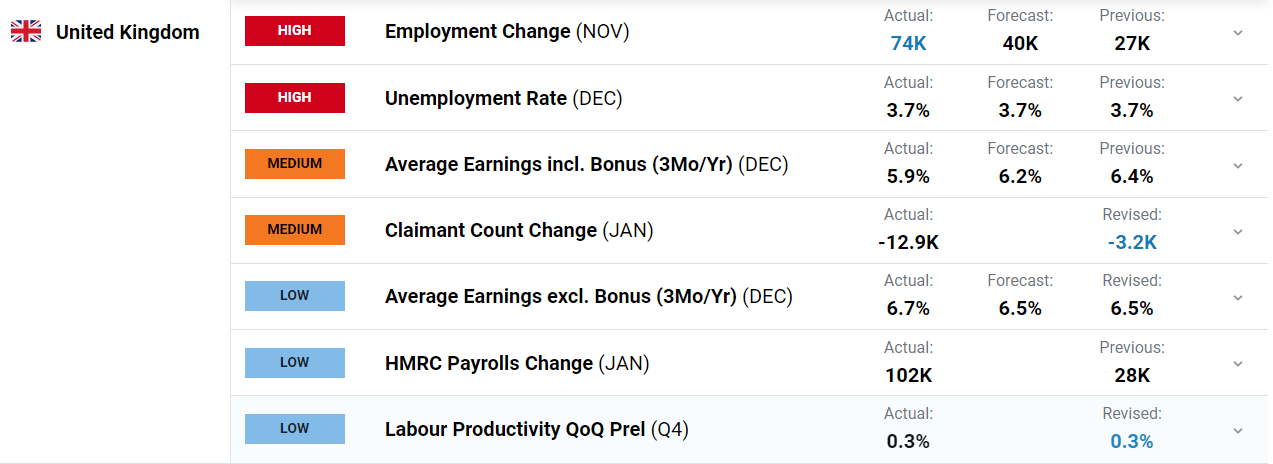

UK EMPLOYMENT DATA KEY POINTS:

Recommended by Zain Vawda

Get Your Free GBP Forecast

READ MORE: UK GDP Data in Line with Estimates, GBP/USD Steady

The UK unemployment rate remained unchanged for the 3 months to December 2022, in line with expectations. The number of people unemployed for up to six months increased, driven by people aged 16 to 24 years. The number of people in work in the UK rose by 74K in the three months to December, well-above market forecasts of a 40K increase and following a 27K rise in the previous month. Meanwhile, in November 2022 to January 2023, job vacancies fell by 76K to 1,134K, the seventh consecutive quarterly fall, reflecting uncertainty across industries, as survey respondents continue to cite economic pressures as a factor in holding back on recruitment. UK Chancellor Hunt meanwhile commented that unemployment remaining close to record lows is an encouraging sign of resilience in our labor market.

Customize and filter live economic data via our DailyFX economic calendar

AVERAGE EARNINGS INCL. BONUS

The wages in the United Kingdom increased 5.90 percent in December of 2022 over the same month in the previous year beating estimates and down from the previous print of 6.4%. The worry however will be in the rise of average earnings excluding bonuses which increased to 6.7% beating forecast of 6.5%. Figures compare with market forecasts of a 6.2% and 6.5% rise, respectively. In real terms (adjusted for inflation), growth in total and regular pay fell on the year in October to December 2022, by 3.1% for total pay and by 2.5 for regular pay. This is smaller than the record fall in real total pay we saw in February to April 2009 (4.5%), remains among the largest falls in growth since comparable records began in 2001. Wage growth has remained a sticking point for the Bank of England and a key contributor to inflation.

