[ad_1]

EUR/USD ANALYSIS

- EZ CPI report shows softening headline inflation with core remaining sticky.

- Jackson Hole in focus next week.

- Bears stalk key support zone.

Recommended by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

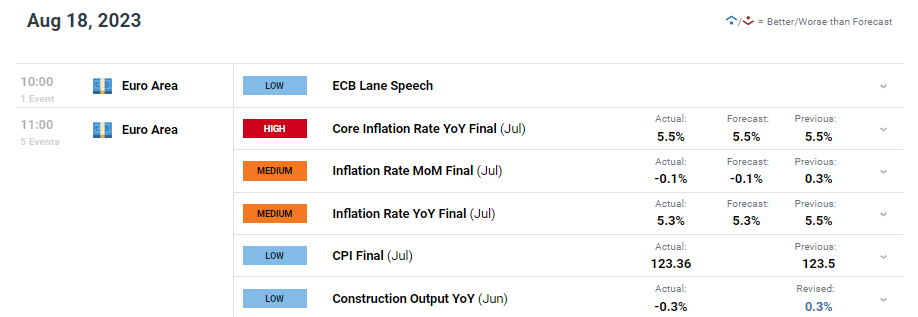

The euro extended its slide downward this Friday after euro area inflation (see economic calendar below) showed marginal signs of slowing on the headline print (both MoM and YoY). That being said, the all important core inflation figure remained elevated with food ,alcohol and tobacco as well as services the highest contributors. Construction output contracted highlighting concerns around the eurozone economy and with Chinese growth fears gaining traction, this could weigh further on the Europe, exposing the euro to further downside.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

EUR/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

From a USD perspective, the greenback has found support via a spike in US short term Treasury yields (2-year) as well as risk averse investors in response to uncertainty in China. The safe haven appeal of the greenback is one of many factors that has kept the DXY buoyant but looking ahead, next weeks Jackson Hole Economic Symposium could change momentum should Fed Chair Jerome Powell decide to reorientate the narrative to one of a more accommodative/dovish monetary policy outlook.

TECHNICAL ANALYSIS

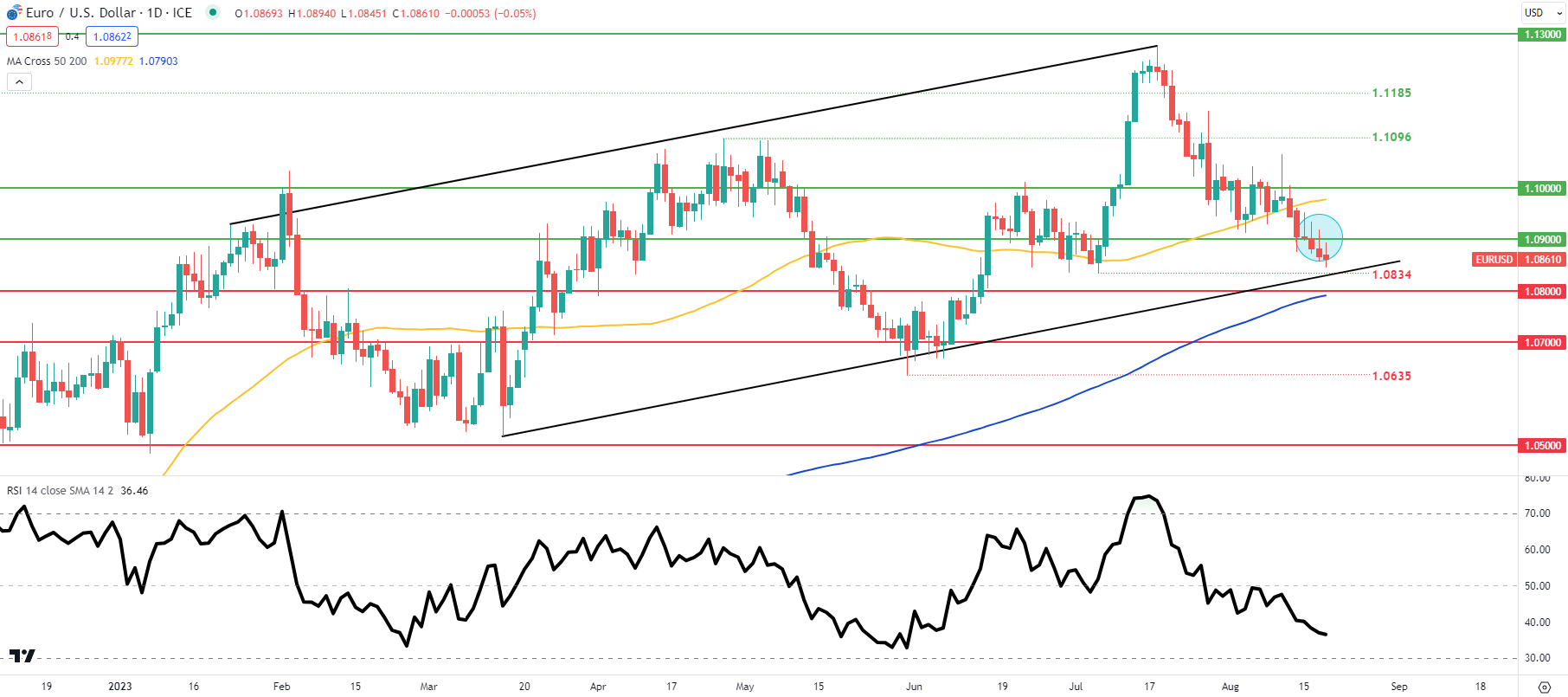

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily EUR/USD price action is nearing channel support (black) after a succession of long upper wicks candles (blue). Current fundamentals are in favor of further dollar strength short-term and with no high impact economic data to speak between now and Jackson Hole, traders will be cautious as the symposium historically brings about large volatile market reactions.

Resistance levels:

- 50-day moving average (yellow)

- 1.0900

Support levels:

- 1.0834/Channel support

- 1.0800

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently neither NET LONG on EUR/USD, with 61% of traders currently holding long positions (as of this writing). Download the latest sentiment guide (below) to see how daily and weekly positional changes affect EUR/USD sentiment and outlook.

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas

[ad_2]