[ad_1]

FED DECISION KEY POINTS:

- The Federal Reserve raises interest rates by 25 basis points to 4.75%-5.00%, in line with expectations

- The policy statement removes guidance indicating that ongoing increases in the target range will be appropriate

- The dot-plot signals the same hiking path for 2023 than envisioned three months ago

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: EUR/USD Price Forecast – Is the Panic Over? Sentiment Reversal Lifts the Euro

The Federal Reserve concluded today one of its most anticipated meetings in recent memory and voted by unanimous decision to raise interest rates by a quarter of a percentage point to 4.75%-5.00%, largely in line with consensus estimates. This adjustment brings borrowing costs to their most restrictive level since 2007, a sign that the central bank will not relent in its efforts to restore price stability.

Ahead of today’s announcement, Wall Street’s expectations were in flux amid banking sector turmoil in the aftermath of the collapse of two lending institutions and the bailout of Credit Suisse earlier this month. Although market stress has begun to ease after government authorities swiftly unveiled coordinated measures to shore up the financial system, sentiment was still fragile.

In the policy statement, the FOMC noted that the labor market continues to be robust, and that inflation remains elevated. Regarding recent developments related to regional banks, the Fed stated that the banking system is sound and resilient, but underscored that the situation could result in tighter credit conditions for households and businesses, creating downside risks for economic activity, hiring and inflation.

In terms of forward guidance, language indicating that “ongoing increases in the target range will be appropriate” was removed and replaced by “additional policy firming may be appropriate”. While this points to further tightening, it is less hawkish than the previous message, a sign that the hiking cycle is coming to an end. This is likely to be bearish for the U.S. dollar over the medium term.

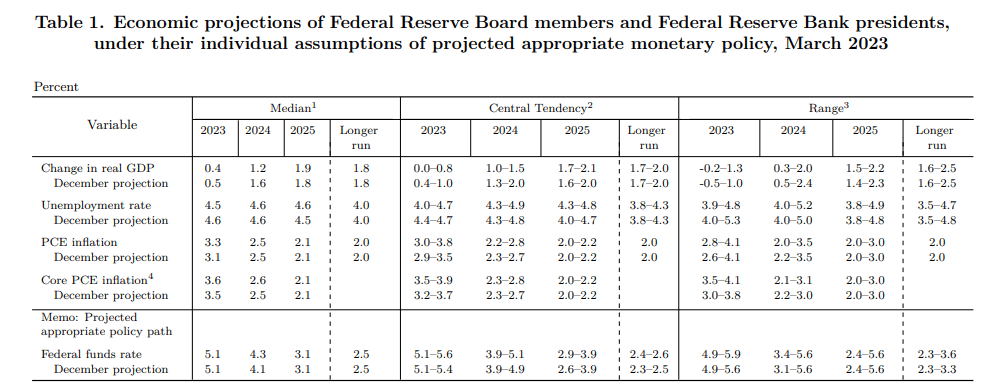

SUMMARY OF ECONOMIC PROJECTIONS

There were meaningful changes in the March Summary of Economic Projections (SEP) compared to the material presented in December of 2022. For 2023, the GDP forecast was downgraded to 0.4% from 0.5% previously, while the unemployment rate was marked down to 4.5% from 4.6%, a vote of confidence in the labor market despite growing economic headwinds. Meanwhile, core PCE inflation f0r 2023 and 2023 was revised higher by one tenth of a percent to 3.6% and 2.6%, respectively. The main details are highlighted below.

Source: Federal Reserve

FED DOT PLOT

The Fed’s so-called dot plot, which shows the trajectory for interest rates, signaled the same hiking path for 2023 than contemplated three months ago, with the median projection steady at 5.1%, implying about 25 basis points of additional tightening through year’s end. For 2024, rates are seen at 4.3% versus 4.1% in December, indicating a little less easing on the horizon.

Stay tuned for our market reaction analysis

Written by Diego Colman, Contributing Strategist

[ad_2]