[ad_1]

EURO FORECAST:

- The Fed is expected to raise rates by 25 basis points on Wednesday

- The ECB will unveil its monetary policy announcement on Thursday, followed by the Bank of Japan on Friday

- This article looks at EUR/USD and EUR/JPY’s key tech levels to watch over the coming trading sessions

Recommended by Diego Colman

Get Your Free EUR Forecast

Most Read: Japanese Yen Forecast – USD/JPY Fumbles Ahead of Fed and Bank of Japan Decision

Three of the world’s most important central banks will announce their monetary policy decisions this week. The Federal Reserve will be the first to do so on Wednesday, followed by the ECB on Thursday and the Bank of Japan on Friday. Against this backdrop, the U.S. dollar, euro, and Japanese yen are likely to experience increased volatility, which could create attractive trading setups, but also carry more risks.

Focusing first on the Federal Reserve, the rate-setting committee is forecast to raise borrowing costs by 25 basis points to 5.25%-5.50% after a brief pause. This move is already fully discounted, so investors will focus primarily on the policy outlook for clues about the normalization campaign.

If Powell maintains an aggressive stance as part of a strategy to prevent financial conditions from easing significantly and to preserve optionality in case inflationary pressures reaccelerate later this year to the point where additional tightening is necessary, interest rate expectations could drift higher, boosting the U.S. dollar. This scenario could weigh on EUR/USD.

Euro Forecast – EUR/USD and EUR/GBP’s Path Tied to Fed and ECB Policy Outlook

As for the European Central Bank, the institution spearheaded by Christine Lagarde is also seen delivering a quarter-point rate rise, but its guidance is unlikely to be hawkish. In fact, it is possible that the bank will refrain from committing to further tightening, given the growing risks of an economic downturn in the Euro Area, opting instead for a data-dependent approach.

If Lagarde embraces a conciliatory message and shows reluctance to lift rates again in September, traders could quickly reprice lower the hiking path, creating headwinds for the euro. This could mean a sharp pullback in the EUR/USD and EUR/JPY.

Finally, the Bank of Japan is expected to hold its current policy settings unchanged. However, there is a small chance that policymakers could vote to adjust the yield curve control program in a context of steadily rising inflation. Should the latter scenario occur, the Japanese yen could stage a strong comeback in currency markets, reversing some of its earlier losses against the U.S. dollar and the euro

