[ad_1]

British Pound (GBP) Analysis and Charts

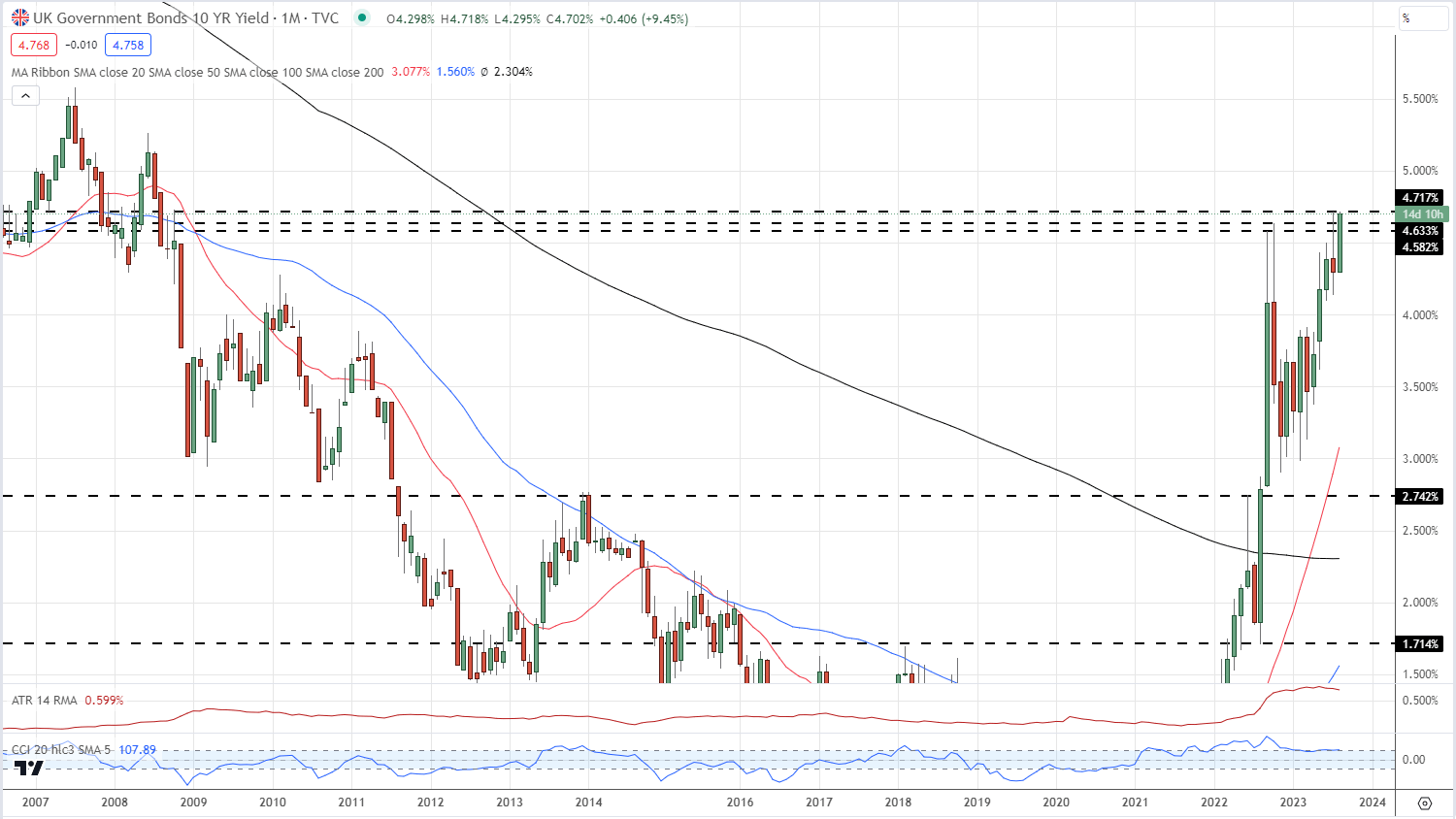

- 10-year UK gilt yield touching levels last seen 15 years ago.

