[ad_1]

British Pound Talking Points:

Recommended by James Stanley

Get Your Free GBP Forecast

It’s been a strong Q4 for the British Pound, and if you could go back to the beginning of the quarter, that probably would’ve been a difficult fact to come to grips with. It was in late-September when the currency put in a collapse-like move after Liz Truss came under fire. Her tenure didn’t last long and British Pound weakness dried up as she was hitting the exits.

And then for most of the next two and a half months, GBP/USD rallied, eventually re-claiming the 1.2000 psychological level and then this week, pushing up to a fresh six-month-high. To be sure, a large portion of that move was pushed by USD-weakness; but GBP was strong elsewhere, such as in GBP/JPY, which closed Q3 below the 162 handle and today sits above the 168 level.

GBP/USD

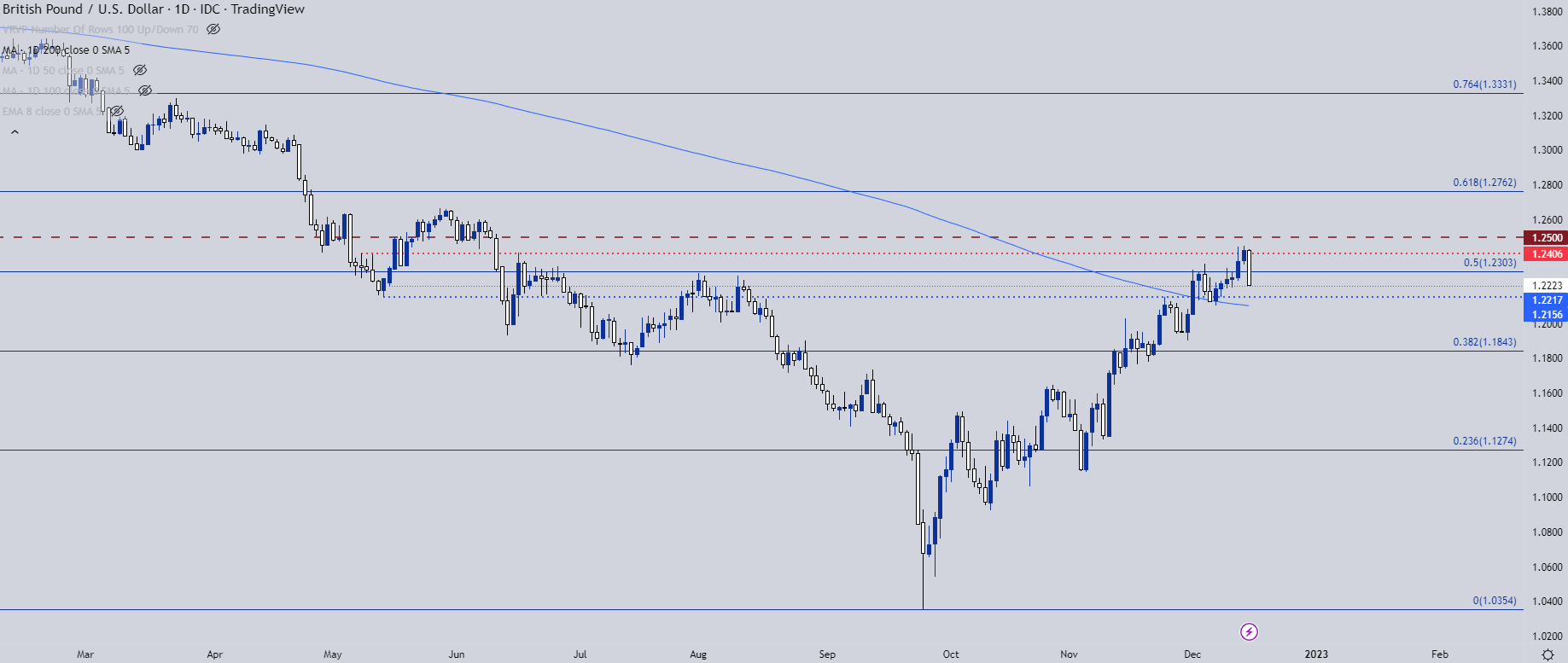

The 1.2500 level is taking a toll and it hasn’t even really come into the equation yet. GBP/USD put in a breakout on Tuesday, crossing above the Fibonacci level at 1.2203 to set that fresh six-month-high. This set a higher-high at 1.2445. Bulls put in a second attempt to breakthrough that level yesterday, around the FOMC rate decision but were similarly stifled below 1.2445, setting the stage for a slightly lower-high, and that’s extended into this mornings bearish push which has sent prices back-below that 1.2303 level.

