[ad_1]

EUR/USD Forecast – Prices, Charts, and Analysis

- Middle East tensions rise, President Biden visits Israel, Fed speakers on tap.

- EUR/USD is starting to look trapped in a range.

Recommended by Nick Cawley

Get Your Free EUR Forecast

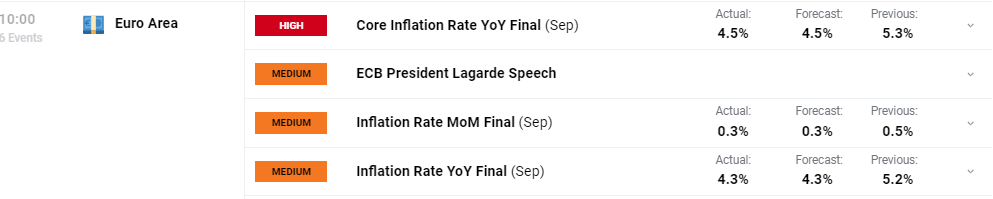

The final Euro Area y/y core inflation reading (September) printed met initial expectations of 4.5%, down from 5.3% in August, while headline inflation fell to 4.3% against a prior month’s print of 5.2%. The Euro barely moved after the release with markets instead looking at other macro-economic drivers.

While there is a lack of high-value economic data releases over the rest of the trading session, there are five Federal Reserve members scheduled to speak later in the session, ahead of next week’s pre-FOMC meeting blackout.

DailyFX Calendar

Financial markets are looking away from macro data releases and towards the increasingly volatile situation in the Middle East. US President Joe Biden arrived in Israel today for talks with PM Benjamin Netanyahu, but his meeting with Palestinian, Egyptian, and Jordan Heads of State was abruptly canceled last night after a hospital in the Gaza Strip was hit by missiles, reportedly fired by Israel. As fighting between the two sides escalates, traders are shunning a range of markets for haven assets, notably gold.

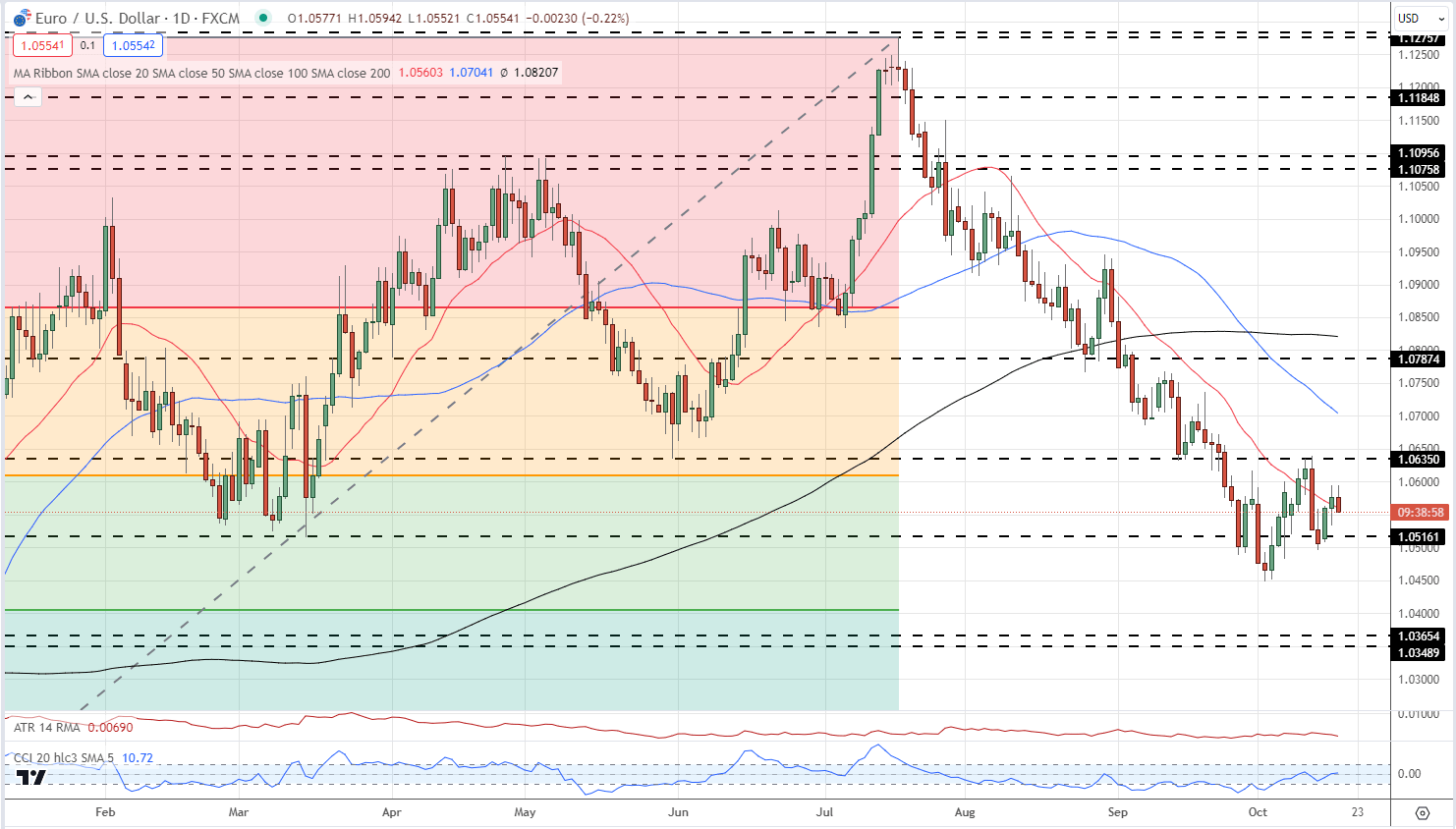

With little to help steer the Euro, EUR/USD trading is being driven by the US dollar. The greenback is marginally higher today, but EUR/USD looks caught in a short-term range between 1.0450 and 1.0630. A confirmed break below the 20-day simple moving average will add downside pressure on the pair and leave the 1.0500 to 1.0516 zone as the first area of support. Below here 1.0450 comes into play.

Learn How to Range Trade with ir Free Guide Below

Recommended by Nick Cawley

The Fundamentals of Range Trading

EUR/USD Daily Price Chart – October 18, 2023

Retail trader data shows 63.43% of traders are net-long EUR/USD with the ratio of traders long to short at 1.73 to 1. The number of traders net-long is 3.14% lower than yesterday and 1.43% higher than last week, while the number of traders net-short is 1.20% higher than yesterday and 6.72% lower than last week.

See How Daily and Weekly Changes in Sentiment Affect EUR/USD

| Change in | Longs | Shorts | OI |

| Daily | -3% | 2% | -1% |

| Weekly | 3% | -1% | 1% |

All Charts via TradingView

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]