UK LABOR MARKET MOVING FORWARD

The IMF warned that the UK is yet to absorb as many people back into employment as it had before the pandemic in March 2020. Despite the positive data out today this seems set to continue with BDO (accountancy and business advisory firm) releasing its monthly business trends report which indicated UK businesses plan to hire less but pay more for those they need. The report further indicated that UK businesses plan to recover these costs by raising prices which is something that will worry the Bank of England as it looks to tame inflation.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The Bank of England has made its feelings known in regard to the labor market and will be closely monitoring its decision maker panel (a survey of business), with the next instalment due on March 2. This forward-looking gauge on potential wage and price pressures will provide a picture of what to expect in the months ahead.

MARKET REACTION

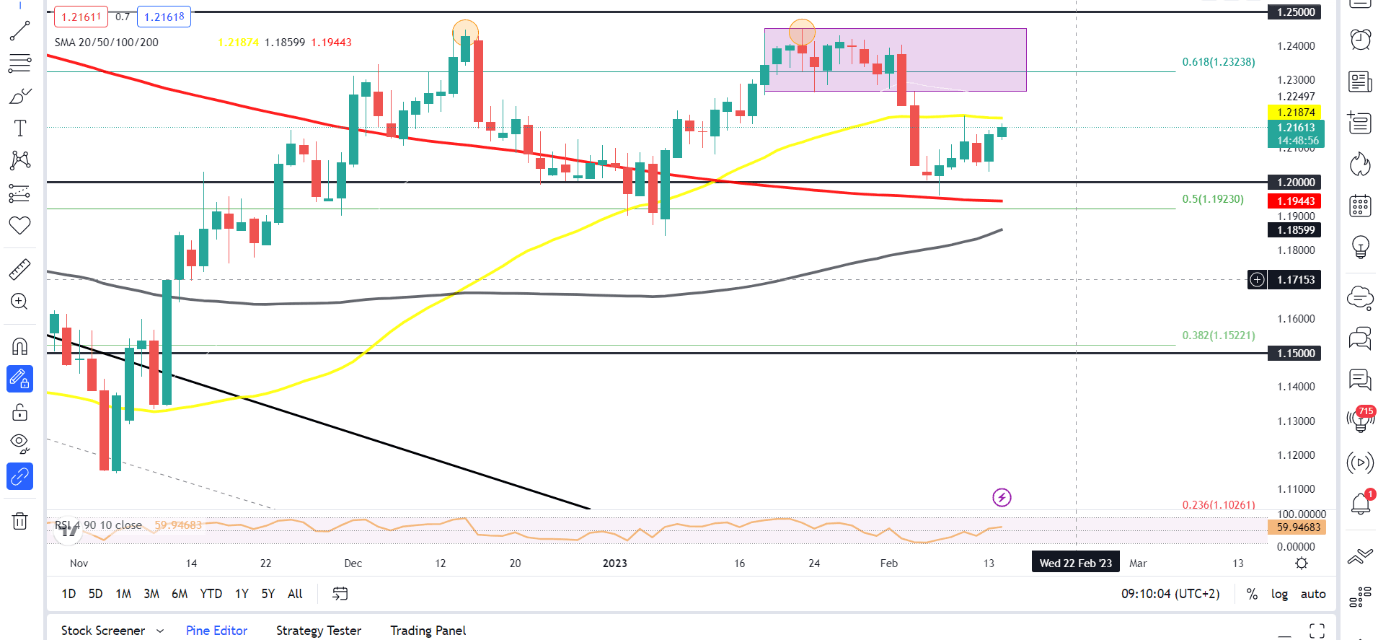

The initial market reaction following the news has seen GBPUSD jump 25 pips to trade at 1.21650. Looking at the bigger picture from a technical perspective, GBPUSD price pushed higher yesterday back toward the 50-day MA. We remain between the 200 and 50-day MAs with a break above the 50-day MA likely to face resistance at the 1.2270 area, the lower end of the range breakout from February 2. A potential downside break must contend with the psychological 1.2000 handle as well as the 200 and 100-day MA if it is to make a significant push to the downside. At this stage the technicals aren’t giving much away with a breakout in either direction a possibility.

GBPUSD Daily Chart, February 14, 2022

Source: TradingView, prepared by Zain Vawda

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda