[ad_1]

Australian Dollar, AUD/USD, RBA, Lowe, Bullock, AU GDP, ASEAN, Range Trade – Talking Points

- The Australian Dollar bounced off some trend lines last week

- The RBA appears certain to be on hold tomorrow as the guard prepares to change

- GDP data and China relationships may provide some impetus. Higher AUD/USD?

Recommended by Daniel McCarthy

How to Trade AUD/USD

The Australian Dollar is steady near 0.6450 going into Monday’s trading session ahead of the Reserve Bank of Australia’s rate decision tomorrow and then GDP data on Wednesday.

Tuesday’s RBA monetary policy committee meeting will be the last chaired by Governor Philip Lowe as he will be passing the baton to Michele Bullock later this month.

Interest rate markets anticipate that the bank will keep rates on hold at 4.10% for the third month in a row after raising them by 400 basis points since May 2022.

A Bloomberg survey of economists supports this perspective. The decision can be watched live here.

Last week, the incoming Governor made it clear that future rate decisions are a meeting-by-meeting scenario and data-dependent.

The market is currently not pricing in any more hikes in this cycle and is looking for cuts in the cash at the back end of 2024.

On Wednesday, 2Q quarter-on-quarter GDP is forecast to be 0.3% against 0.2% previously.

Annual GDP to the end of July is anticipated to be 1.8% against the prior read of 2.3% as the base effect kicks in.

The US are on holiday today and market conditions could be skittish overnight on less liquidity.

Elsewhere, the ASEAN 2023 summit gets underway in Jakarta tomorrow. It is being reported that Australian and Chinese officials will be meeting on the sidelines for the first time since 2020 when relationships soured.

Although there are not expected to be any major announcements, the thawing of tension between the nations might be seen as a positive step by the markets.

The weekend AUD article can be viewed here.

Recommended by Daniel McCarthy

The Fundamentals of Range Trading

AUD/USD DAILY CHART

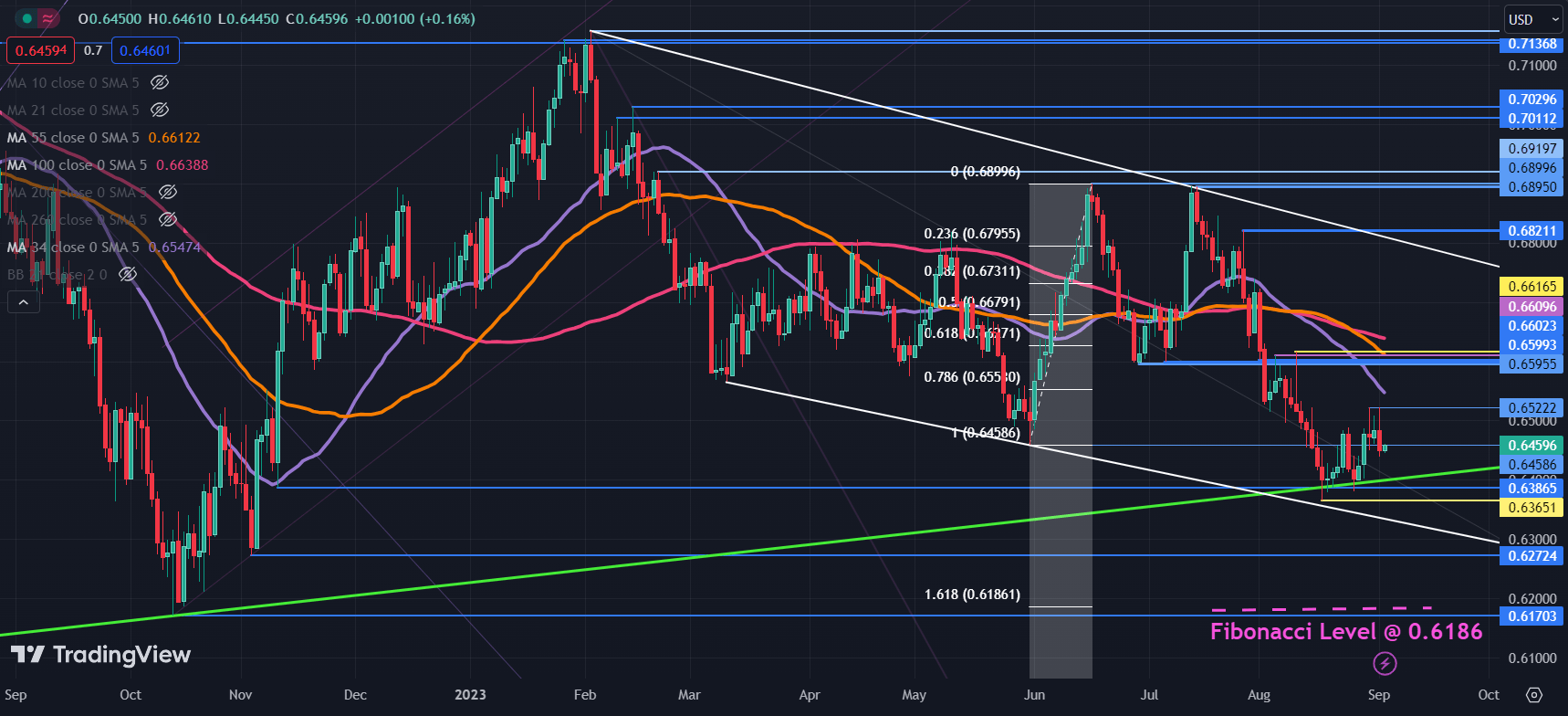

AUD/USD appears to be at somewhat of a crossroads. It has consolidated after bouncing off a long-term ascending trend line but remains in a shorter-term descending trend channel.

The price remains below the 34-, 55- and 100-day Simple Moving Averages (SMA) which may suggest that bearish momentum is intact for now.

The 0.6600 – 0.6620 area seems to be shaping up as a notable resistance zone with several breakpoints and prior peaks there.

The 100-day SMA is currently just above there, near 0.6640 and if it clears that, it might indicate that the overall range trade scenario is intact for now.

To learn more about range trading, click on the banner above.

On the downside, support may lie at the breakpoints and previous lows of 0.6386,

0.6365, 0.6272 and 0.6170.

The latter might also be supported at 161.8% Fibonacci Extension level at 0.6186. To learn more about Fibonacci techniques, click on the banner below.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

[ad_2]