[ad_1]

EUR/USD and EUR/JPY Forecast – Prices, Charts, and Analysis

- Heavyweight US and Euro Area data are on tap this week.

- The US dollar remains undecided after chair Powell’s Jackson Hole speech.

The Federal Reserve and the European Central Bank both reiterated their stance of keeping rates higher for as long as it takes at the Jackson Hole Symposium last week, leaving EUR/USD traders with little to work with. Fed chair Powell gave the market a very gentle dovish nod when he said that the central bank would ‘proceed carefully’ when assessing future policy moves, while President Lagarde said that while progress was being made, ‘the fight against inflation is not yet won’. Both central bank heads remain data-dependent and unless inflation begins to fall sharply, rates are set to be held at current levels in the coming months.

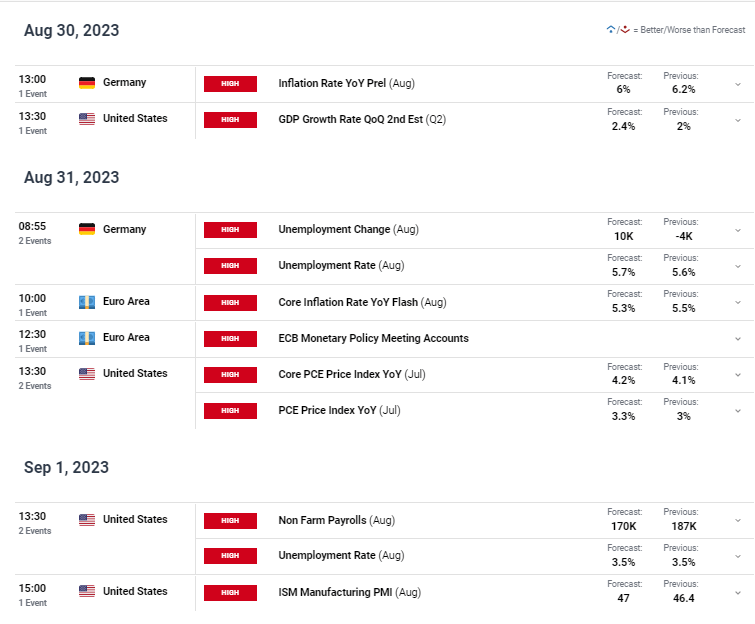

Inflation readings for Germany, the Euro Area, and the US are due this week and this is likely to give EUR/USD traders the volatility that has been lacking of late. At the end of the week, the latest monthly US Jobs Report (NFPs) will be released at 13:30 UK and this again may provide a shot of price action going into the weekend.

