[ad_1]

DAX 40, FTSE 100, Dow Jones Talking Points:

Recommended by Tammy Da Costa

Get Your Free Equities Forecast

Dax, FTSE Trade Higher While Dow Jones Futures Lag

Global stock indices have entered the new year on a positive note with Dax, FTSE and Dow futures trading higher. With the first trading session well underway, China’s reopening and expectations of a ‘mild’ recession have encouraged recent gains.

While Europe, United States and the United Kingdom continue to grapple with the winter cold, rising demand for energy could place additional pressure on growth prospects for 2023.

However, with the recent German inflation report showing positive signs of easing, interest rate expectations and economic data will likely continue to drive risk sentiment.

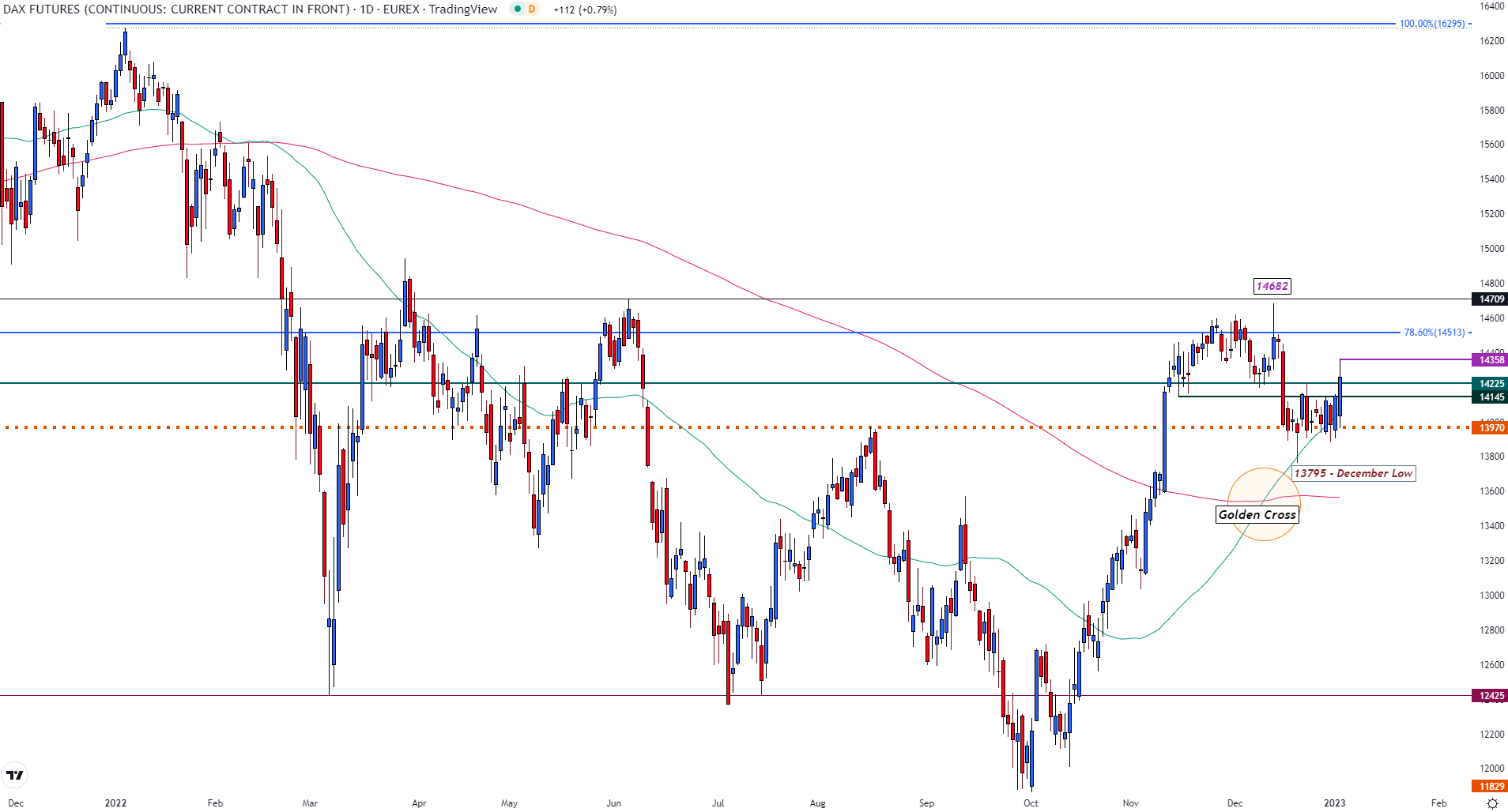

German Dax Technical Analysis

From a technical perspective, the German Dax is currently holding above support at the key psychological level of 14,000. After the formation of a golden cross on the daily timeframe in December, the 50-day MA (moving average) has stepped in as additional support at 14052.

Dax Futures Daily Chart

Chart prepared byTammy Da Costausing TradingView

As Dax futures head retrace back from today’s high of 14358, the 14400 handle is the next psychological level that needs to be broken to sustain the upside move. If bulls are able to gain traction above this level, the 78.6% Fibonacci retracement may come into play at 14513 opening the door for the December high at 14682.

