[ad_1]

Euro Vs US Dollar, Australian Dollar, British Pound – Outlook:

- EUR/USD is nearing key support ahead of Euro area GDP and FOMC minutes.

- EUR/AUD is attempting to break above a vital ceiling; EUR/GBP is off highs.

- What is the outlook and the key levels to watch in key Euro crosses?

Recommended by Manish Jaradi

Forex for Beginners

The euro is testing key levels against some of its peers ahead of the release of Euro area GDP data (due later today) and the FOMC minutes (due Thursday).

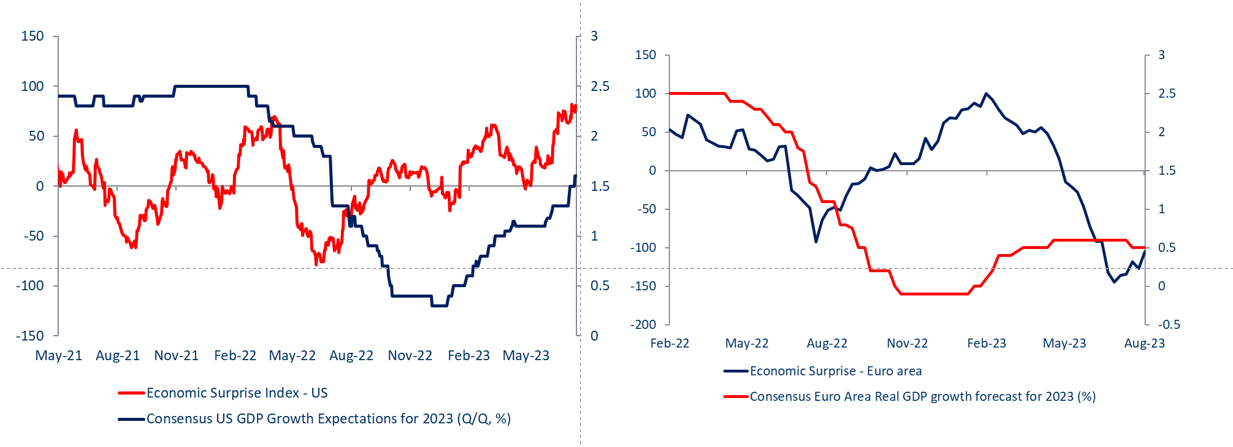

The Euro area economic growth slowed to 0.6% on-year in the April-June quarter from 1.1% in the previous quarter on tightened credit conditions as the effect of aggressive ECB rate hikes spills over. The underwhelming macro data is reflected in the Euro area Economic Surprise Index (ESI), which is just off 3-year lows.

Economic Surprise Index – Euro Area and US

Chart Created by Manish Jaradi Using TradingView

While the unexpected improvement in German investor morale in August is positive, the economic growth outlook needs to reverse for a sustained rebound in EUR, especially against the US. Against other currencies, EUR has been largely resilient, reflecting stable ECB rate expectations until mid-2024.

