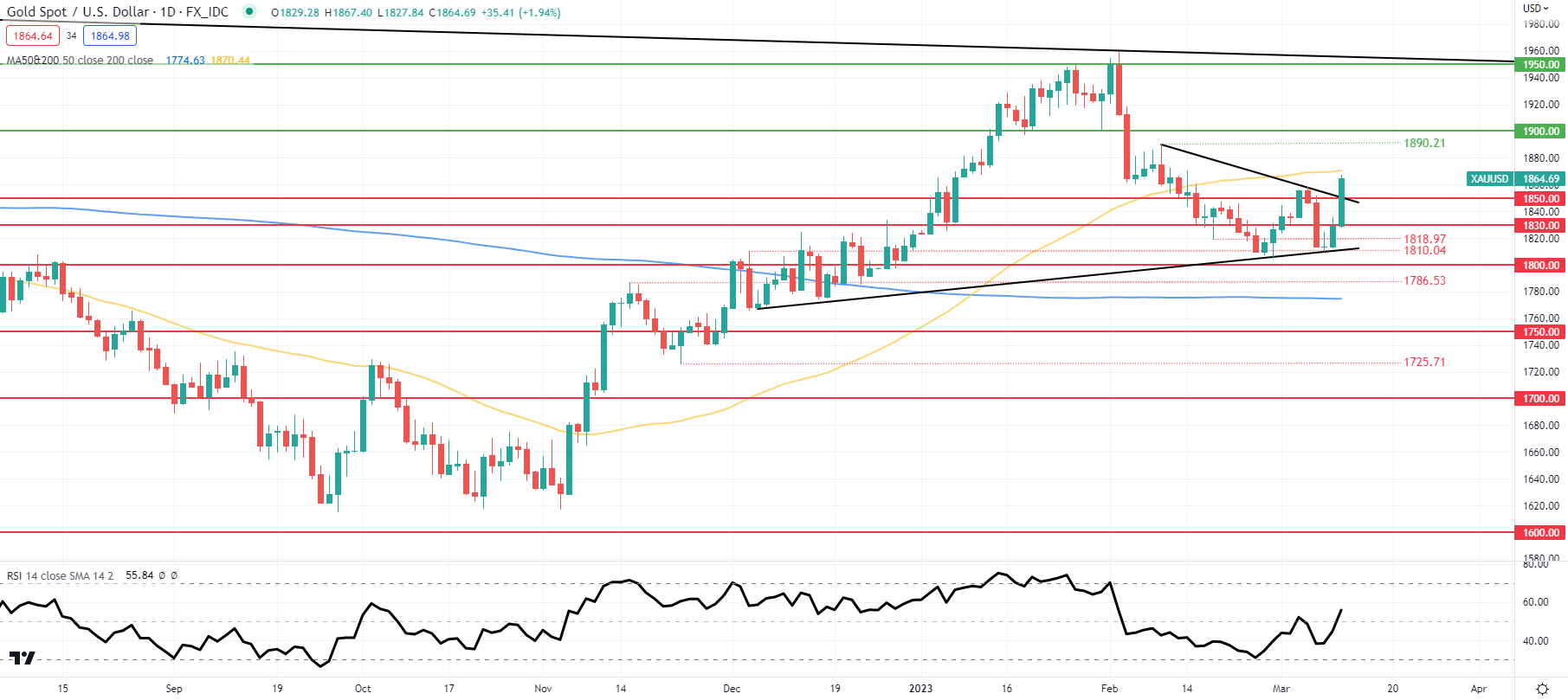

GOLD PRICE DAILY CHART

Chart prepared by Warren Venketas, IG

Daily XAU/USD price action shows a breakout from the recent symmetrical triangle chart pattern (black) and above the 1850.00 psychological handle. With the Relative Strength Index (RSI) now above the midpoint 50 level, bullish momentum is in favor but should Friday’s daily candle close below triangle resistance, this may be invalidated.

Resistance levels:

- 1890.21

- 50-day MA (yellow)

Support levels:

IG CLIENT SENTIMENT: MIXED

IGCS shows retail traders are currently distinctly LONG on gold, with 70% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning we arrive at a short-term cautious disposition.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]