[ad_1]

Gold, XAU/USD, Federal Reserve, Technical Analysis – Briefing:

- Gold prices rallied the most in almost 2 weeks after the Fed

- Markets continue to bet against Powell’s rate outlook vision

- XAU/USD now turns to non-farm payrolls data on Friday

Recommended by Daniel Dubrovsky

Get Your Free Gold Forecast

Gold prices gained 1.14 percent on Wednesday, the most in almost 2 weeks. The yellow metal is on course for a 7th consecutive week of gains. That would be the longest winning streak since the summer of 2020. All eyes were on the Federal Reserve over the past 24 hours, which delivered a 25 basis point rate hike, as expected. That brought benchmark lending rates to a range of 4.50% – 4.75%.

As usual, the focus was on what could come rather than on what occurred. Since the end of last year, markets have been pricing in an increasingly dovish outlook. As a result, the US Dollar and Treasury yields fell as the S&P 500 gained. The Chicago Fed National Financial Conditions Index is at its lowest since the Fed started tightening last year – a sign of easing liquidity in markets despite quantitative tightening.

What did Chair Jerome Powell say? He acknowledged that inflation has eased somewhat but that ‘it remains elevated’. He stressed that the central bank ‘will need to stay restrictive for some time’ and that if the economy performs as expected, policymakers don’t see cuts this year. How did the markets respond?

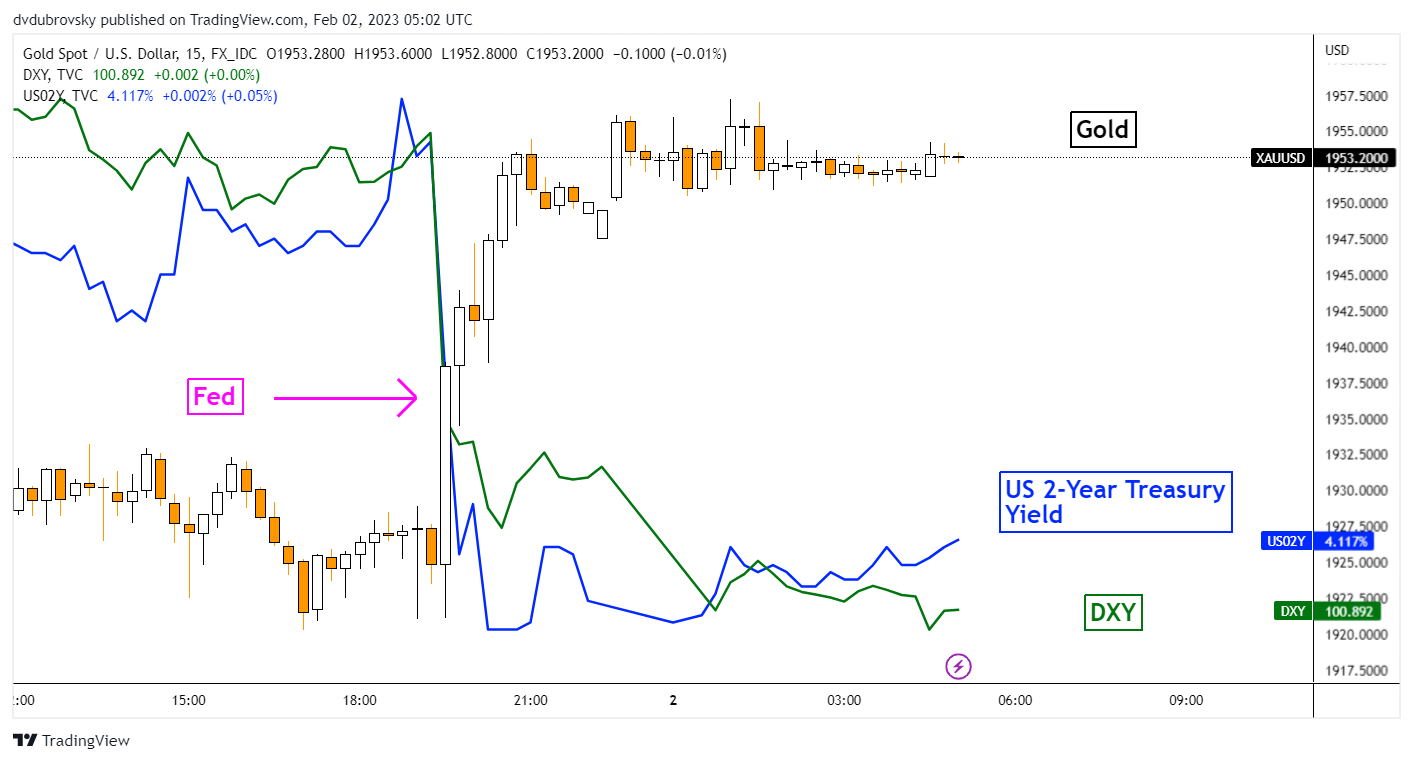

Despite Powell’s rhetoric, financial markets continued to bet against the central bank. Fed Fund Futures point at 2 rate cuts towards the end of this year. This is as traders added in almost half a cut to the 2-year horizon. On the intraday chart below, you can see the US Dollar falling alongside front-end bond yields. Gold rallied, capitalizing as the ‘anti-fiat’ trading instrument.