There is some possible support nearing: The 1.2217 level is a prior swing low that came in as support on Monday, and below that is another swing-low at 1.2156 that’s probably more meaningful as this helped to show as the monthly low in May and then the monthly high for November. Below that, the 200 day moving average comes back into the picture and this held two separate support bounces earlier in December. Sellers breaking-below that opens the door for bigger picture reversal potential of the Q4 bullish trend.

Recommended by James Stanley

How to Trade GBP/USD

GBP/USD Daily Chart

Chart prepared by James Stanley; GBPUSD on Tradingview

GBP/JPY

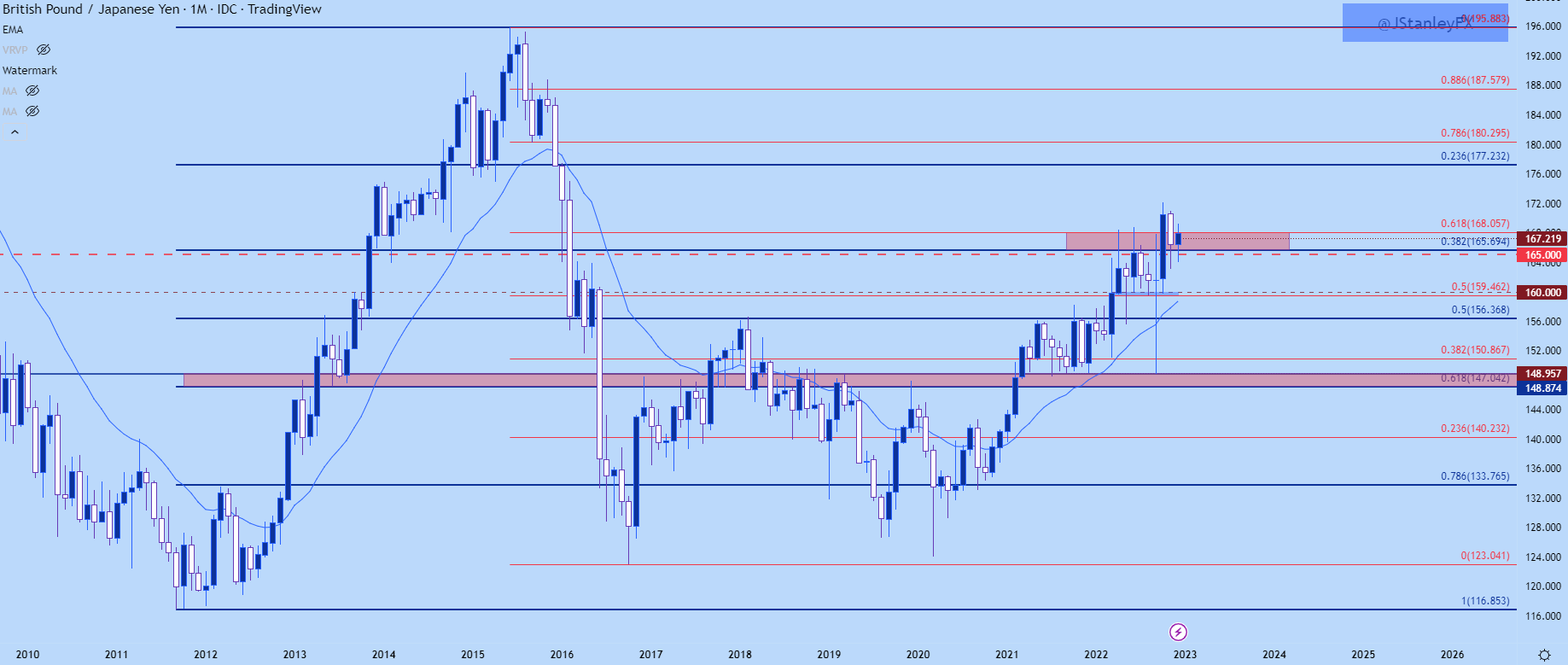

GBP/JPY has similarly seen strength in Q4. The big question there is whether GBP/JPY is getting closer to a top or, perhaps the top is already in-place. The pair tested above the 170 handle in early-Q4 trade and wasn’t able to substantiate much drive beyond that level, pulling back-below in early-November and not venturing back above since.