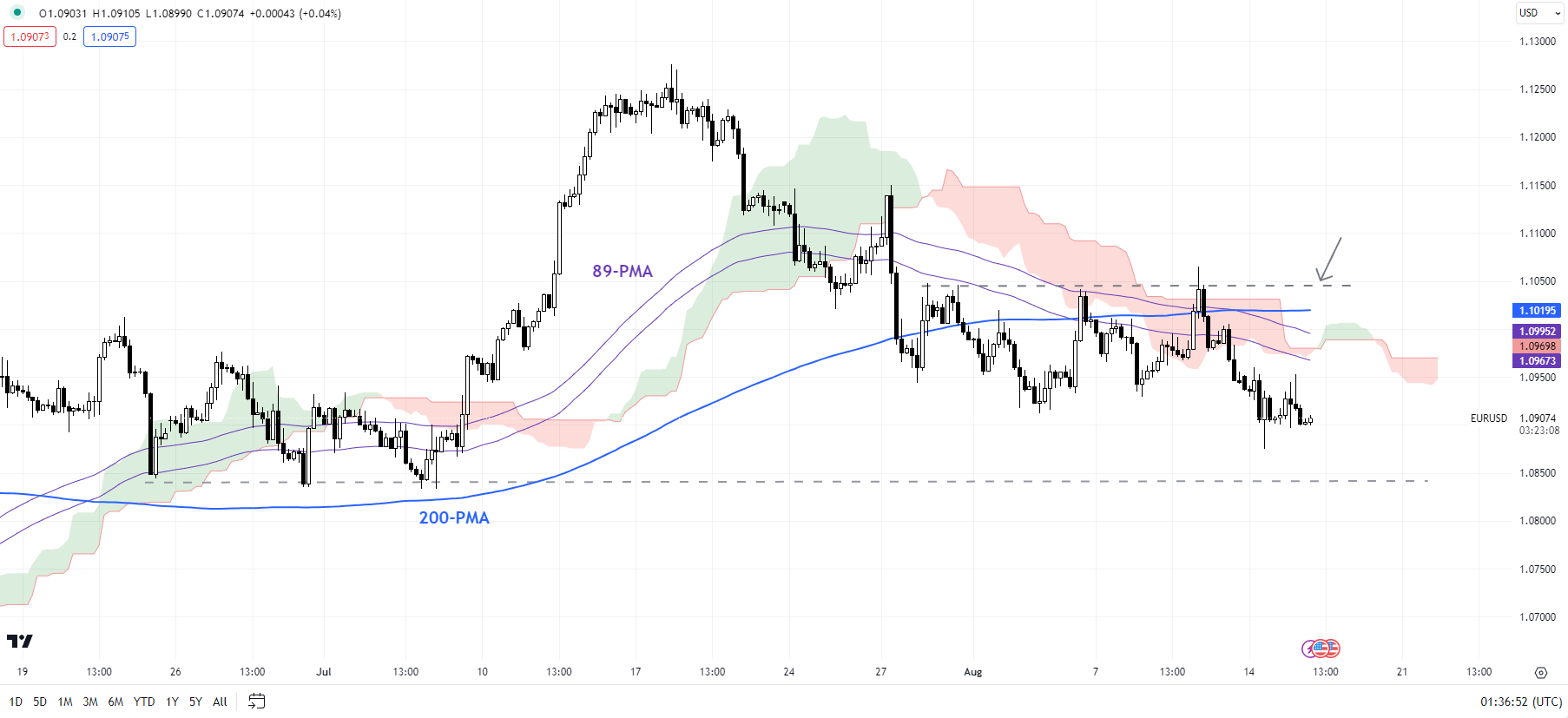

EUR/USD 240-Minutes Chart

Chart Created by Manish Jaradi Using TradingView

The US ESI is hovering around the highest level since early 2021. In addition, consensus has upgraded its US economic assessment for the current year. A data-dependent Fed is likely to keep the optimistic 2024 rate cut expectations in check. In this regard, the focus is on minutes of the June FOMC meeting due on Thursday, especially given a resilient US economy, a tight labour market, and market expectations that Fed rates may have peaked.

