[ad_1]

US Dollar (DXY) Price and Chart Analysis

- US Treasury yields slump post-FOMC meeting.

- Friday’s NFPs are the next obstacle for the bulls to negotiate.

Recommended by Nick Cawley

Introduction to Forex News Trading

Most Read: US Dollar Latest: Weak Rebound Off the Multi-Month Low, Slowdown Fears Grow

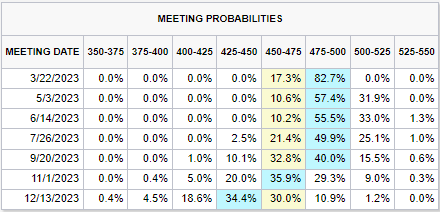

The chairman of the Federal Reserve, Jerome Powell, gave the markets a dovish nudge yesterday by stating in his post-FOMC press conference that the ‘disinflationary process has started…We can see that and we see it really in goods prices so far’. This is the first time in many months that Powell has given the markets even the slimmest hint that the Fed is happy with the path of inflation and raises the question of whether another couple of 25 basis point rate hikes are needed. The markets are currently pricing in one more quarter-point rate increase on March 22 before the Fed pauses and then looks to cut rates at the back end of the year.

Recommended by Nick Cawley

Building Confidence in Trading

For all market-moving data releases and economic events see the real-time DailyFX Calendar.

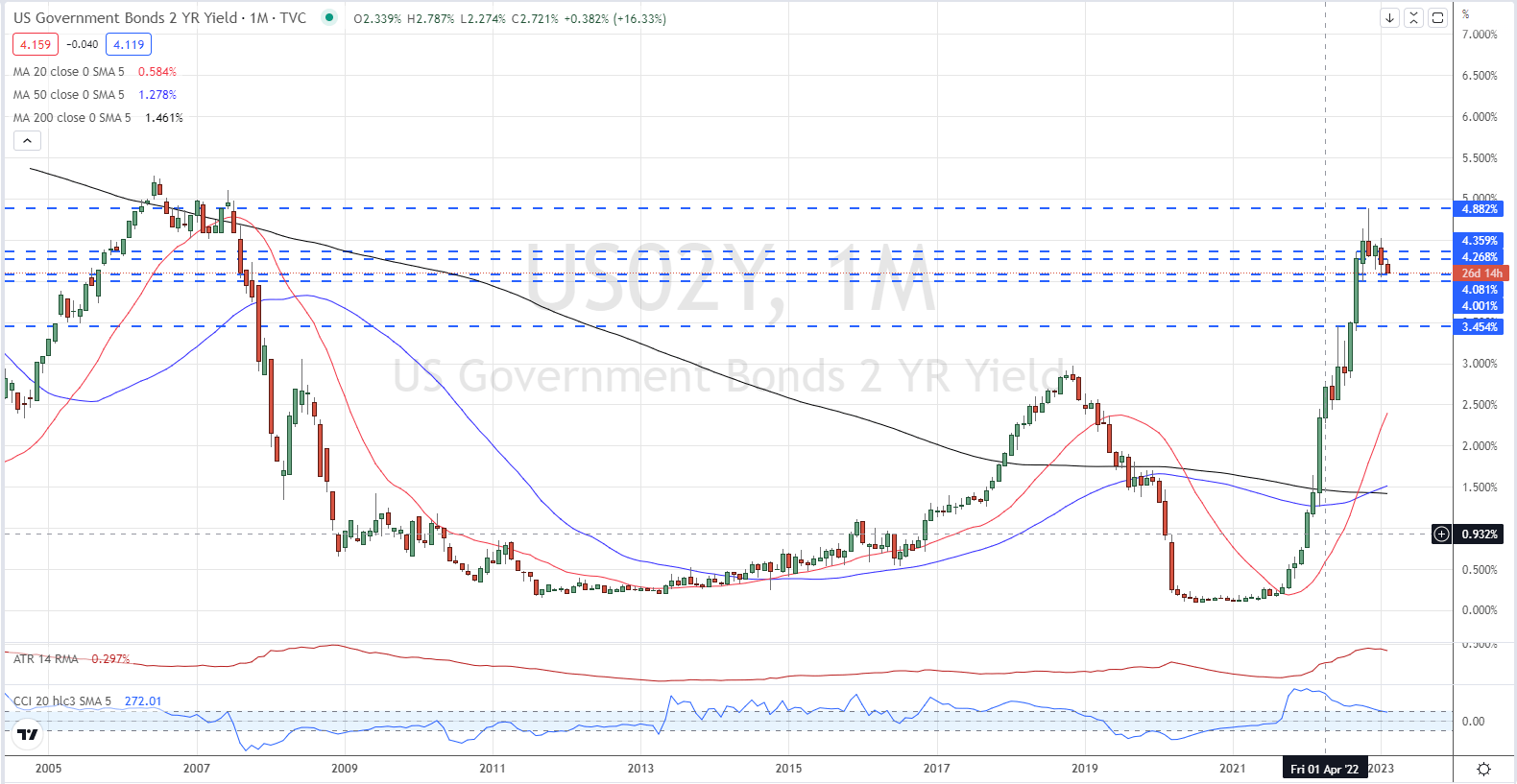

US Treasury yields fell sharply post-fed chair Powell’s press conference and are now set to test multi-month yield levels. The US 10-year is trading at 3.43%, down from a 15-year high of 4.33% made in late October, while the rate-sensitive UST 2-year is quoted with a yield of 4.11%, sharply lower than the early November multi-year high of 4.88%.