Taking a step back, and there’s a big zone of resistance that’s been difficult for bulls to break this year around the 168 level. This is the 61.8% retracement of the 2015-2016 major move, and it helped to hold resistance in April, June and September until bulls made that failed venture above 170 in October. The corresponding pullback has since held support at 165, but there may be something to work with here before too long.

GBP/JPY Monthly Price Chart

Chart prepared by James Stanley; GBPJPY on Tradingview

GBP/JPY Shorter-Term

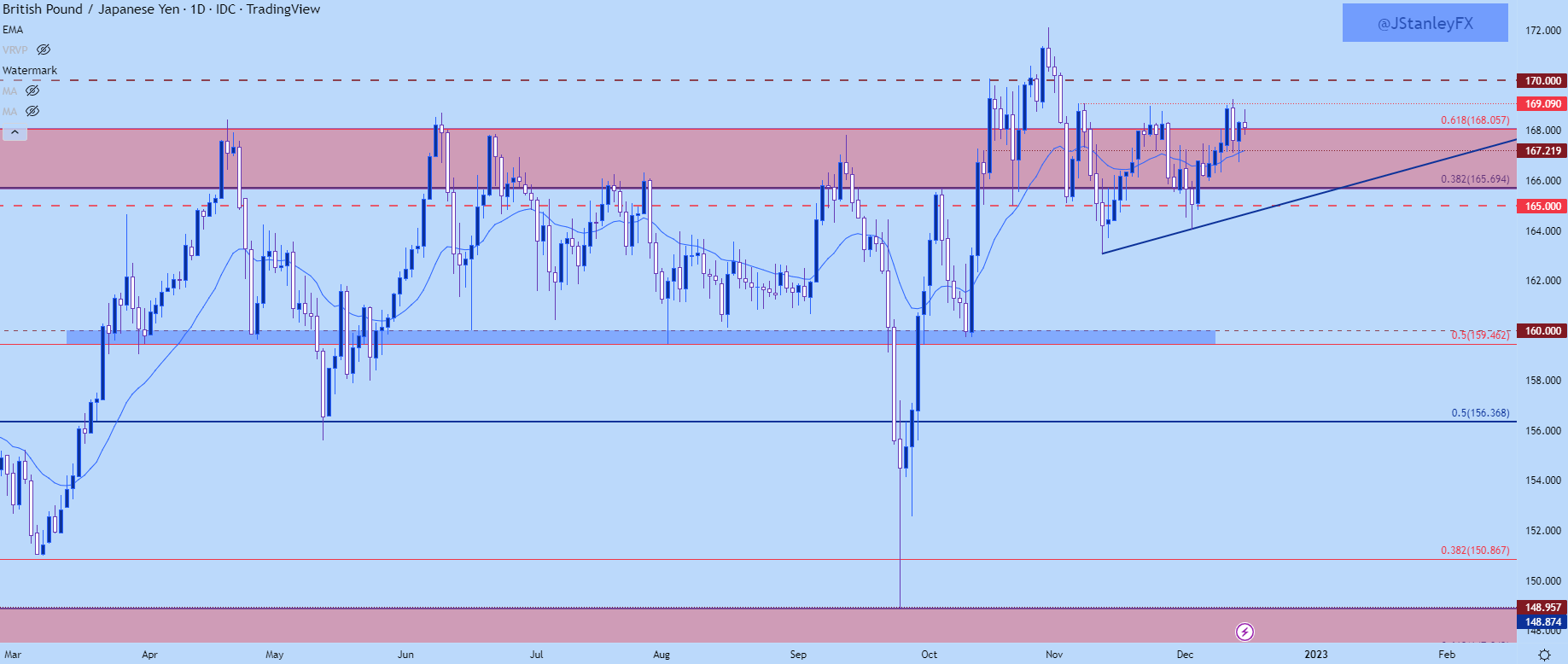

Going down to the daily shows that resistance zone being in-play over the past month, helping to moderate a range with resistance holding around the 169.09 level. And just above that is the 170.00 psychological level.

This sets the stage for a breakout that may open the door for fades. If bulls can poke above the 169.09 level, 170 resistance becomes a factor, and if there’s a long wick reaction on the daily chart, that can open the door for bearish setups. But – if that bearish run stalls at a higher-low, holding above 165, the door very much remains open for bullish trends as the current setup could also be construed as an ascending triangle.

