U.S. DOLLAR ANALYSIS & TALKING POINTS

- USD looks to Jerome Powell for direction – will the rally continue?

- Key inflection point on daily DXY chart awaiting catalyst.

Recommended by Warren Venketas

Get Your Free USD Forecast

USD FUNDAMENTAL BACKDROP

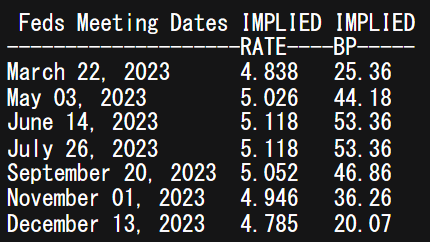

The Dollar Index (DXY) has shown no signs of letting up its recent gains after the stellar Non-Farm Payroll (NFP) report last week Friday. Since then, minimal U.S. economic data has contributed to the success of the rally but rather market repricing of U.S. interest rates going froward. The implied Fed funds futures shown in the table below now shows terminal rates for 2023 above the 5% mark – previously disregarded by money markets due to signs of softening Inflation. Although inflation remains well above the target level, a tight labor market and rising wage pressures will make the job of the Fed to initiate a ‘soft’ landing that much harder (if at all possible).

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Source: Refinitiv

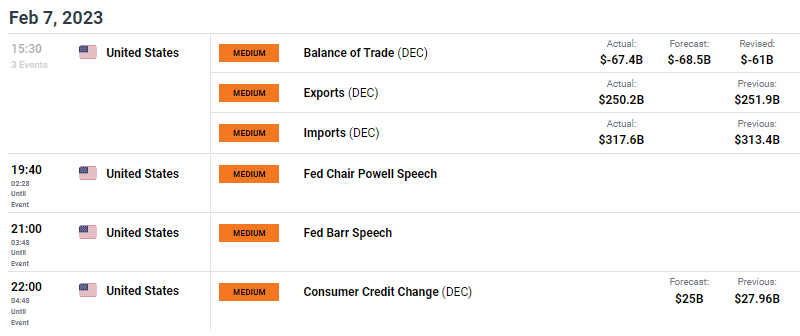

Yesterday saw the Fed’s Bostic deliver some rather hawkish comments and even eluded to a possible return to 50bps interest rate hike increments to penetrate the jobs market in the U.S.. More recently. The Fed’s Kashkari echoed these comments by preferring holding rates at elevated levels for longer. Markets seem to be expecting a similar narrative from Fed Chair Jerome Powell later today (see economic calendar below) and could extend the USD recovery; however, any slight dovish tone could see a significant pullback in the dollar.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

From a euro perspective (comprises 57.6% of the DXY), ECB officials have been mixed in their guidance but the unanimous front shown by Fed speakers thus far have clearly tipped the scales in favor of the USD ahead of Mr. Powell’s address.

TECHNICAL ANALYSIS

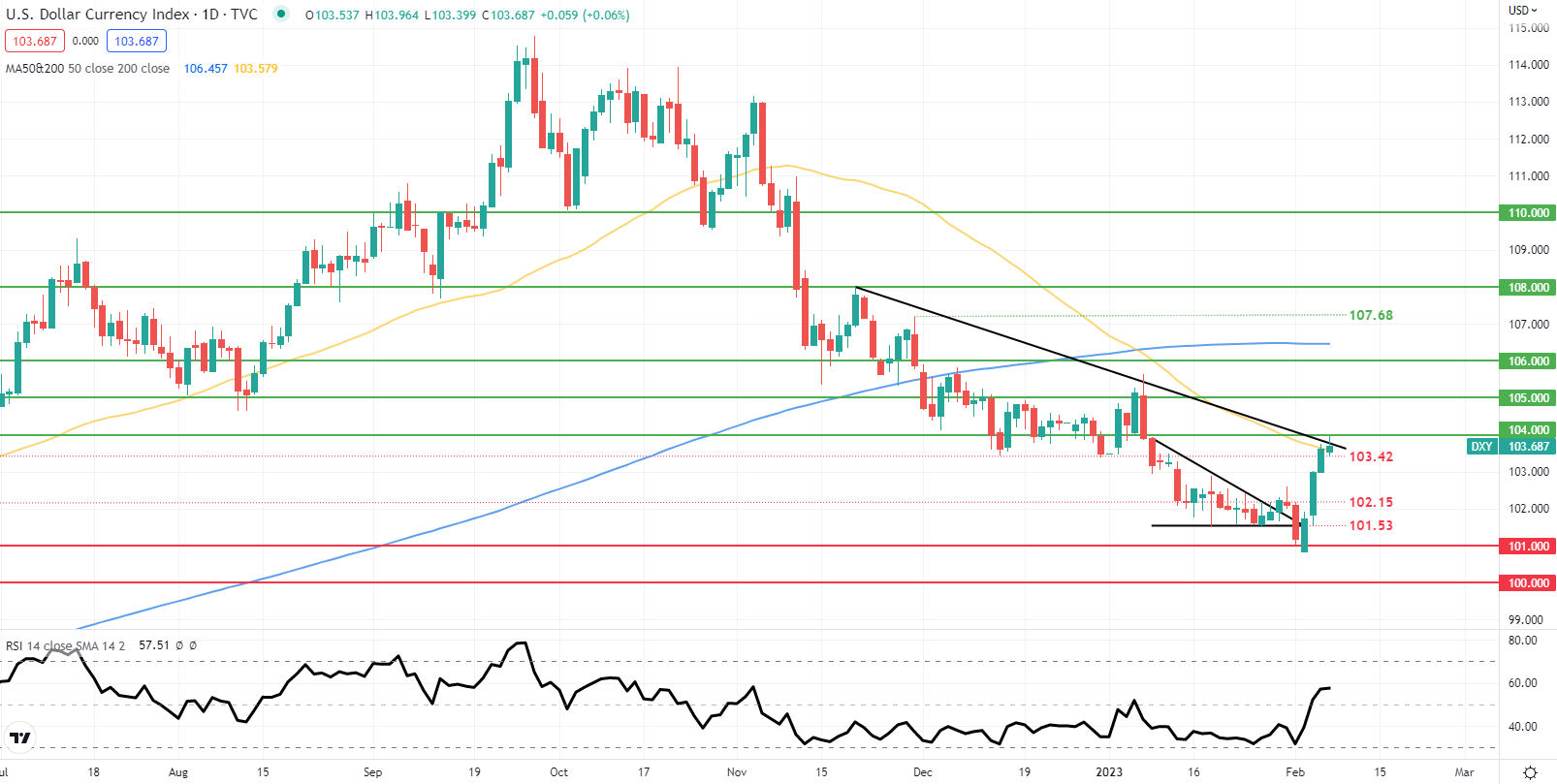

U.S. DOLLAR INDEX DAILY CHART

Chart prepared by Warren Venketas, IG

Daily DXY price action above highlights the short but powerful ascension in the Dollar Index but now finds itself at a key area of confluence around the 104.00 psychological handle, 50-day SMA (yellow) and medium-term trendline (black). A breakout via Jerome Powell could easily see 105.00 come back into focus but as mentioned above, the language used by the Fed Chair is extremely important as a gauge for short-term directional bias.

Resistance levels:

Support levels:

Contact and followWarrenon Twitter:@WVenketas