[ad_1]

Recommended by Daniel Dubrovsky

Get Your Free Equities Forecast

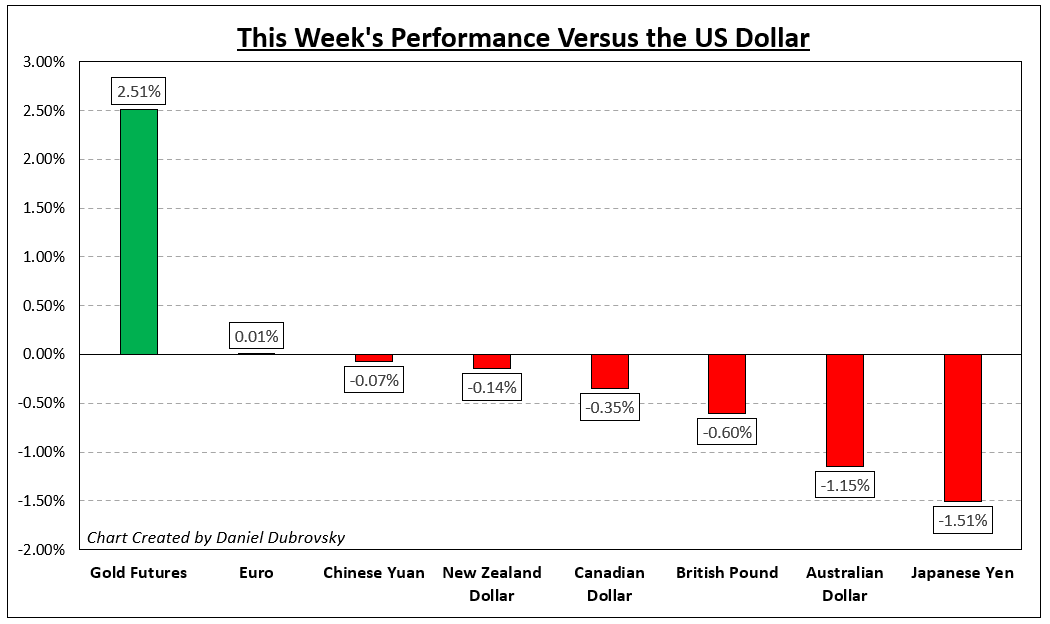

Global risk appetite improved this past week. On Wall Street, the Dow Jones and S&P 500 rallied 1.79% and 1.86%, respectively. Meanwhile, Across the Atlantic Ocean, the DAX 40 and FTSE 100 rallied 2.59% and 0.46%, respectively. This is as Japan’s Nikkei 225 and Hong Kong’s Hang Seng Index gained 1.73% and 2.79%, respectively. The rosy mood meant a disappointing week for the anti-risk US Dollar as gold prices aimed higher. Will this momentum keep up?

Notable event risk for financial markets includes a few central bank rate decisions. These are the RBA, BoC and BoJ for the Australian Dollar, Canadian Dollar and Japanese Yen, respectively. Meanwhile, traders will be closely scrutinizing testimony by Federal Reserve Chair Jerome Powell before Congress. Recent signs that inflation might be stickier than thought have seen markets price in more rate hikes this year. At the end of the week, we will wrap things up with non-farm payrolls data. What else is in store for markets in the week ahead?

Recommended by Daniel Dubrovsky

Get Your Free USD Forecast

How Markets Performed – Week of 2/27

Fundamental Forecasts:

Euro Week Ahead Forecast: Fed’s Powell Testimony Will Drive Market Sentiment

EUR/USD will be dancing to the US dollar’s tune next week with Fed chair Powell’s Semi-Annual Testimony to the US Senate’s Banking Committee and the delayed US Jobs Report the highlights.

GBP Weekly Forecast: Pound Eyes UK GDP Alongside US NFP

GBP/USD is preparing for some price volatility next week including UK GDP, Fed Chair Jerome Powell and US NFP data.

Australian Dollar Forecast: Will China PMI Help Reverse AUD/USD’s Decline?

The slide in the Australian dollar has paused following surprisingly strong China manufacturing and services data. Would it be enough to trigger a sustainable rebound in AUD/USD?

US Dollar Weekly Forecast: Will Another Solid Jobs Report Boost the Greenback?

The US Dollar may rise if another solid non-farm payrolls report underscores a tight labor market amid sticky price pressures, causing the Federal Reserve to remain tighter for longer.

Canadian Dollar Outlook: USD/CAD Halted by Event Risk. Fed, BoC on Deck

USD/CAD prices move cautiously ahead of a busy economic calendar. What will move Loonie this week?

Australian Dollar Outlook: Steady Ahead of RBA Decision

The Australian Dollar consolidated last week pre-RBA monetary policy meeting as yield differentials provide a headwind. If the RBA hike, will AUD/USD get a boost?

Technical Forecasts:

S&P 500, Nasdaq 100 Forecast: Speculative Frenzy at Risk ahead of Key US Jobs Report

The speculative frenzy that triggered a rally in the S&P 500 and Nasdaq 100 this past week could end if U.S. labor market data beat estimates and bolster Fed rate hikes expectations.

Gold Technical Forecast: XAU/USD Bull Run Extends

Gold has achieved a phenomenal turnaround after the massive sell-off in February. A close above 1833 entrenches the recent advance as momentum turns positive.

— Article Body Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members

To contact Daniel, follow him on Twitter:@ddubrovskyFX

[ad_2]