[ad_1]

WTI PRICE, CHARTS AND ANALYSIS:

- US Inventories Decline Based on API Data, Production Continues to Rise.

- Supply Concerns Remain Amid Russia and NATO Tension.

- WTI Rally Faces a Host of Technical Hurdles for the Rally to Continue While a Potential Midweek DXY Reversal Could Limit Further Upside.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Recommended by Zain Vawda

How to Trade Oil

Most Read: Gold Prices Remain Vulnerable to PCE Data as Retail Traders Boost Upside Exposure

WTI FUNDAMENTAL OUTLOOK

Crude Oil prices have been on a tear this week with Monday seeing the commodity advance close to 5% on supply concerns, its best day of gains since May 2022. Yesterday brought further support for prices as inventories in the US fell with the Strategic Petroleum Reserves (SPR) hovering at lows last seen in December 1983. Can the Rally continue as technical headwinds lie in wait?

A surprise to me at least has been the lack of action from the United States to refill the SPR, given prices last week met the target range as set out by the US Department of Energy. According to the API data, US inventories declined by 6,076 million barrels for the week ended March 24 compared to forecasts expecting a buildup of 187k barrels. US Oil production meanwhile rose 12.3 million bpd for the week ending March 17, leaving production levels 700k bpd higher than the same time last year. The data coupled with a continued slide in the US dollar despite a positive consumer confidence read kept oil prices supported during Tuesdays US session.

Supply concerns remain in play with fears around further sanctions on Russia rearing their ugly head. This comes in the wake of comments by Russian President Vladimir Putin around deploying tactical nuclear weapons in Belarus. Any announcement from G7 members on further sanctions may serve as another catalyst for oil prices as it looks to continue its recent advance.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

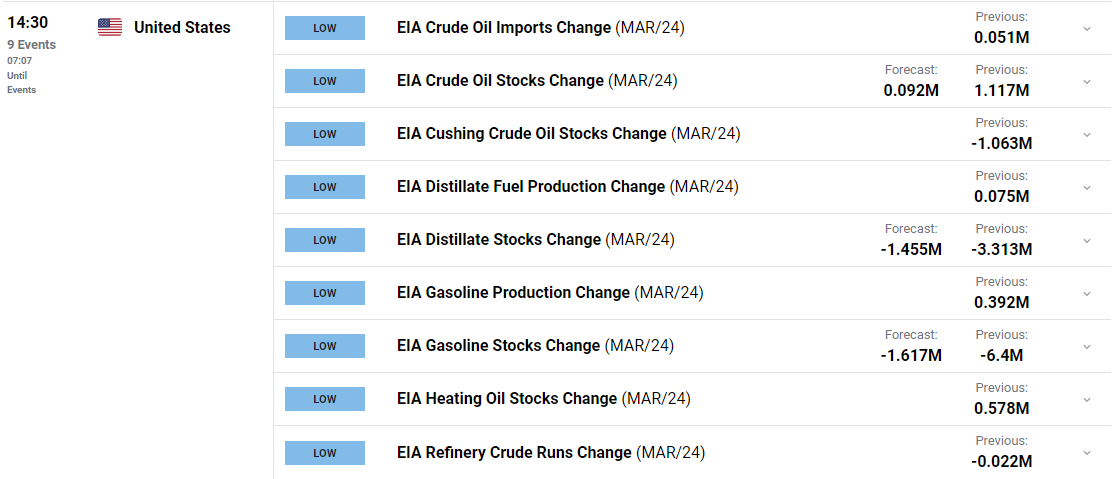

Looking at event risk on the economic calendar, the EIA will release its updated inventory numbers for the week ending March 24 later in the day. A decrease in inventories and miss of estimates could also keep prices supported ahead of the US PCE data release on Friday.