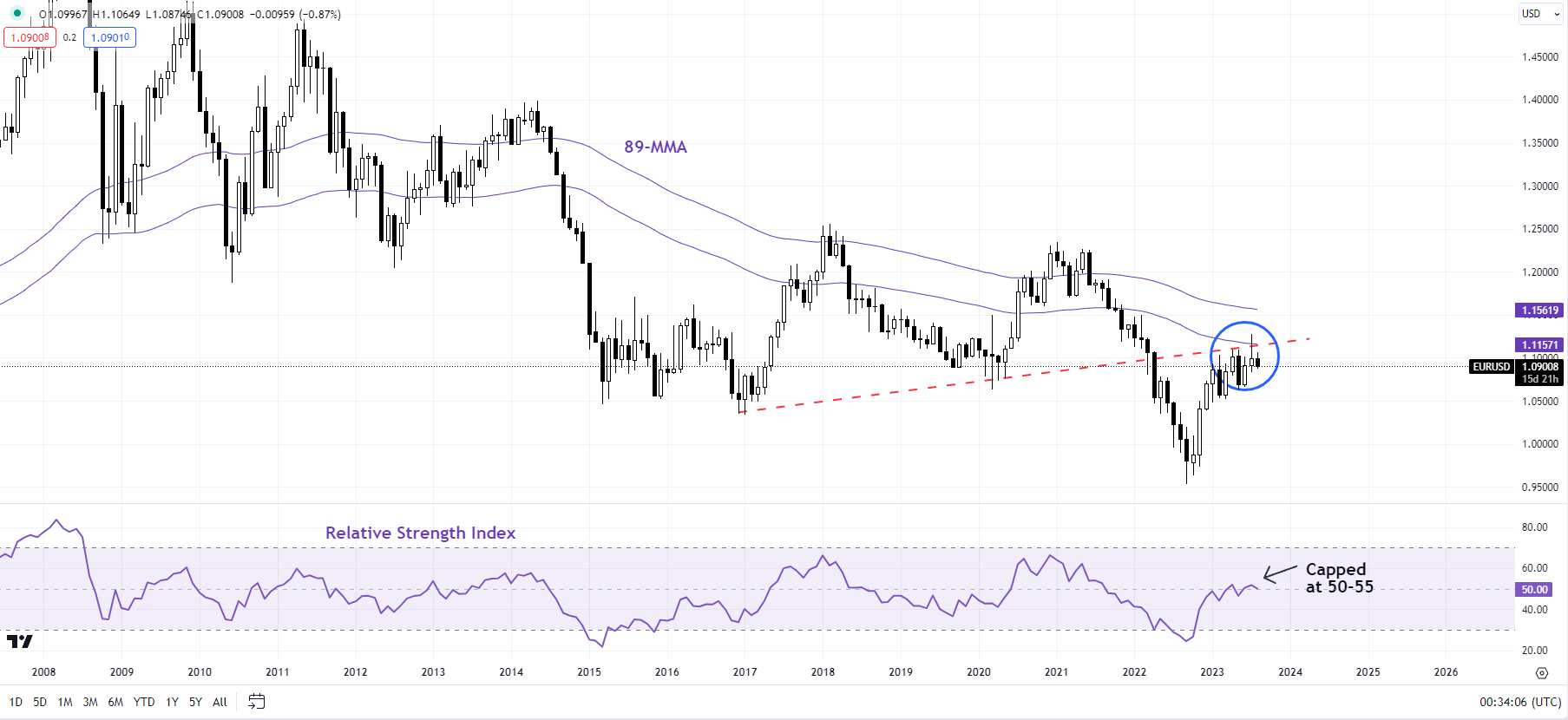

EUR/USD Monthly Chart

Chart Created by Manish Jaradi Using TradingView

EUR/USD: Approaching a vital cushion

On technical charts,EUR/USD is now approaching a fairly strong cushion zone, including the July low of 1.0830, the 200-day moving average, and the 89-day moving average. This follows a failed attempt to rise above the July 31 high of 1.1045 – a risk pointed out in the previous update. See “Euro Lifted Slightly by US Downgrade, but Will it Last? EUR/USD, EUR/AUD, EUR/NZD Price Action,” published August 2.