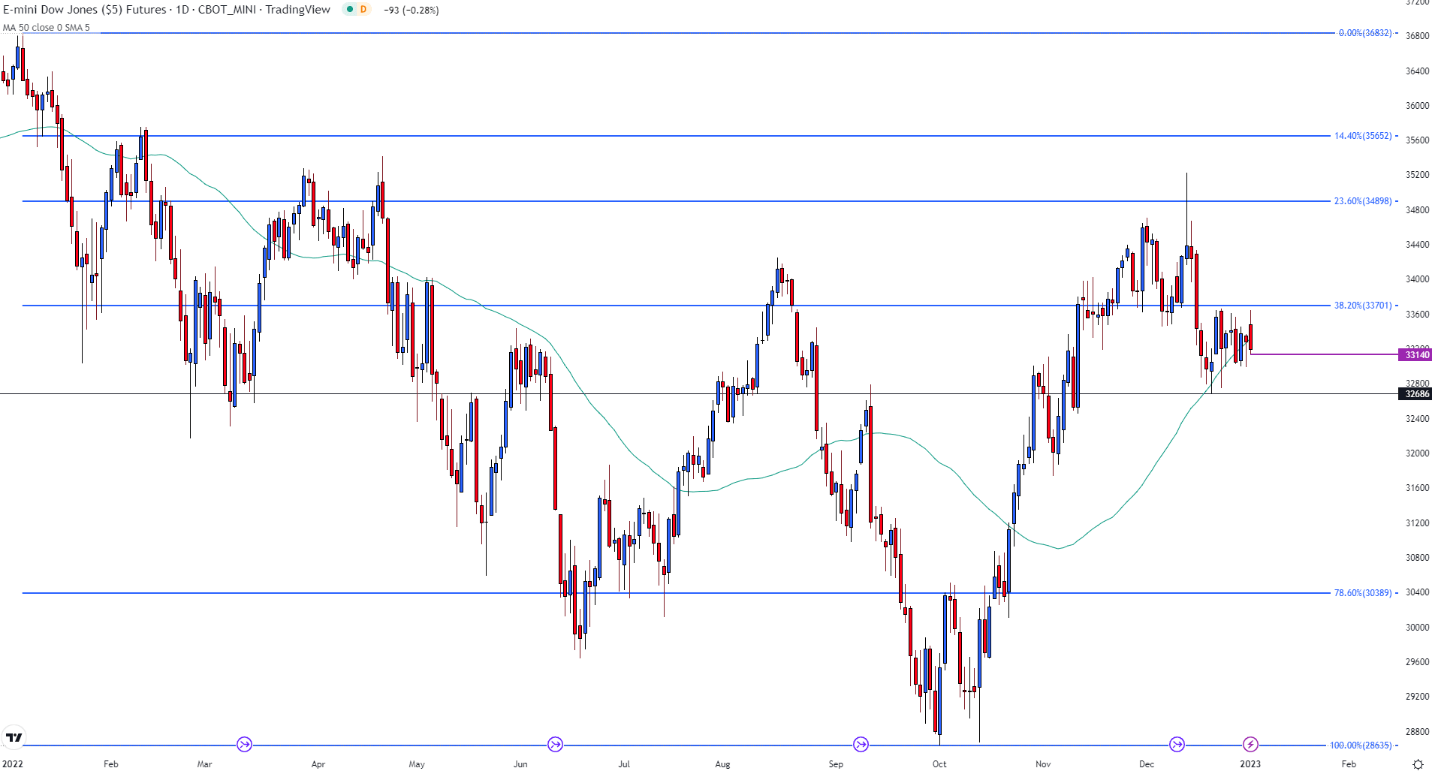

Dow Jones (DJI) Technical Analysis

In anticipation of the first NFP (non-farm payroll) report which is due for release this Friday, Dow futures have eased back below 33200. With the current daily low resting around 33140, the 38.2% retracement of the 2022 move remains as critical resistance at 33701.

Dow Jones Futures Daily Chart

Chart prepared byTammy Da Costausing TradingView

With the US Dollar providing an additional catalyst for price action, USD resilience could see Dow surrender additional gains. Meanwhile, if the major currency struggles against its counterparts, a move above 33600 may drive DJI higher.

Recommended by Tammy Da Costa

Get Your Free USD Forecast

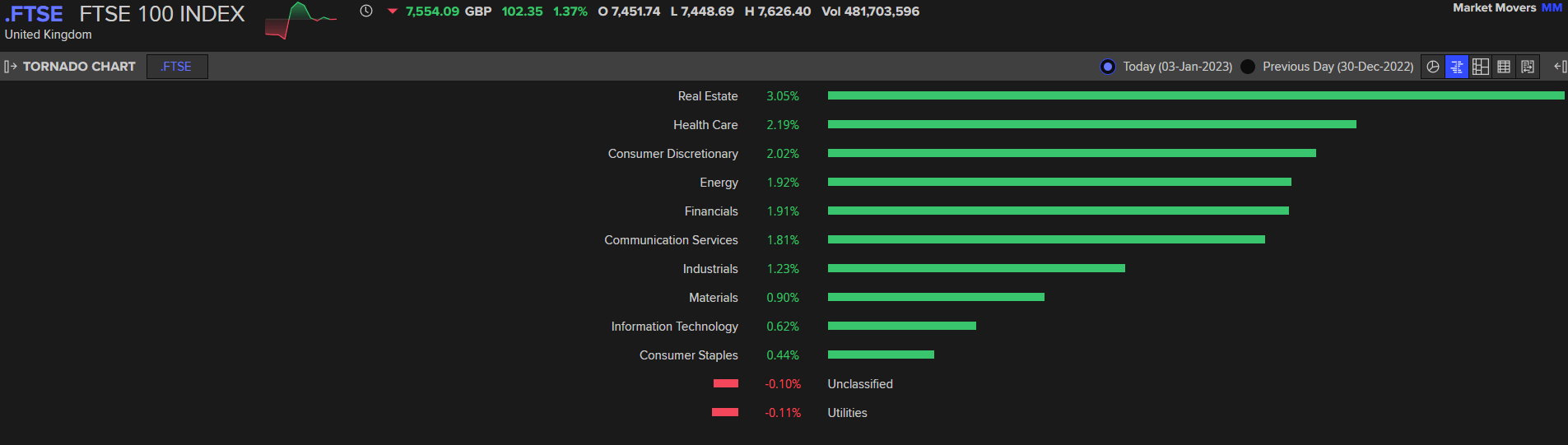

FTSE 100 Analysis

For the FTSE 100, gains have been driven by the real estate sector followed by healthcare. Although the UK index has benefited from the recent shift in sentiment, IG retail sentiment suggests that participants should not rule out the possibility of further gains.

Source: Refinitiv

| Change in | Longs | Shorts | OI |

| Daily | -33% | 26% | 9% |

| Weekly | -35% | 21% | 5% |

FTSE 100:Retail trader data shows 15.07% of traders are net-long with the ratio of traders short to long at 5.63 to 1.The number of traders net-long is 35.60% lower than yesterday and 35.89% lower from last week, while the number of traders net-short is 41.66% higher than yesterday and 34.17% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests FTSE 100 prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger FTSE 100-bullish contrarian trading bias.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]