[ad_1]

EUR/USD OUTLOOK:

- Euro plunges against the U.S. dollar amid strong demand for defensive currencies

- The banking sector turmoil in the U.S. and Europe weighs on sentiment ahead of the ECB’s interest rate decision

- While the European Central bank has signaled a 50 bp hike, market expectations have shifted in a dovish direction, with the probability of a 25 bp adjustment now higher

Recommended by Diego Colman

Get Your Free EUR Forecast

Most Read: S&P 500 Dives as Banking Stress Triggers Market Tremors, Dollar Up on Haven Demand

EUR/USD (Euro – U.S. Dollar) plummeted on Wednesday on strong safe-haven flows, sinking more than 1% towards its lowest level in 2023, with risk assets coming under intense downward pressure as the U.S. banking turmoil spread to Europe, worsening Credit Suisse’s already fragile position, and igniting a $60 billion rout in the entire space.

For context, Credit Suisse’s shares cratered while its credit default swaps soared to distressed levels after the institution’s biggest backer (Saudi National Bank) said that it will absolutely not provide additional cash injections, raising the likelihood of a collapse.

The banking sector stress in the U.S. and now Europe may prompt central banks to backtrack on their hawkish message and embrace a more cautious approach to avoid escalating systemic risks, as a full-blown crisis will be a lot harder to fix than inflation. This means doves may prevail for now.

We will know how concerned policymakers are about the current situation when the ECB announces its policy decision tomorrow. Although the central bank has signaled that it would raise rates by half a point, expectations have shifted in a more dovish direction, with traders now betting on a 25 bp hike.

| Change in | Longs | Shorts | OI |

| Daily | 56% | -44% | -1% |

| Weekly | -1% | -15% | -6% |

With European lenders starting to convulse, the ECB may refrain from rocking the boat too much and opt for a more moderate interest rate increase to buy time to assess the state of the financial system and its vulnerabilities in light of recent developments.

A dovish hike by the ECB is likely to be neutral to bearish for the euro, but the bulk of the reaction will depend on forward-guidance and any general commentary on plans regarding the introduction of new liquidity facilities to shore up banks if needed at some point. In any case, global sentiment may be more relevant in setting the trading tone in the very near term.

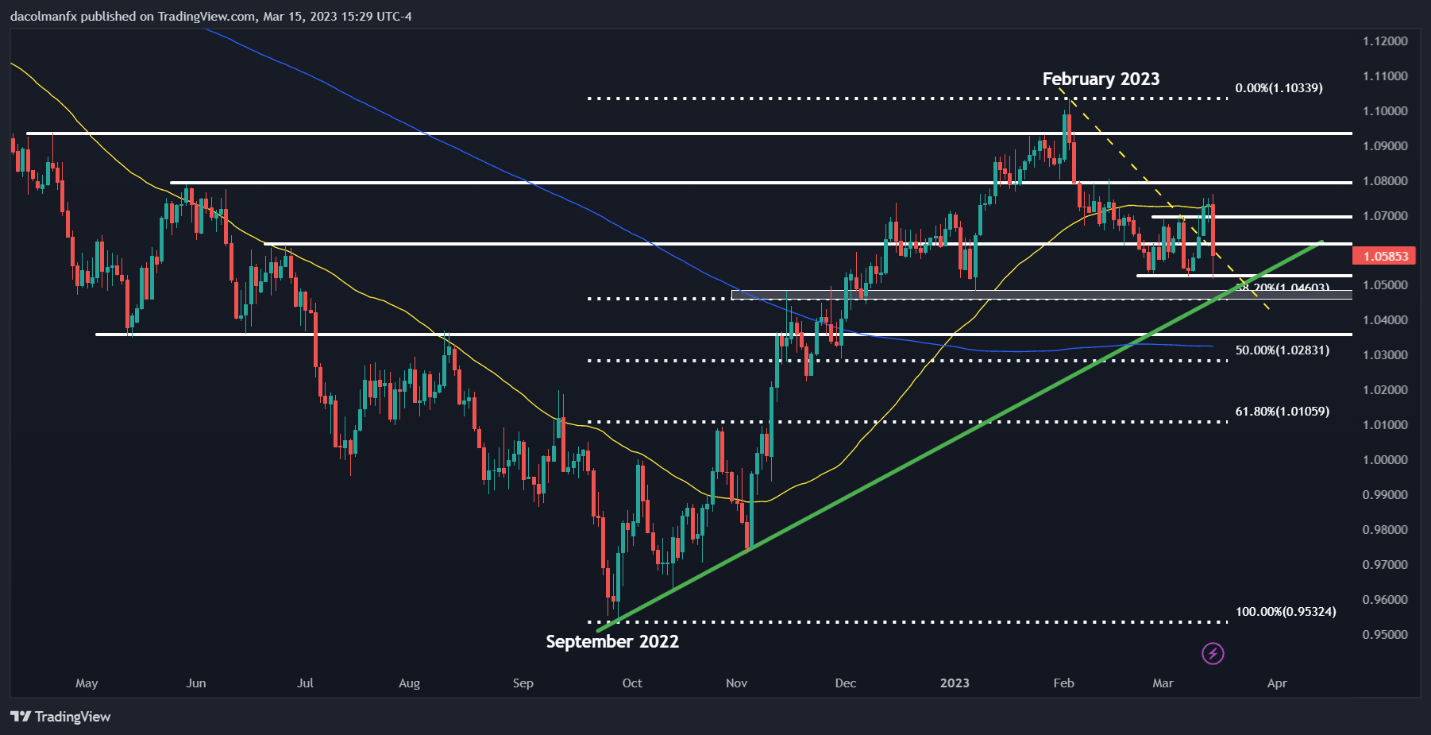

Focusing on technical analysis, EUR/USD plunged on Wednesday but was unable to break below support at ~1.0525, with the pair bouncing off that floor modestly. If prices are ultimately repelled from those levels and bulls regain the upper hand, we could see a move towards 1.0620, followed by 1.0700.

Conversely, if sellers retake decisive control of the market and manage to drive the exchange rate below 1.0525 on daily closing prices, the focus shifts to 1.0460, the 38.2% Fibonacci retracement of the September 2022/February 2023 rally. Below this region, the next floor rests at 1.0355.

Recommended by Diego Colman

How to Trade EUR/USD

EUR/USD TECHNICAL CHART

[ad_2]