US Treasury 2-Year Yield – Monthly Chart

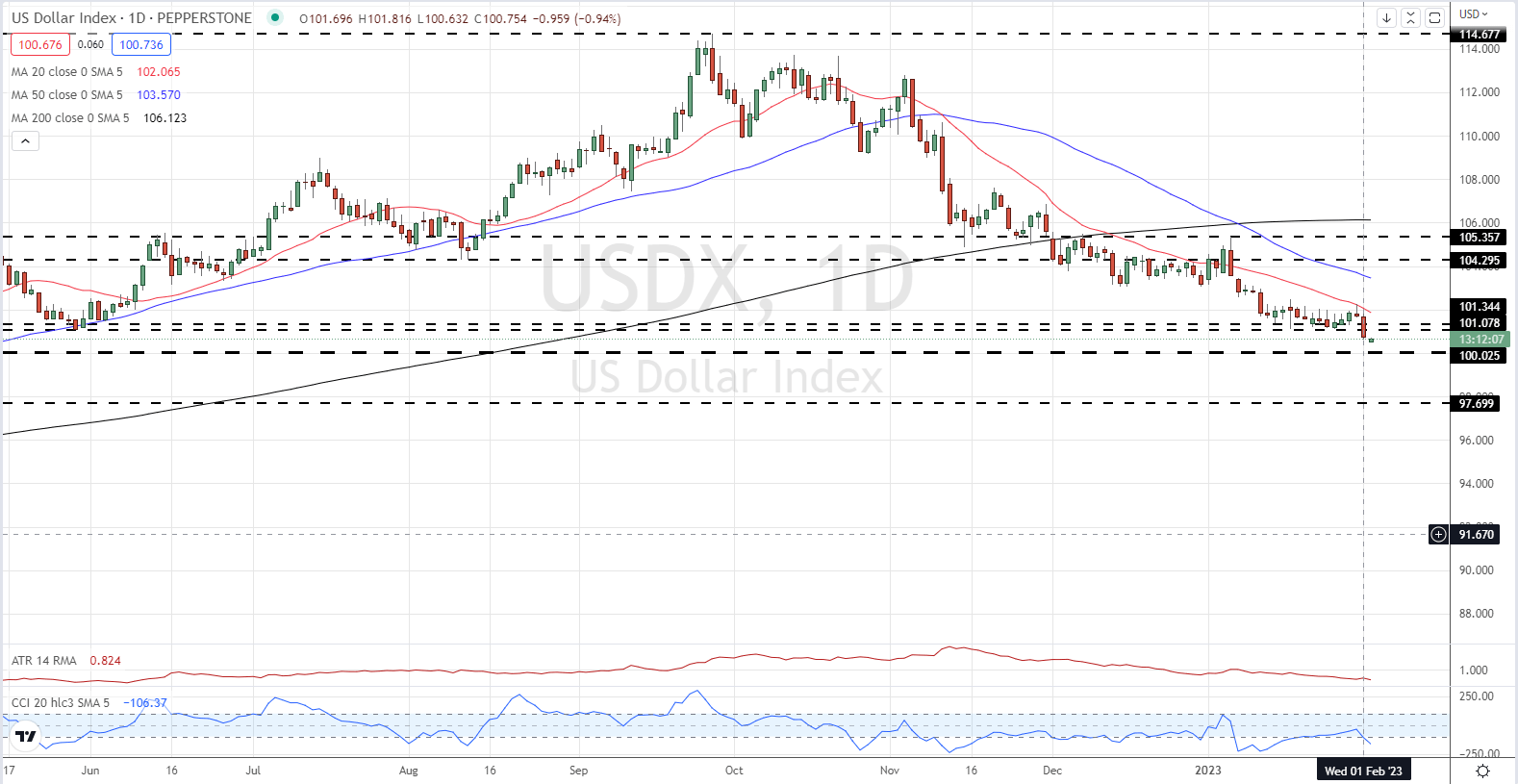

The US dollar slipped further post-FOMC and pushed below a zone of support that has held over the past couple of weeks. The DXY chart remains bearish and the US dollar index is likely to test the psychological 100 level soon, maybe even this week depending on Friday’s US Job Report. Today’s ECB rate decision – a 50bp hike is fully priced-in – may also weigh on the dollar if President Lagarde continues to repeat the central bank’s hawkish stance. The Euro has an approximate 57% weighting in the US dollar index (DXY).

US Dollar (DXY) Daily Price Chart – February 2, 2023

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]