[ad_1]

EUR/USD ANALYSIS TALKING POINTS

- Interest rate hikes looks to be the preferred path for ECB at this point.

- Economic calendar holds no high impact releases next week – volatility if any, likely USD driven.

- 200-day SMA not out of the woods just yet however, upside looks limited.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

The current situation within the eurozone has not changed much with geopolitical tensions remaining giving rise to the energy threats that seem to ebb and flow periodically. That’s being said, from an ECB standpoint, things are getting interesting. ECB officials seem to be divided in their opinions with some favoring a sustained aggressive stance while others are looking at introducing Quantitative Tightening (QT) sooner than expected to avoid such hawkish interest rate hikes.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

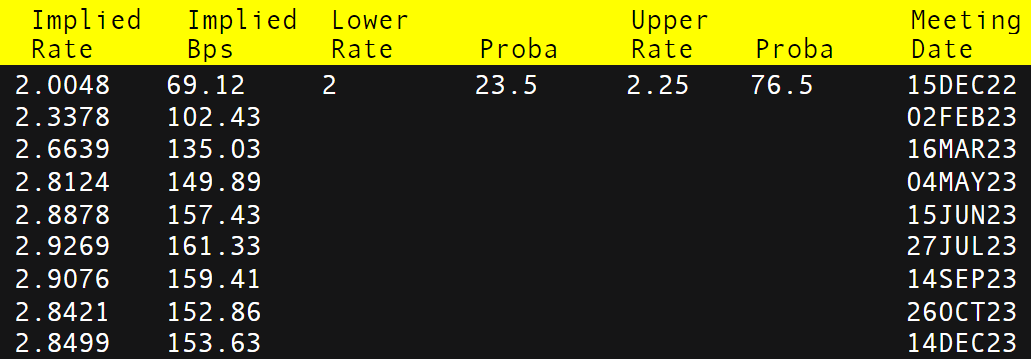

The ECB’s Knot has been vocal about using an earlier implementation of QT to quell inflationary pressures and thus reducing the peak rate which is currently priced in at 2.9269% in July 2023. ECB President Christine Lagarde however, seems to favor interest rate hikes as a superior tool to curb inflation.

ECB INTEREST RATE PROBABILITIES

Source: Refinitiv

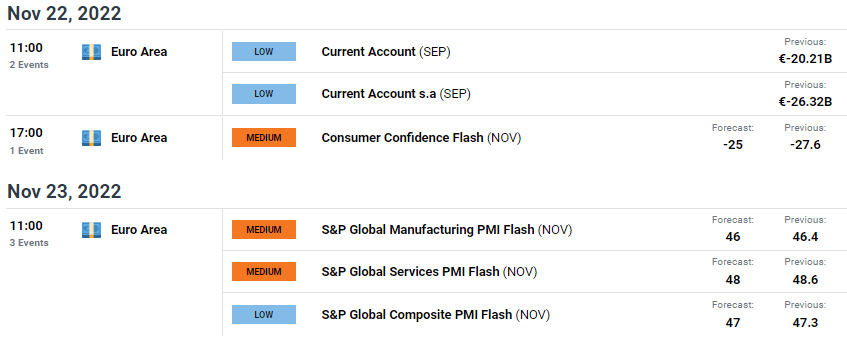

Next week is fairly light from a eurozone perspective with manufacturing and services data for November being the standout releases. Expectations are lower than the prior print and may add to lesser euro support against the greenback.