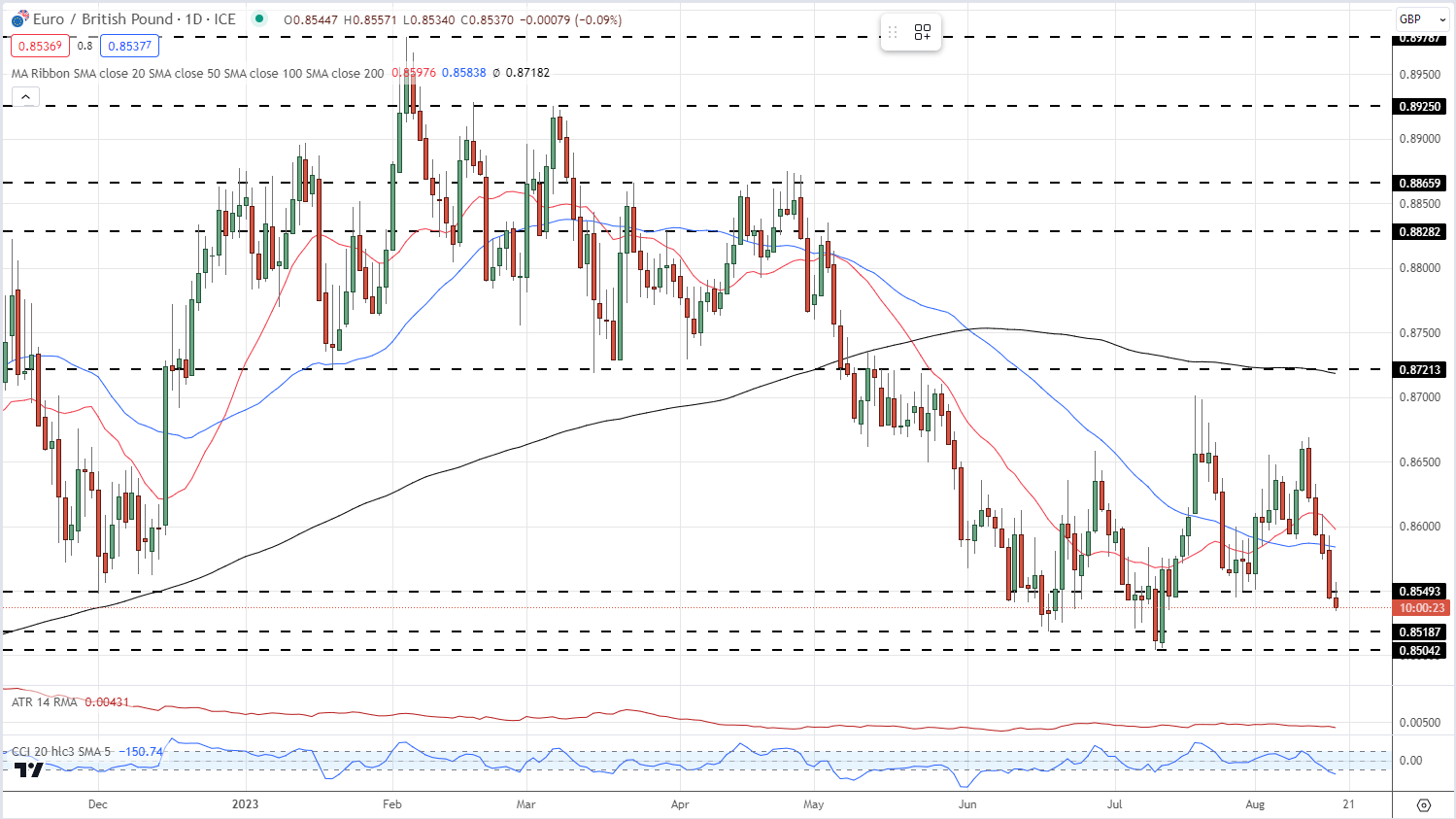

- EUR/GBP eyeing a test of multi-month support.

Recommended by Nick Cawley

How to Trade GBP/USD

The British Pound is pushing higher against a strong US dollar as fixed-income traders push the yield on UK government debt ever higher. The rate-sensitive UK 2-year is trading around a one-month high yield of 5.25%, while the yield on the benchmark UK 10-year is close to highs made nearly 15 years ago. UK government bond yields are pushing higher on expectations that the Bank of England (BoE) will continue to raise borrowing costs to try and force stickily high inflation back down to the central bank’s target.