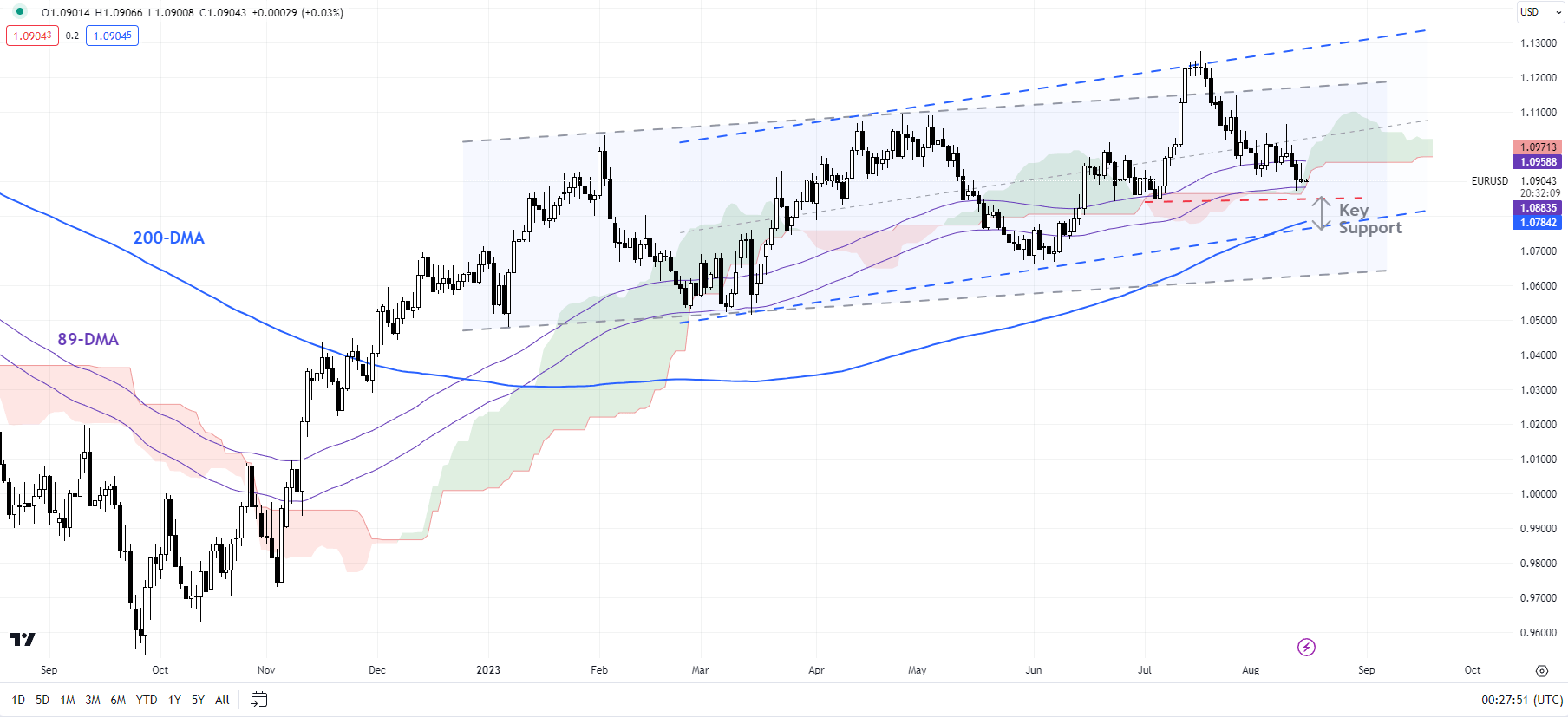

EUR/USD Daily Chart

Chart Created by Manish Jaradi Using TradingView

Any break below could open the door toward the 1.0500-1.0600 area, including the early-2023 lows. This support area needs to hold for the broader uptrend to persist. On the upside, a break above last week’s high of 1.1065 is needed for the immediate weakness to fade.