Recommended by Nick Cawley

Trading Forex News: The Strategy

DailyFX Calendar

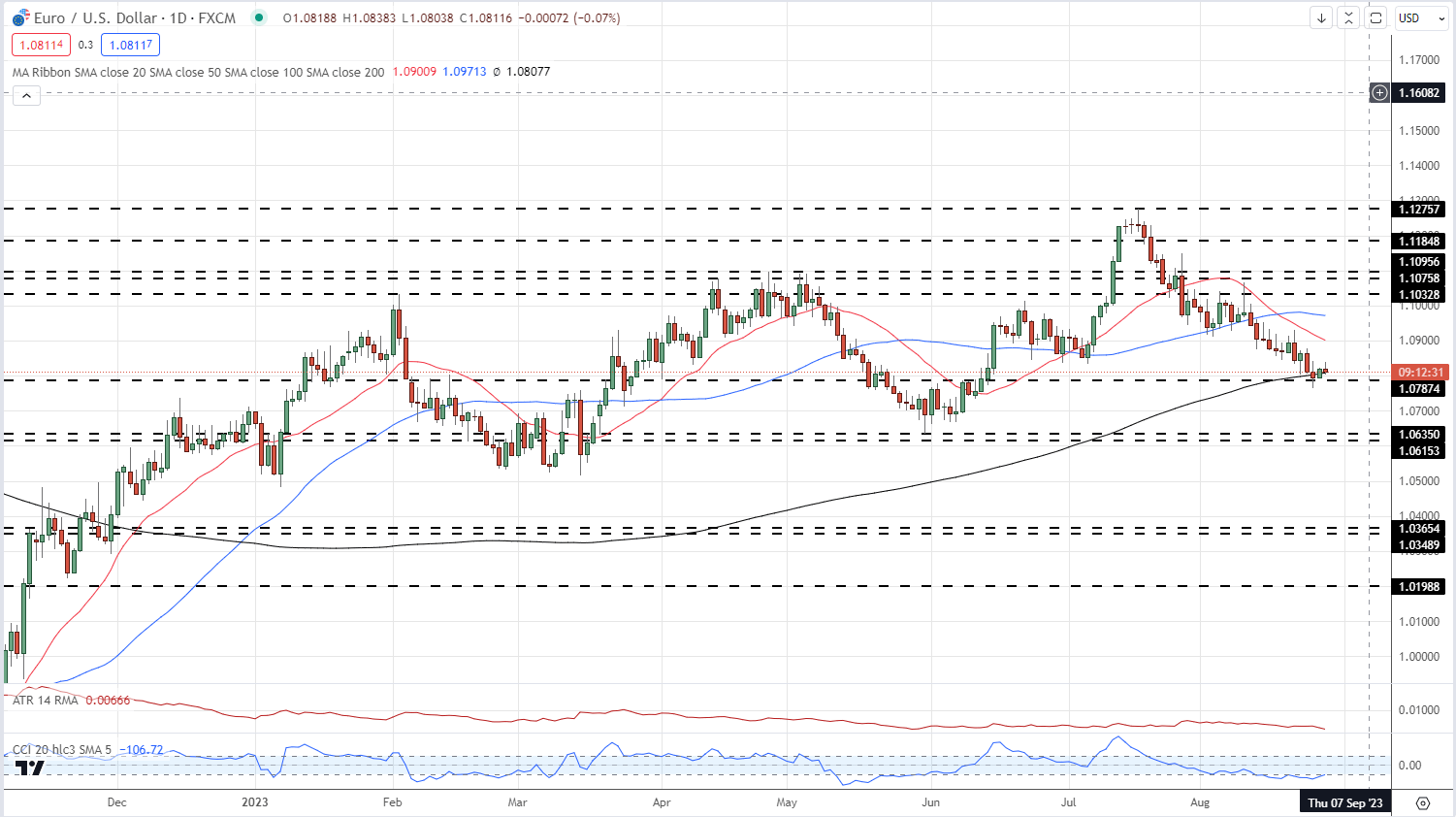

The daily EUR/USD chart shows medium-term EUR/USD weakness and the short-term state of indecision. The pair have fallen from the mid-July high of 1.1276 with little in the way of support stemming the move. EUR/USD now sits on the 200-day simple moving average with a break below here leaving the May 22 swing high at 1.0787 vulnerable. Below here there is little in the way of support ahead of the late-May swing low at 1.0635. A clear break and open below the 200-dsma leaves the pair vulnerable to a move lower.