UK 10-Year Gilt Yield – Monthly Chart

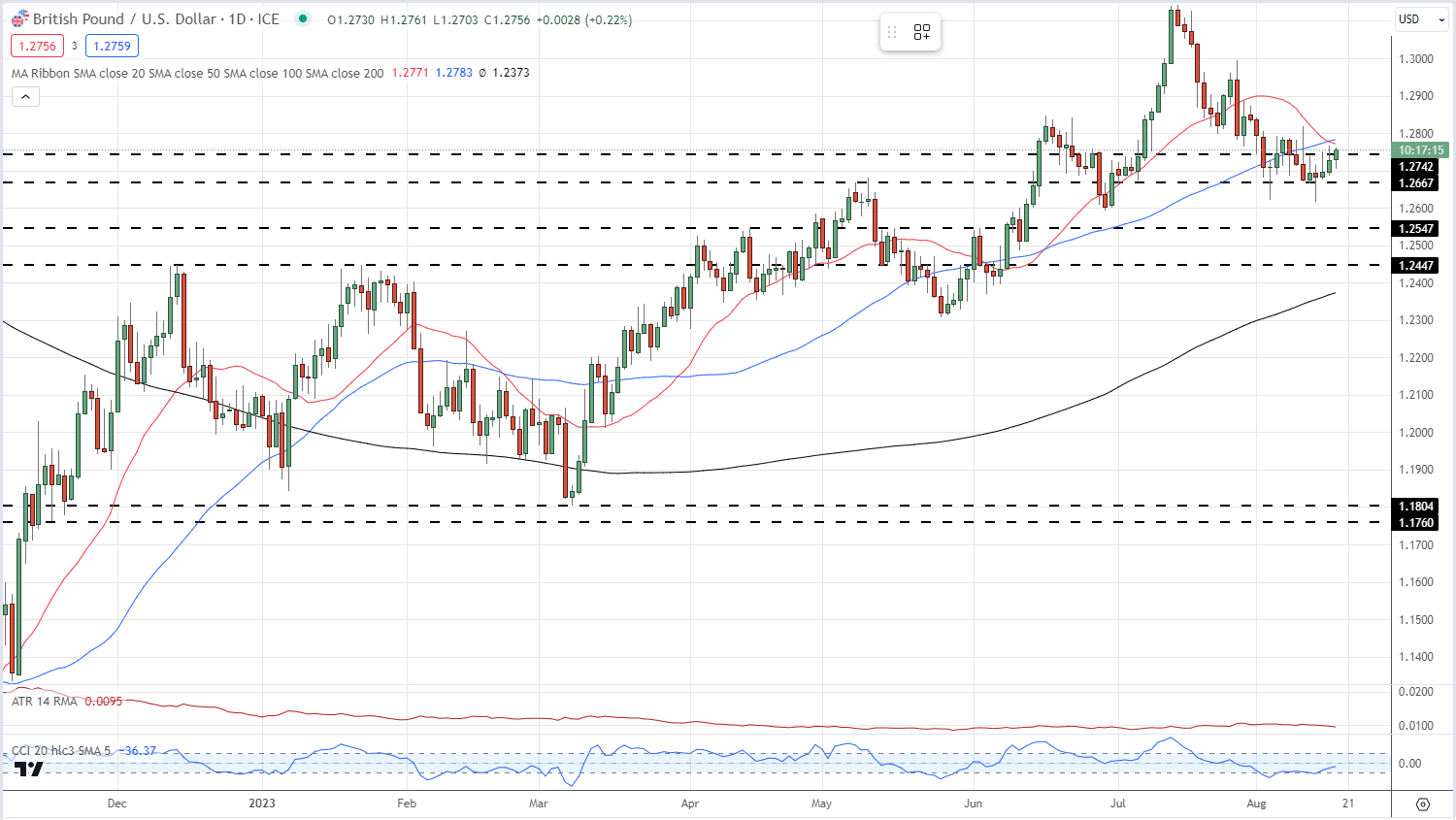

The push higher in GBP/USD comes despite indications from Wednesday’s FOMC minutes that a majority of Fed members ‘continued to see significant upside risks to inflation which could require further tightening of monetary policy’. This hawkish appraisal follows on from recent Fed commentary that the fight against US inflation needs more work. Next week’s Jackson Hole Symposium (August 24-26) will give Fed chair Jerome Powell the perfect platform to remind markets that the central bank can, and will, hike rates further if needed.

For all Economic Releases and Events, see the Updated DailyFX Calendar

GBP/USD is around 125 pips higher this week against the US dollar and is making sizeable gains against a range of other G7 currencies. The recent double-bottom around 1.2620 should provide short-term support, while initial resistance at 1.2771 and 1.2783 from the 20- and 50-day moving averages may not hold for long. A close and open above these levels would leave the August 10 high at 1.2844 vulnerable.

GBP/USD Daily Price Chart – August 17, 2023

For a Full GBP/USD Sentiment Report including Daily and Weekly Changes, Download your Free Guide Below.

| Change in | Longs | Shorts | OI |

| Daily | 9% | -8% | 1% |

| Weekly | 5% | 1% | 3% |

Sterling’s performance against the Euro is pushing the pair back down to a recent multi-month low. Five sizeable red candles have reversed around two weeks of EUR/GBP gains and leave the pair setting up for an eventual test of support at 0.8504. The CCI indicator shows EUR/GBP in heavily oversold territory so a test of support may need to wait until this reading reverses back into neutral territory. Resistance at 0.8584 off the 50-dma ahead of 0.8600.

EUR/GBP Daily Price Chart – August 17, 2023

Recommended by Nick Cawley

The Fundamentals of Breakout Trading

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]