Recommended by James Stanley

Trading Forex News: The Strategy

GBP/JPY Daily Chart

Chart prepared by James Stanley; GBPJPY on Tradingview

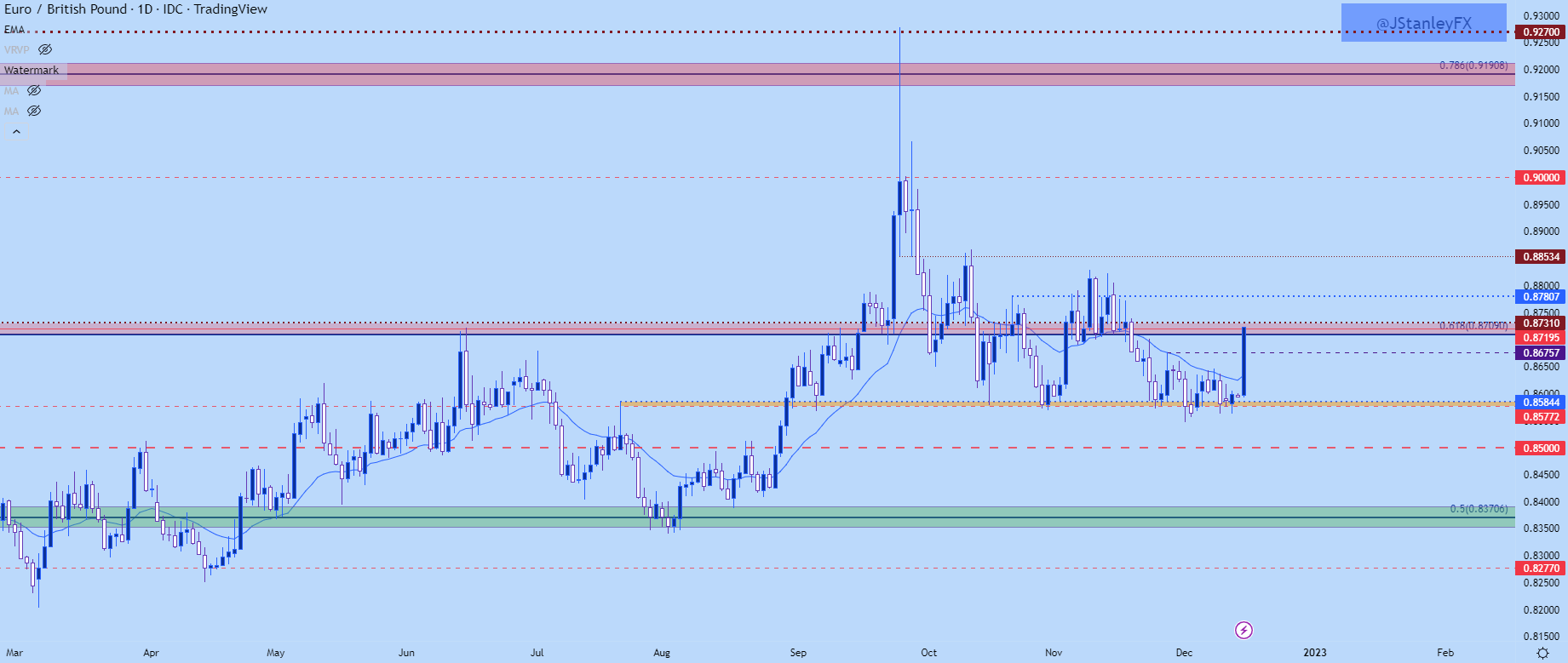

EUR/GBP to Range Resistance

I’ll keep this one rather short as the range remains in-play here. I had looked into the pair last week as part of a Euro Price Action Setups article, highlighting that range with focus on resistance around the .8709 Fibonacci level. This morning’s rate decisions have pushed price into that zone, so we are now nearing range resistance.

With that said, resistance hasn’t been as consistent as support, and this run may last for a little while longer especially given the pace of momentum on this bounce. There’s more resistance potential around the .8781 level. But, at this point, there would need to be some element of seller response before that theme could become workable again, as price is sitting closer to the mid-point of the range as opposed to any actionable edges of the formation.

Recommended by James Stanley

Building Confidence in Trading

EUR/GBP Daily Chart

Chart prepared by James Stanley; EURGBP on Tradingview

— Written by James Stanley, Senior Strategist, DailyFX.com & Head of DailyFX Education

Contact and follow James on Twitter: @JStanleyFX

[ad_2]