Powell was questioned about the recent easing in financial conditions, but his answer left more to be desired. He said that the focus is “not on near-term moves, but on sustained changes”. All things considered; this continues to leave markets vulnerable to disappointment if a pivot becomes increasingly unlikely. To that end, the focus remains on economic data and non-farm payrolls on Friday.

Gold Surges During the Federal Reserve Rate Decision

Gold Technical Analysis

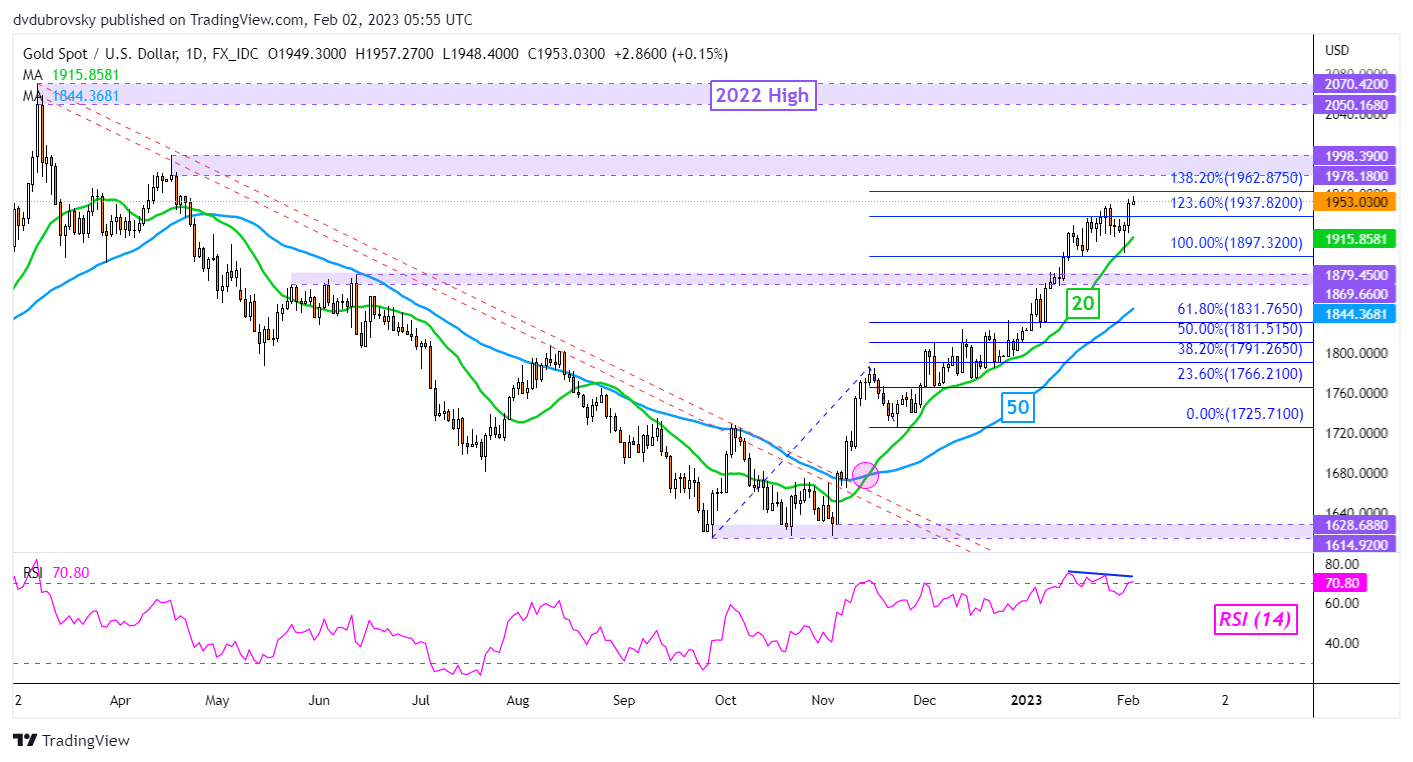

Gold closed at a new high this year, taking out the January peak at 1949.16. That placed XAU/USD closer to the key 1978 – 1998 resistance zone. Negative RSI divergence is present, showing that upside momentum is fading. That can at times precede a turn lower. In such a case, the 20-day Simple Moving Average (SMA) could maintain the upside focus.

Recommended by Daniel Dubrovsky

How to Trade Gold

XAU/USD Daily Chart

Chart Created Using TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX

[ad_2]