[ad_1]

USDJPY, Rate Forecasts and Volatility Talking Points:

- The Market Perspective: USDJPY Bullish Above 132

- USDJPY has developed a remarkably consistent channel, which has led to a range trading-like response from retail traders; but a break will be necessitated sooner than later

- Carry trade appetite is still a strong influence on USDJPY; but with a FOMC plateau seen in the near-future, will risk trends take precedence?

Recommended by John Kicklighter

Get Your Free JPY Forecast

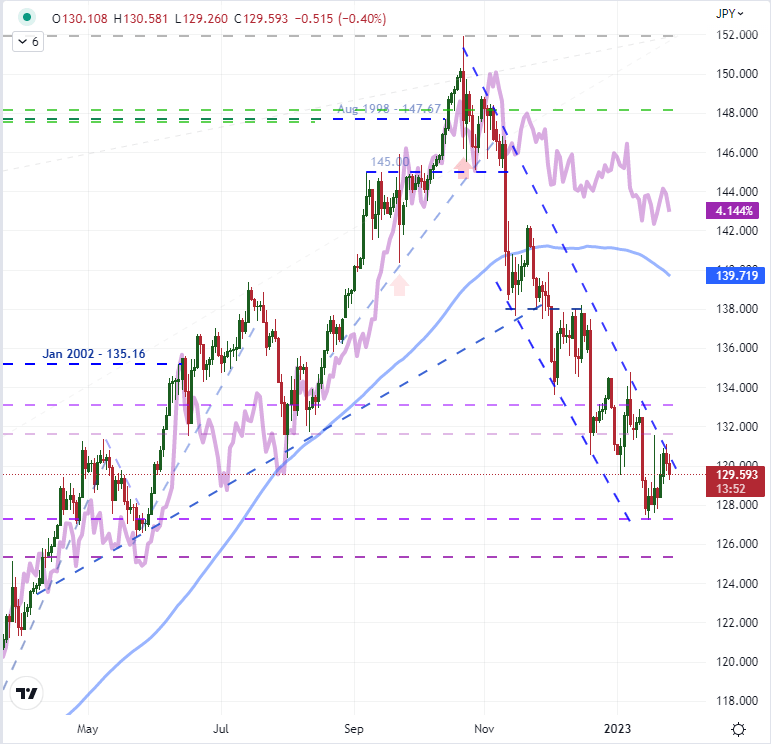

Like most of the Dollar-based crosses, USDJPY is struggling to establish a clear bearing. There is a prevailing bear trend that has developed following the November 10th breakdown – conveniently shaped as a consistent channel that has effectively cut 22 months of progressive advance through October in the span of just 3 months. That said, the past month has seen competing technical barriers arise to slow bears’ momentum while keep any serious jumps from bulls in check. To the upside, resistance is defined by the trend channel resistance stretching back to the October 21st peak high and happens to coincide with the 20-day simple moving average in the vicinity of 130.50-25. The block to progress lower is the midpoint of the January 2021 to October 2022 climb that falls at 127.25. These are fairly distinct levels, but I would warn against treating the chart as if its lines are sacrosanct. There are more than a few examples in the market whereby technical breaks have completely failed to usher in the subsequent technical move that textbooks would suggest (eg the S&P 500 around its 200-day SMA). What we need is fundamental motivation. For USDJPY, the most productive motivation according to correlations has been the progress of the growing carry trade. The relationship between the US and Japan 2-year yield spread to USDJPY was impressive up until November. As the exchange rate retreated sharply, the carry would more level out than reverse course. With the PCE deflator – the Fed’s favorite inflation indicator – on tap Friday, there may be some urge to restore this theme to prominence; but the FOMC decision next Wednesday would likely quickly snuff out momentum.

Chart of USDJPY with 100-Day SMA Overlaid with the US-Japan 2-Year Yield Spread (Daily)