EUR/USD Daily Price Chart – August 29, 2023

Chart via TradingView

Download the Latest IG Sentiment Indicator

| Change in | Longs | Shorts | OI |

| Daily | -1% | 17% | 6% |

| Weekly | 6% | 8% | 7% |

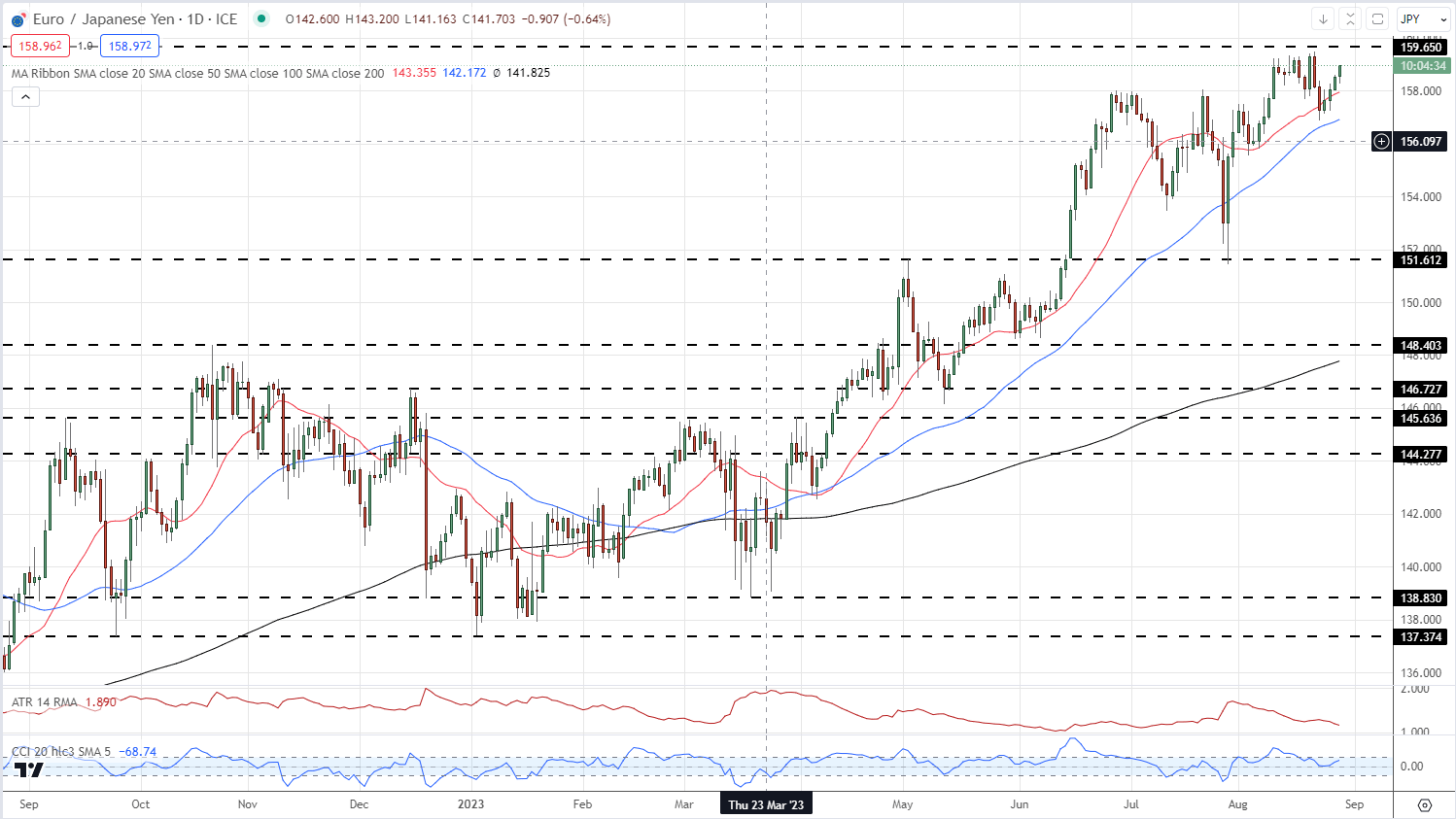

In contrast to EUR/USD, the latest EUR/JPY chart sees the pair looking to re-test a multi-year high. A break above 159.65 would see the pair back at highs last seen in September 2008. All three simple moving averages continue to support the move higher. The main sticking point is the Bank of Japan and whether they will step in and try to support the Yen. The Bank’s normal modus operandi is to try and talk the market down before they actually make a policy change. This leaves the Yen vulnerable to a sharp move higher against a range of currencies, especially the ones where multi-year levels are seen. EUR/JPY may move higher but caution is warranted.

EUR/JPY Daily Price Chart – August 29, 2023

Recommended by Nick Cawley

Traits of Successful Traders

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]