| Change in | Longs | Shorts | OI |

| Daily | 20% | -6% | 3% |

| Weekly | 54% | -28% | -9% |

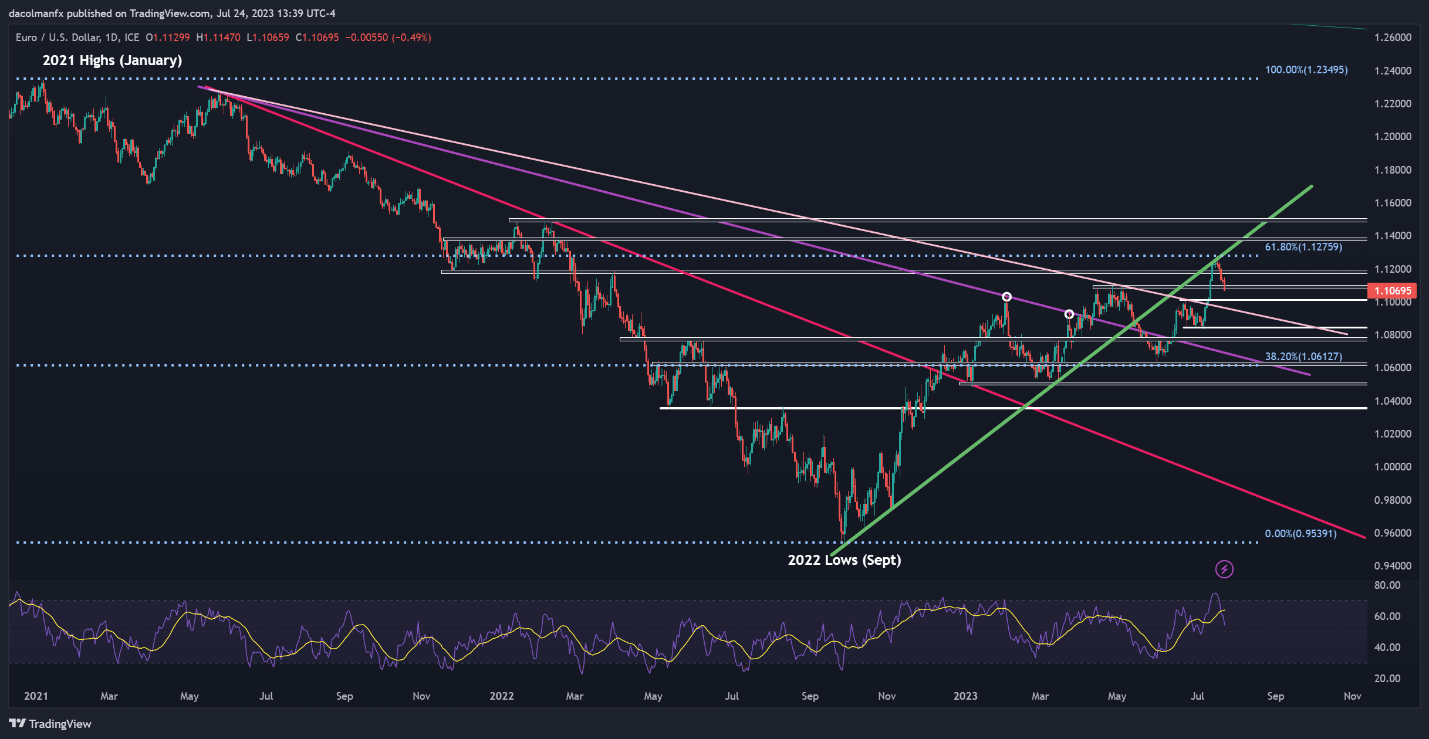

EUR/USD TECHNICAL ANALYSIS

After Monday’s pullback, EUR/USD slipped below technical support at 1.1080. If this breakdown is sustained in the coming days, we could see a move towards the psychological 1.1000. On further weakness, the focus shifts lower to 1.0950, followed by 1.0840. In contrast, if EUR/USD resumes its recovery, initial resistance appears at 1.1180, and 1.1275 thereafter. If both ceilings are taken out, buyers could launch an attack on 1.1375.

EUR/USD TECHNICAL CHART

EUR/USD Chart Prepared Using TradingView

| Change in | Longs | Shorts | OI |

| Daily | 70% | -1% | 12% |

| Weekly | -3% | 3% | 1% |

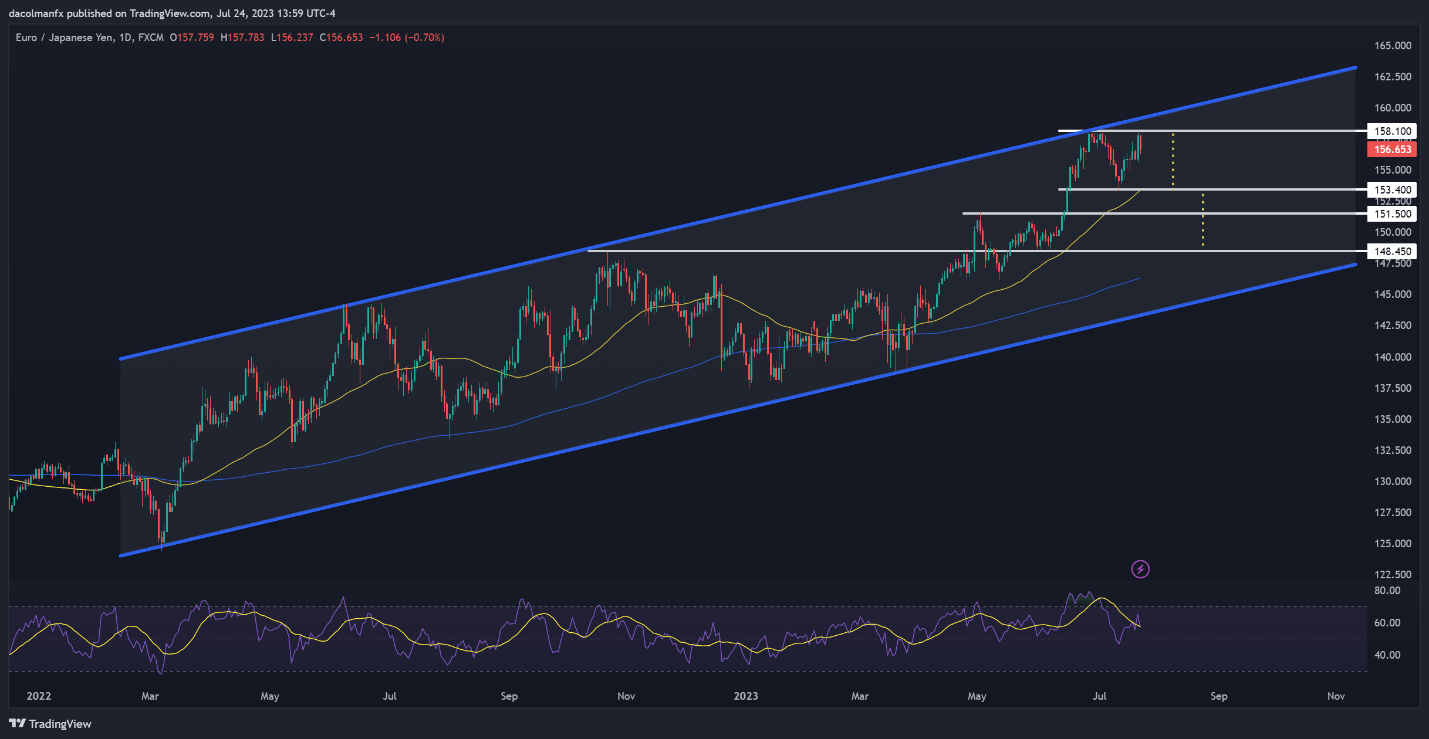

EUR/JPY TECHNICAL ANALYSIS

EUR/JPY rallied late last week and retested its multi-year highs, but failed clear this peak, with prices slipping on Monday following a rejection from technical resistance. It is too soon to say, but the pair appears to be developing a double-top, a bearish reversal pattern that often forms in the context of an extended move higher.

If prices extend their slide, initial support appears at 153.40. If this floor is taken out, the double top would be confirmed, setting the stage for a drop toward 151.50, followed by 148.45. Conversely, if buyers retake control of the market and trigger a bullish turnaround, the first resistance to consider is located at 158.10, and 159.25 thereafter.

EUR/JPY TECHNICAL CHART

EUR/JPY Chart Prepared Using TradingView

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

[ad_2]