For all market-moving economic releases and events, see the DailyFX Calendar

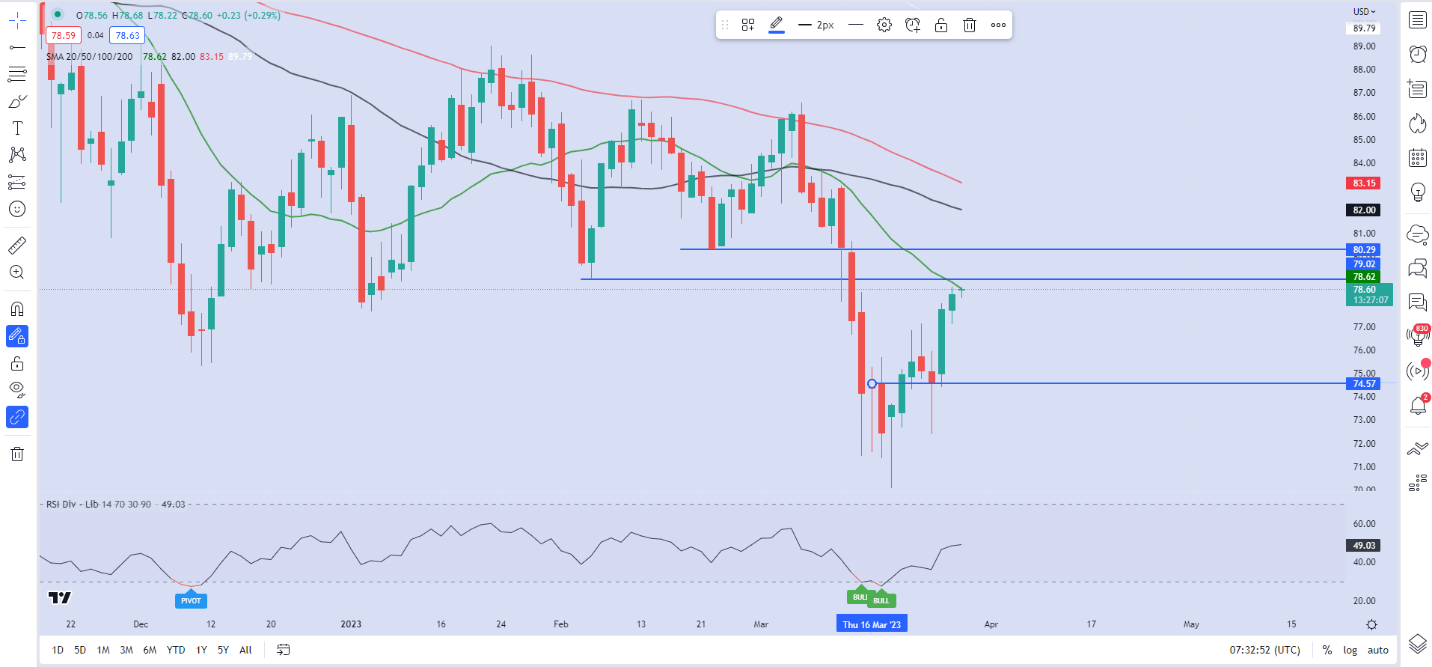

BRENT CRUDE UPDATE

Bent Prices have been on the exact same trajectory this week as WTI . benefitting from supply chain concerns and a weaker US dollar. There remains a host of technical hurdles ahead if Brent is to regain the $80 a barrel handle. The dollar has started the day slightly stronger, whether this is sustainable remains to be seen, with a midweek reversal not out of the question for the dollar index (DXY). A return of dollar strength could hinder further gains on Brent while the technical picture sees significant resistance up ahead with the price currently testing the 50-day MA. A move higher will bring the February 6 and 22 swing lows into play before the 100-dy MA at the $82 a barrel handle.

Brent Daily Chart – March 29, 2023

Source: TradingView

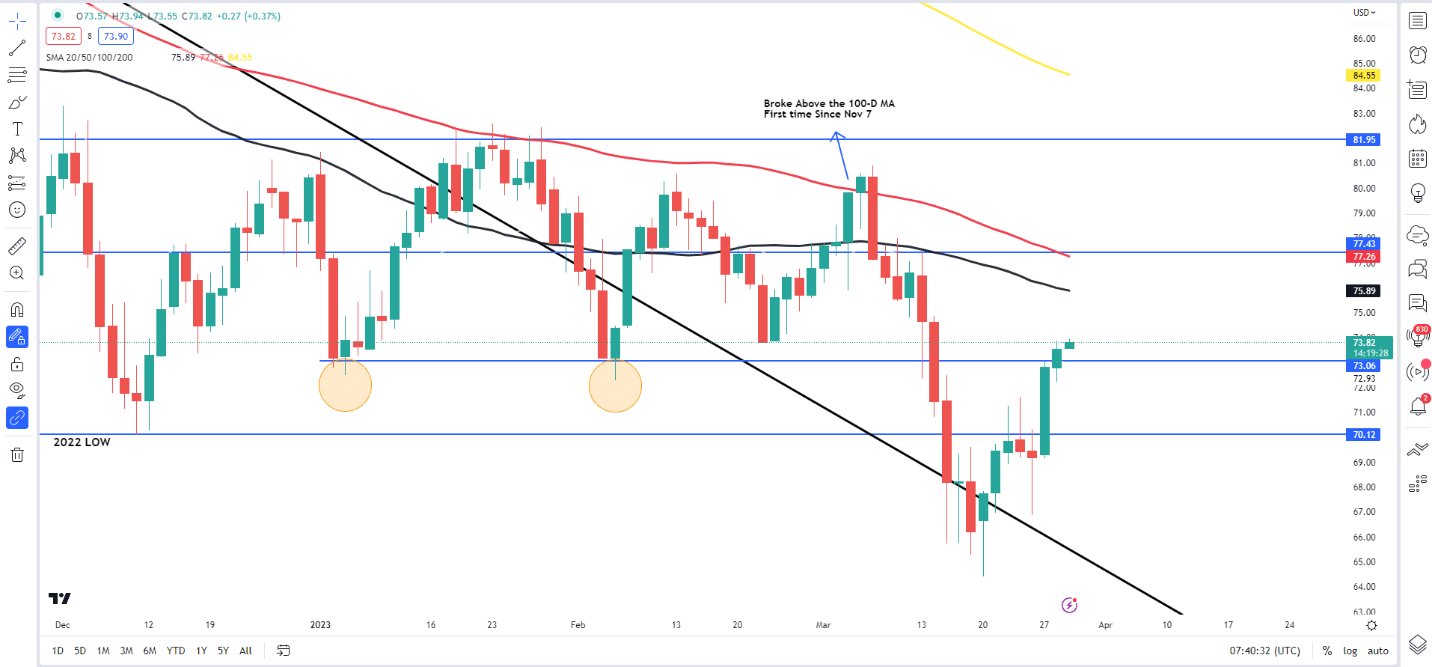

WTI TECHNICAL OUTLOOK

From a technical perspective, WTI is printing higher highs and higher lows as it approaches the $75 a barrel mark. We have now recorded a daily close above resistance provided by the February and January swing lows (blue horizontal ray on chart below) as we approach the 50-day MA around the $75.89 handle.

Alternatively, a push lower from here could bring a retest of yet 2022 lows back into play which did provide some resistance last week around the $70 a barrel mark. A more intraday support level rests around $71.50 which was the March 23 swing high and could help keep prices supported in the event of a decline.

WTI Crude Oil Daily Chart – March 29, 2023

Source: TradingView

Introduction to Technical Analysis

Learn Technical Analysis

Recommended by Zain Vawda

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]