GBP/USD PRICE, CHARTS AND ANALYSIS:

Recommended by Zain Vawda

How to Trade GBP/USD

Most Read: ECB Delivers 50bps Hike Despite Banking Sector Woes, EURUSD Indecisive

GBP/USD FUNDAMENTAL BACKDROP

GBPUSD continued to edge higher overnight as overall market sentiment improved and the US Dollar weakened. Following the Swiss National Bank announcement, yesterday news filtered through that major US banks including CitiBank and JPMorgan agreed a $30 billion Dollar aid package for distressed lender First Republic Bank. The news further boosted sentiment and saw GBPUSD rally from lows around 1.20300 to trade at the 1.2160 handle (at the time of writing).

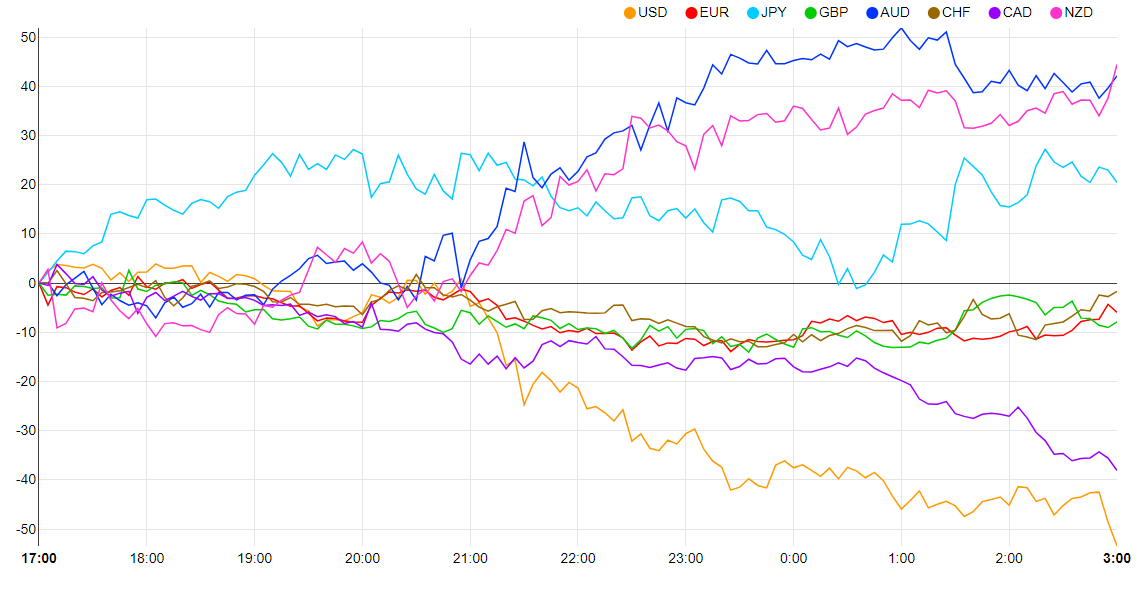

Currency Strength Chart: Strongest – NZD, Weakest – USD.

Source: FinancialJuice

Given that the economic docket for next week includes both the Federal Reserve and the Bank of England rate decisions any further upside move may be capped by the weekly high around 1.22016. This could mean a continuation of rangebound trade between the 1.2000 and 1.2200 mark for the remainder of the day and the early part of next week.

According to reports the UK Government has confirmed that it is making a new offer to National Health Services (NHS) staff regarding wage increases which may include a one-off bonus payment which unions claim amounts to GBP2.5 billion. The Unions have said they would recommend members accept the new offer while confirming further strikes have been suspended. Furthermore, it seems the long-awaited end to the new Brexit deal may finally be coming to an end as UK MPs are expected to vote on the ‘Windsor framework’ next week Wednesday.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Following the 50bps hike by the ECB yesterday we have seen a knock-on effect, with the probability of a rate hike from both the Federal Reserve and the Bank of England (BoE) now appearing more likely. The probability for a Fed Rate hike of 25bps next week has jumped from 54% yesterday to 82% as of this morning. Next week’s UK inflation data comes a day before the BoE rate decision and could serve as a final guide for the Central Bank with an increase in inflation likely to result in a rate hike.