Chart Created on Tradingview Platform

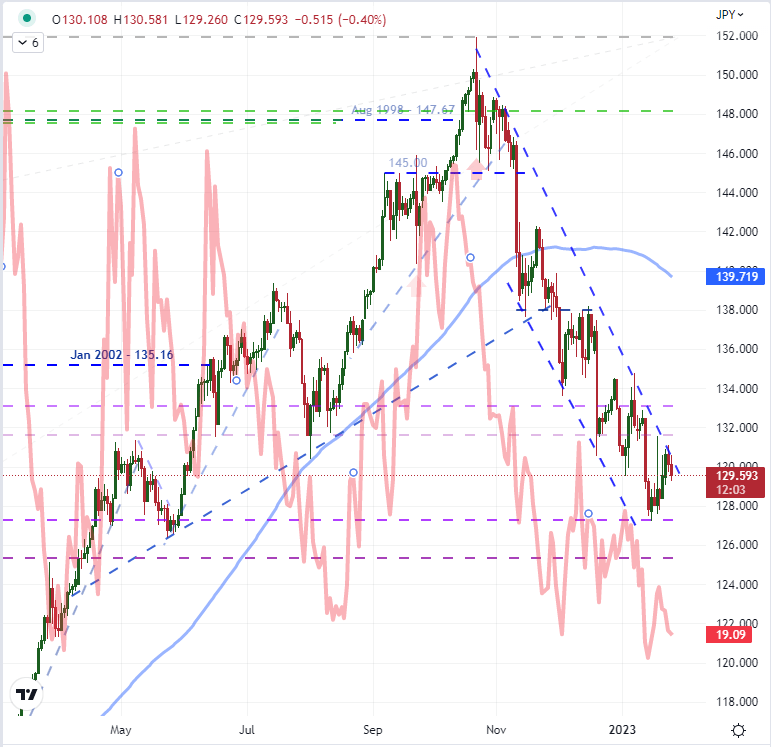

A more practical driver for USDJPY moving forward is the same systemic source that is likely to restore momentum to the markets at large: the undercurrent in risk trends. When we pit most other currencies against either the US Dollar or Japanese Yen, those benchmark currencies are typically treated as the havens in the pairing. But, which currency is the haven in USDJPY? The natural assumption given the carry trade build up behind the FOMC’s aggressive tightening regime would be for the Yen to benefit from a slump in risk appetite that forces an unwind of the yield-collecting exposure. That said, the correlation between USDJPY and the familiar VIX volatility index (often referred to as the ‘fear index’) presents generally the opposite scenario. Given the 50 percent retracement on this pair from peak highs, the carry implications are likely significantly discounted; which amplifies the more elemental aspects of risk aversion. Given that there is less likely a sudden and steep slide in volatility from here, the more potent scenario going forward would be a surge in risk aversion. If the relationship holds, that would seem to benefit USDJPY clearing the topside of its channel. Now, we just need to see if risk trends will catch.

Chart of USDJPY with 100-Day SMA Overlaid with the VIX Volatility Index (Daily)

Chart Created on Tradingview Platform

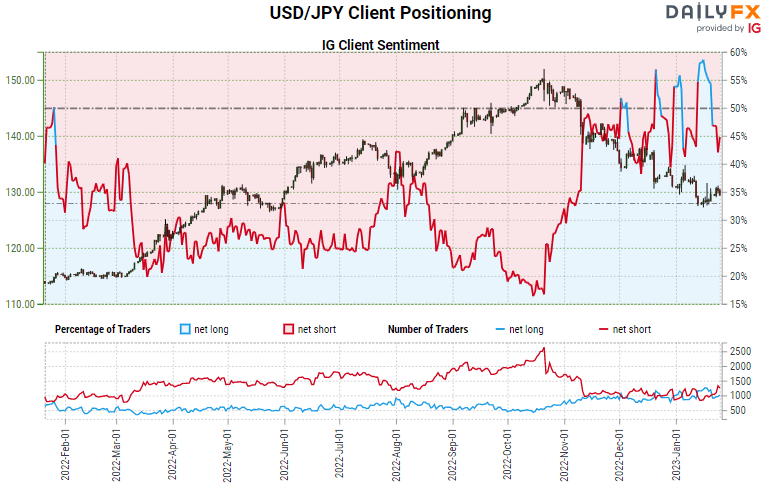

As we keep vigil over the eventual next trend for USDJPY, it is worth reflecting on how retail traders are engaging the pair. Reflecting on the IG Client Sentiment data, we can see that there has been a distinct swing from net long to short and back again in distinct cycles these past two months. It seems retail traders are growing comfortable with the distinctive channel in staging range positions. That is not a bad approach considering the market’s actions over the period, but channel will eventually come to an end – and the range consistency along with it.

| Change in | Longs | Shorts | OI |

| Daily | -5% | 12% | 4% |

| Weekly | -18% | 54% | 13% |

Chart of USDJPY Overlaid with IG Client Positioning (Daily)

Chart Created on DailyFX

[ad_2]