[ad_1]

US Dollar (DXY) Analysis

- US dollar waiting game continues ahead of next week’s CPI data with the 50 SMA in focus once more

- Consolidating DXY symptomatic of a market waiting for the next catalyst. Key levels to watch

- University of Michigan Sentiment and more Fed speak into the end of the week

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free USD Forecast

Dollar Exercises Patience Ahead of Inflation data Next Week

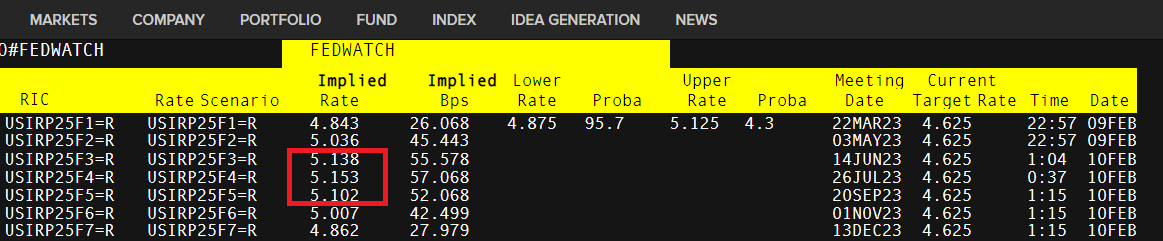

Fed officials have been out in their numbers this week to have their say on the state of the US economy and their outlook on inflation as well as rates. Interestingly enough, the actual Fed statement after the Federal Open Market Committee’s (FOMC) two-day meeting failed to see a favourable market response, in the view of the Fed. It was then down to a massive beat in NFP and very encouraging services PMI data to align market expectations with that of the Fed. We now we see the market anticipating a terminal rate at 5.1% – precisely the number detailed in the Fed’s December dot plot.

Implied Interest Rate Probabilities via Fed Funds Futures

Source: refinitiv, prepared by Richard Snow

Markets Await the Next Catalyst: US CPI

Taking a look at DXY price action, it is clear to see a lack of follow through as market participants look ahead to next week’s US CPI data on Tuesday. It’s no secret that both headline and core inflation have shown encouraging disinflationary momentum and markets rejoiced on the mere mention of this in the FOMC statement.

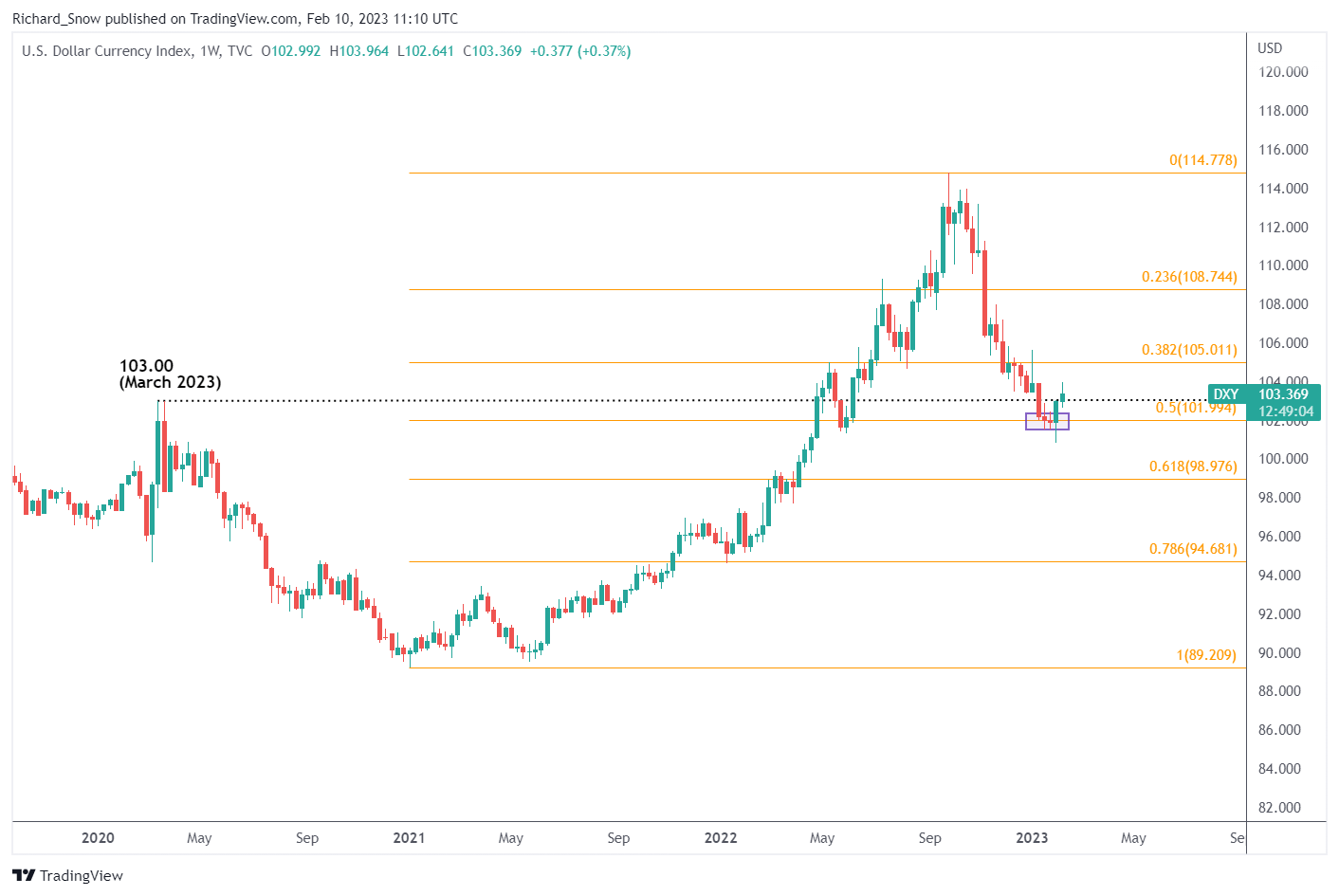

On the technical front, DXY appears to have found support at the 50% retracement of the major rise spanning from late 2021 to late 2022 as forward-looking markets began to price in the likelihood of future rate cuts. Another strong component of the selloff was the narrowing of euro and US yield differentials as the US reaches the end of its rate hiking cycle while the ECB found renewed motivation to push on aggressively, supporting the euro while the dollar weakened. Rate hikes typically boost local FX valuations.

DXY Weekly Chart with US-Bund Yield Differential (US10Y-DE10Y) in Purple

Source: Tradingview

The next area of interest is around the 103 level, the March 2020 high. If the dollar holds here, it may be a shallow victory considering current disinflationary trends suggest we’ll see another encouraging CPI print, adding to a softer dollar.