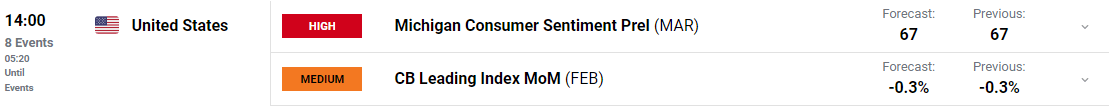

Later today we do have the BoE Ipsos Survey at 09:30 UK time which could give further insights into consumer sentiment as well as consumer expectations and feelings around inflation. This will be followed up in the US session by the Preliminary Michigan Consumer Sentiment Release, both events could add some degree of volatility but are unlikely to change the overall picture for GBPUSD.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK

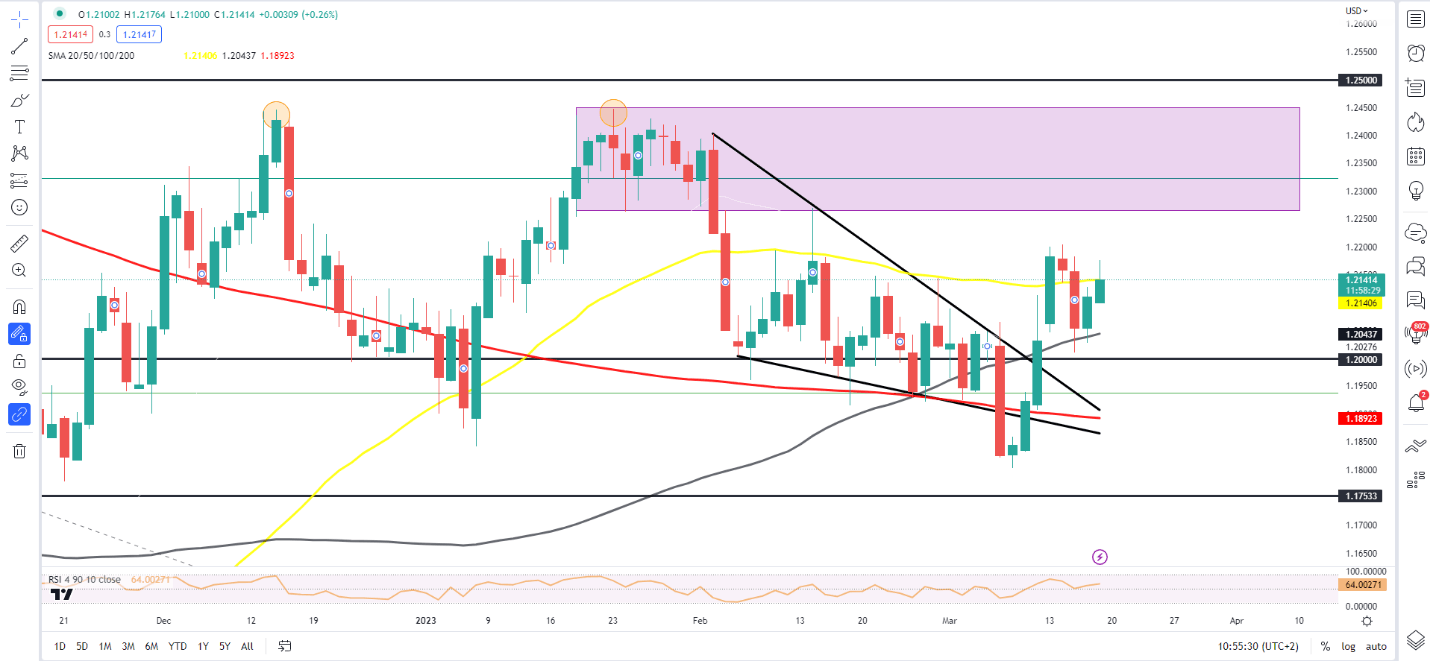

On the daily timeframe price action is hinting at further upside with a new higher high looking more likely. Since bottoming out around the 1.1800 handle on March 8 we have had a significant upside rally with a daily candle close above the previous range high of 1.2173. We have had a bit of retracement before finding support yesterday at the 100-day MA while printing a bullish inside bar daily candle close hinting at further upside. The key test for the pair will be whether the weekly high of 1.2200 will hold firm today or whether we could potentially break higher and bring the 1.2260 resistance level into play.

Alternatively, a rejection from current price could see a push back toward the 100-day MA at 1.20400 keeping the pair within its weekly range between the 1.2000 and 1.2200 handles respectively.

GBP/USD Daily Chart – March 17, 2023

Source: TradingView

Trading Strategies and Risk Management

Market Conditions

Recommended by Zain Vawda

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda