EURO OUTLOOK:

- EUR/USD resumes its ascent on risk-on market mood after a brief pullback earlier this week

- While positive momentum is on the euro’s side, the bullish impetus may run out of gas soon

- This article explores key EUR/USD technical levels to key an eye on in the near term

Most Read: British Pound Outlook – GBP/USD Pushing Higher on US Dollar Weakness

Recommended by Diego Colman

How to Trade EUR/USD

The euro resumed its advance on Thursday and traded around 1.0785 on the back of risk-on sentiment following a slight pullback in recent days. Taking a longer-term view, EUR/USD has staged a powerful rally over the past several months, rising more than 13% from the depths of a relentless bear market that saw the exchange rate fall below 0.9600 at the end of September last year. While broad-based U.S. dollar weakness in the FX space has contributed to the euro’s rapid recovery, there is another catalyst worth mentioning: the plunge in natural gas prices.

After reaching record highs above €300/MWh in August 2022, European gas prices have tumbled back to earth, plummeting more than 85% from those stratospheric levels amid lower demand thanks to above-normal winter temperatures. This story, coupled with ample gas inventories, has drastically reduced the likelihood of an energy crisis in the region induced by Russia’s weaponization of fossil fuel exports in the wake of its invasion of Ukraine.

EUR/USD, EUROPEAN NATURAL GAS PRICES & DXY INDEX CHART

Source: TradingView

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Although the outlook for the euro zone has improved compared to three months ago, when the situation was dire, the bloc is far from out of the woods: in fact, many Wall Street analysts still believe that a shallow recession will materialize later this year. Weak economic performance in the coming months could cap the euro’s upside in the near term, paving the way for the U.S. dollar to regain some upward momentum.

Admittedly, expectations that the Fed will adopt a less hawkish stance in the face of falling inflation have dampened appetite for the greenback and boosted riskier currencies, but traders may be underestimating the risks of further monetary tightening given the resilience of the U.S. economy.

January’s labor market report proves the previous point. According to the Bureau of Labor Statistics, U.S. employers added 517,000 workers last month, well above estimates and the largest increase in payrolls since July 2022. The strong hiring impetus suggests that wage pressures and consumption could remain higher than desired over the medium term, preventing consumer prices from falling faster toward the Fed’s 2.0% target, a situation that could lead policymakers to continue raising interest rates at upcoming meetings.

All in all, while bullish momentum is on the EUR/USD’s side, the positive trend may be on its last leg or its final stretch, so caution is warranted due to the increased probability of a reversal in price action in the not so distance future.

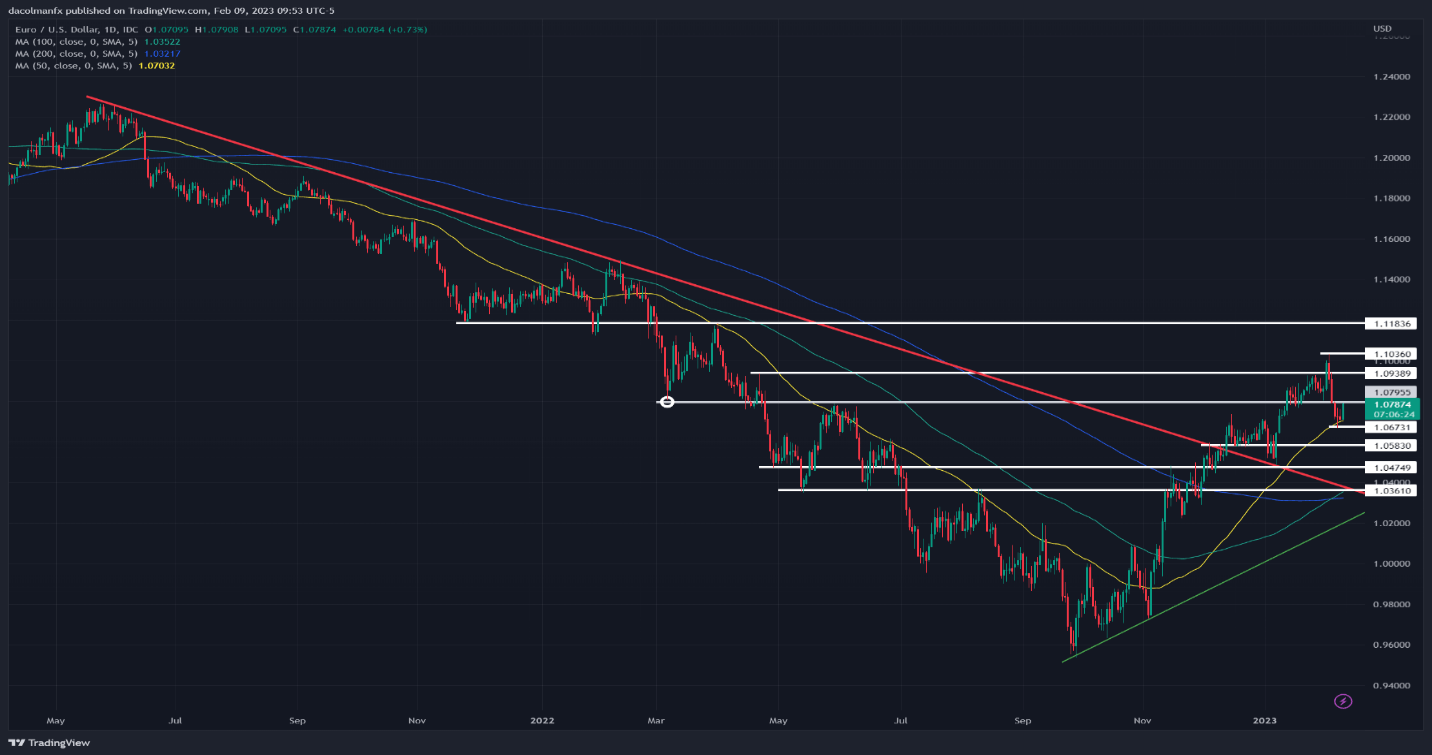

In terms of technical analysis, EUR/USD has resumed its advance after bouncing off support near its 50-day simple moving average earlier this week as seen in the daily chart below. If bulls retain control of the market and manage to push prices higher, resistance is seen near the psychological 1.0800 handle. On further strength, the focus shifts to 1.0940, followed by the February high just a touch below 1.1035. On the flip side, if sellers return and spark a bearish reversal, initial support appears at 1.0675/1.0700. If this floor is breached, there could be scope for a retrenchment towards 1.0585.