[ad_1]

POUND STERLING ANALYSIS & TALKING POINTS

- Will Chinese positivity follow through next week benefitting risk assets?

- UK GDP and Fed speak in focus next week.

- GBP/USD hesitance awaiting fundamental catalyst.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

GBPUSD FUNDAMENTAL BACKDROP

The British pound found some support on Friday with UK services data PMI as well as renewed risk appetite after better than expected Chinese PMI figures. The China re-open story has started to gain traction again allowing risk assets like the GBP to flourish. The key theme for next week remains in line with data dependency and while the Bank of England (BoE) has been erring on the side of caution in terms of their forward guidance, the US seems to be sticking with the hawkish narrative. That being said, market reactions to central bank speak have been on the decline as there has not been much change in forward guidance from Fed officials. This has given economic data more significance however; Fed Chair Jerome Powell who is scheduled to speak next week should bring about more attention relative to the other Fed officials.

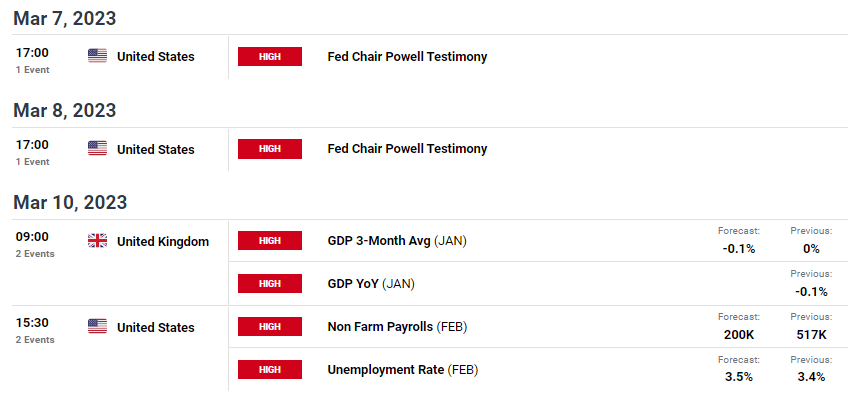

Non-Farm Payroll (NFP) data (see economic calendar below) will take center stage from a US perspective, after persistence robust labor data. This has been supplementing the aggressive approach from the Fed (which is largely priced in). With expectations baked into the upside, any miss on data should result in a positive move for the pound.

Recommended by Warren Venketas

How to Trade GBP/USD

From a UK perspective, UK GDP will be in focus and is expected to dip below 0% and should actual data fall in line, recessionary fears will be renewed, likely hampering GBP upside.

ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

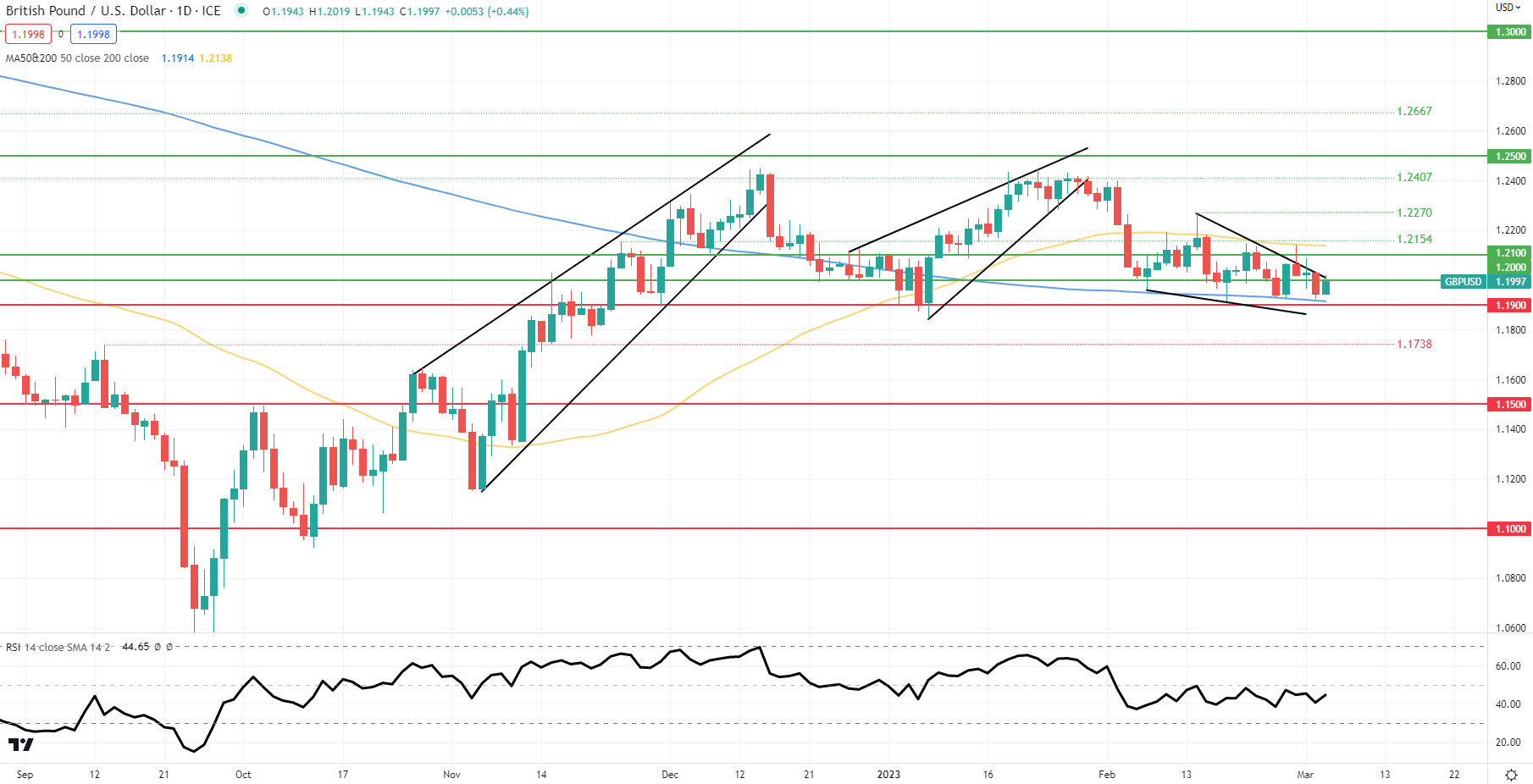

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily GBP/USD price action although weakening against the greenback, is keeping in touch with the 1.2000 psychological handle, seeking a breakout above the falling wedge chart pattern (black). As mentioned above, data will be the key driver of a breakout which could be confirmed by a candle close above or below the wedge formation.

Key resistance levels:

- 1.2100

- Wedge resistance

- 1.2000

Key support levels:

BEARISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 61% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside disposition.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]