EUR/USD ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

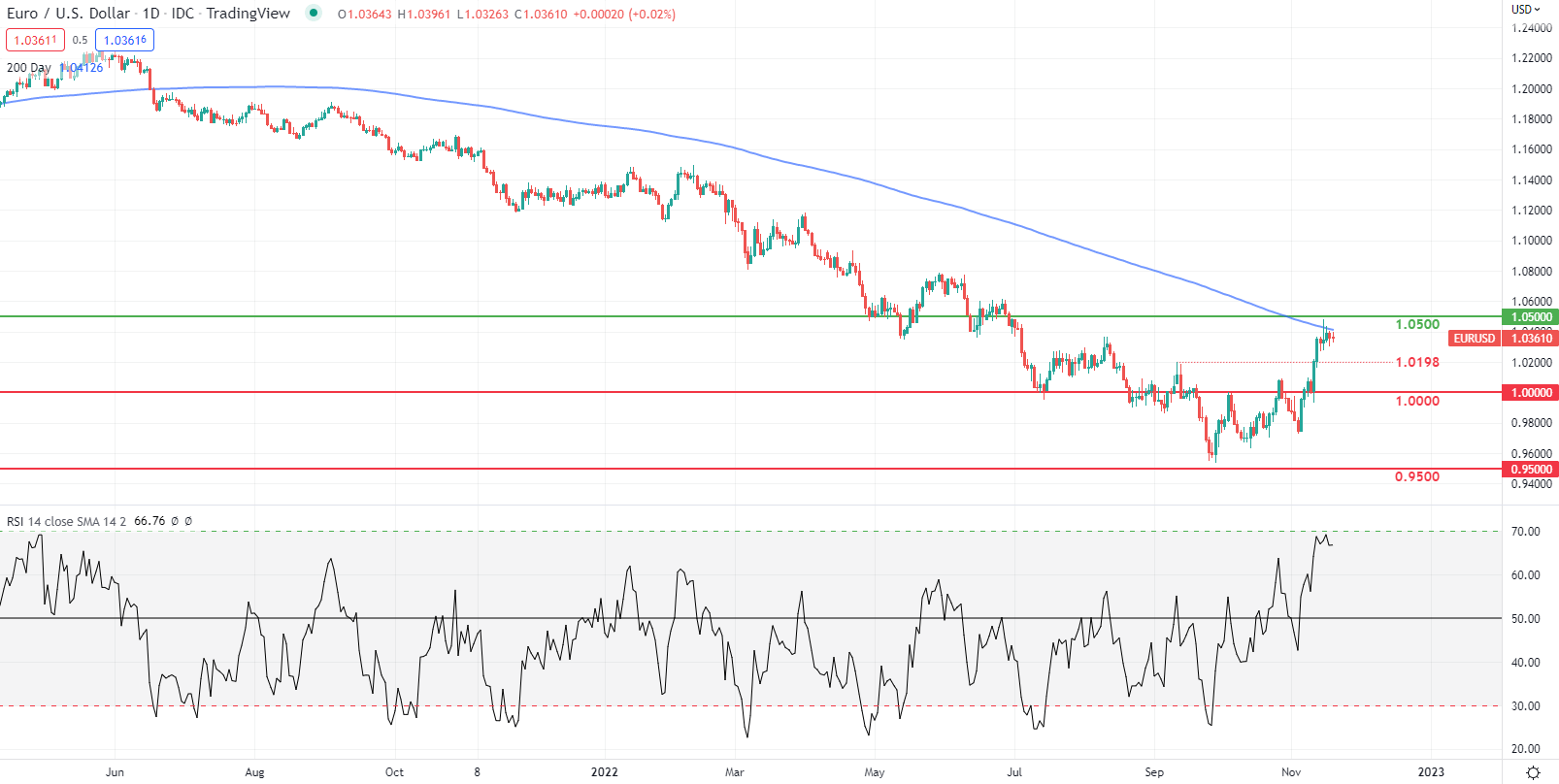

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

EUR/USD price action keeps bulls attempting to pierce above the 200-dy SMA (blue) which has not occurred since June of 2021. The inability of further upside coinciding with the Relative Strength Index (RSI) approaching overbought levels, suggests fading bullish momentum. While there is room for some appreciation, I believe this will be marginal and could be capped around the 1.0500 psychological handle thereafter proceeding to subsequent support zones.

Resistance levels:

Support levels:

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently SHORT on EUR/USD, with 59% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we favor a short-term downside bias.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]