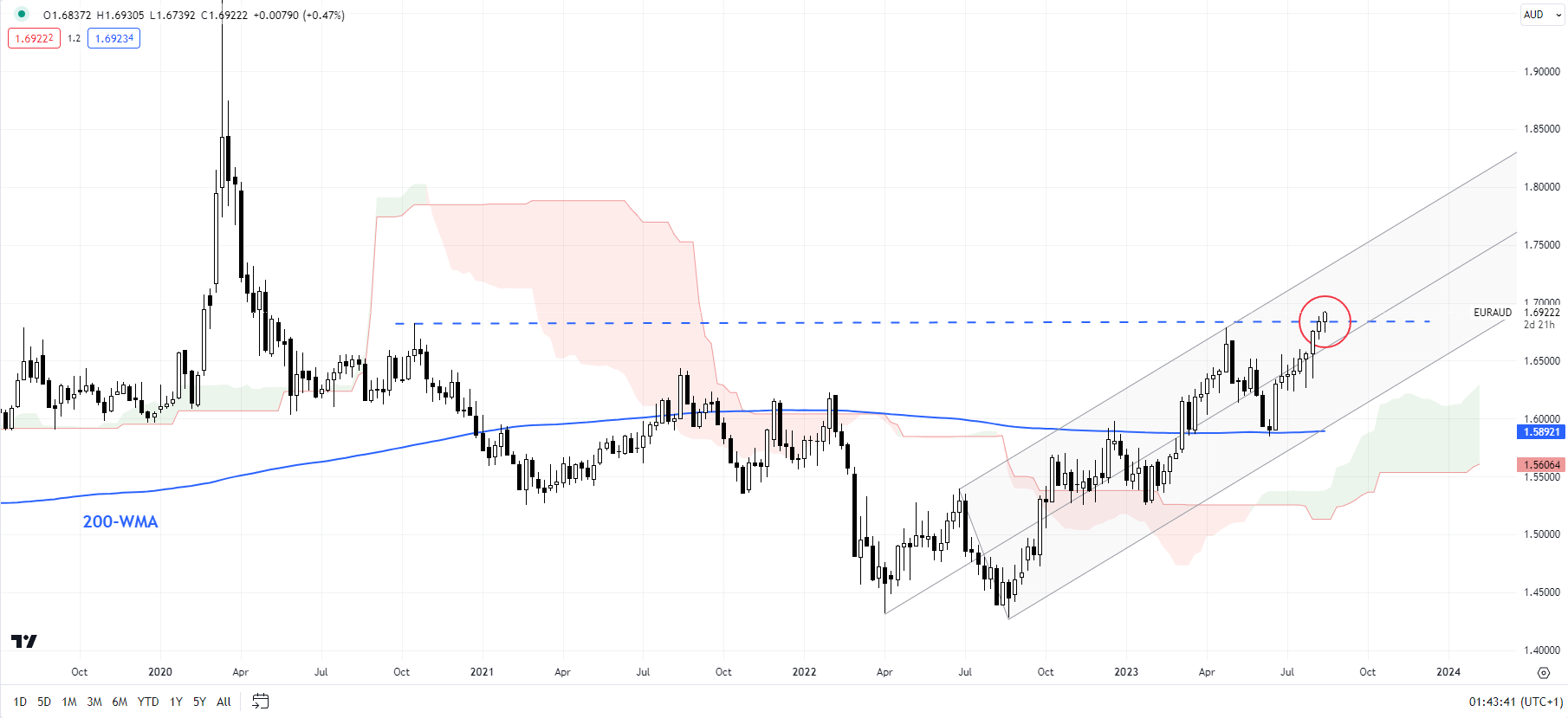

EUR/AUD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

EUR/AUD: Attempting to break higher

EUR/AUD is attempting to break above crucial resistance on a horizontal trendline from 2020, at about 1.6800. Any break above could open the way toward 1.7700 (the 61.8% retracement of the 2020-2022 slide). From a medium-term perspective, the trend is up given the higher-top-higher-bottom sequence since late 2022, as highlighted in the previous update.

EUR/GBP Daily Chart

Chart Created by Manish Jaradi Using TradingView

EUR/GBP: Upside capped

EUR/GBP continues to be weighed by a stiff converged hurdle, including the 200-day moving average, a downtrend line from early 2023, around the July high of 0.8700. Beyond any short-term sideways price action, the overall bias remains toward the downside while the resistance holds.

Recommended by Manish Jaradi

Improve your trading with IG Client Sentiment Data

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]