US Dollar Basket (DXY) Weekly Chart

Source: TradingView, prepared by Richard Snow

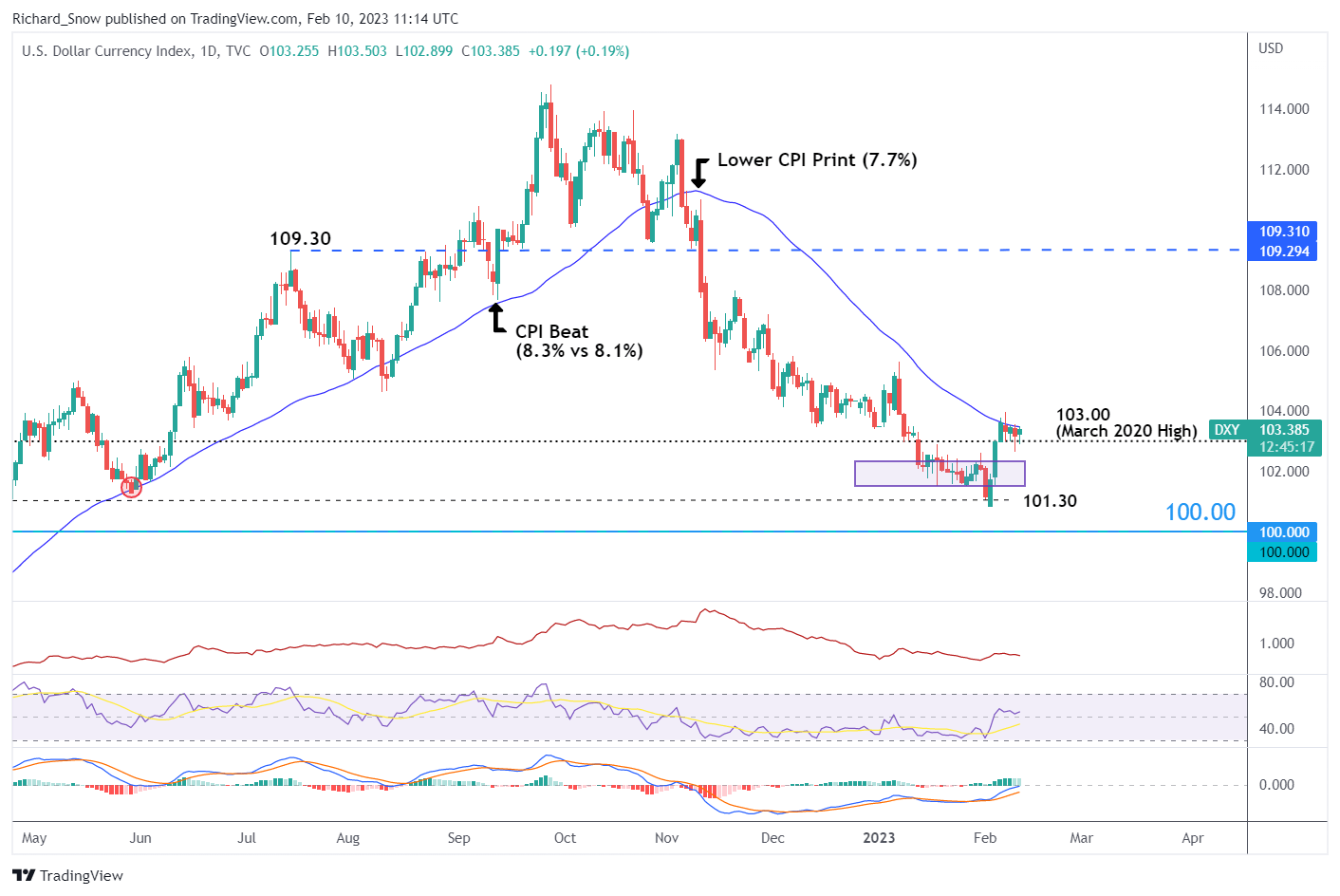

The daily chart reveals an interesting pattern of adherence to the 50 simple moving average (SMA), which supported the dollar on the way up and has capped DXY upside on the way down. Price action over the last 4 sessions have nestled comfortably beneath the moving average where prices remain restricted, consolidation ahead of a rather important CPI figure.

The 50 SMA remains as dynamic resistance with the prior swing high of 105.60, thereafter. The MACD indicator suggests upside continuation remains possible while the RSI (purple) is far off overbought levels. However, a breakdown of the 103 level highlights support at 101.30 once again and then the psychological 100 flat.

US Dollar Basket (DXY) Daily Chart

Source: TradingView, prepared by Richard Snow

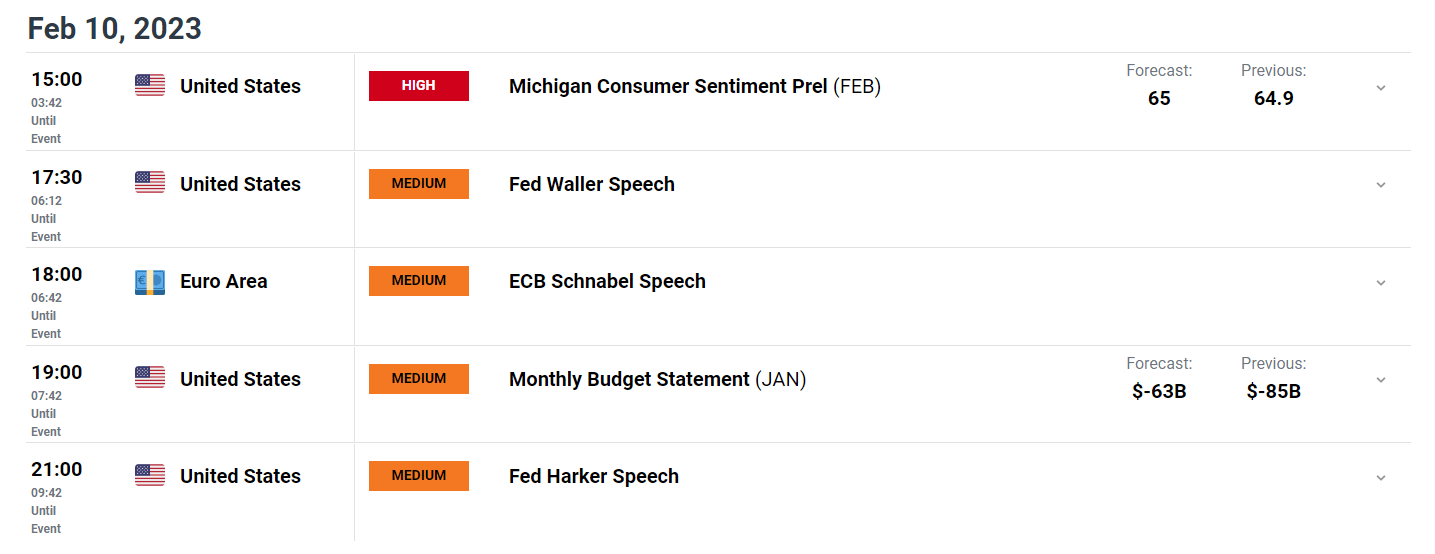

Fed Speak and US Sentiment on the Dockett Today

Could we be seeing peak optimism as the US Michigan Sentiment survey is expected to flatten out around 65? Other than this report we have two more speeches from prominent Fed members to round the week off which ought to be monitored ahead of Tuesday’s CPI report.

Customize and filter live economic data via our DailyFX economic calendar

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]