[ad_1]

EUR/USD Price, Chart, and Analysis

- EUR/USD eyeing the late-May high.

- The US dollar looks oversold but further losses are likely.

Recommended by Nick Cawley

Download our brand new Q1 Euro forecast

For all market-moving economic releases and events, see the DailyFX Calendar

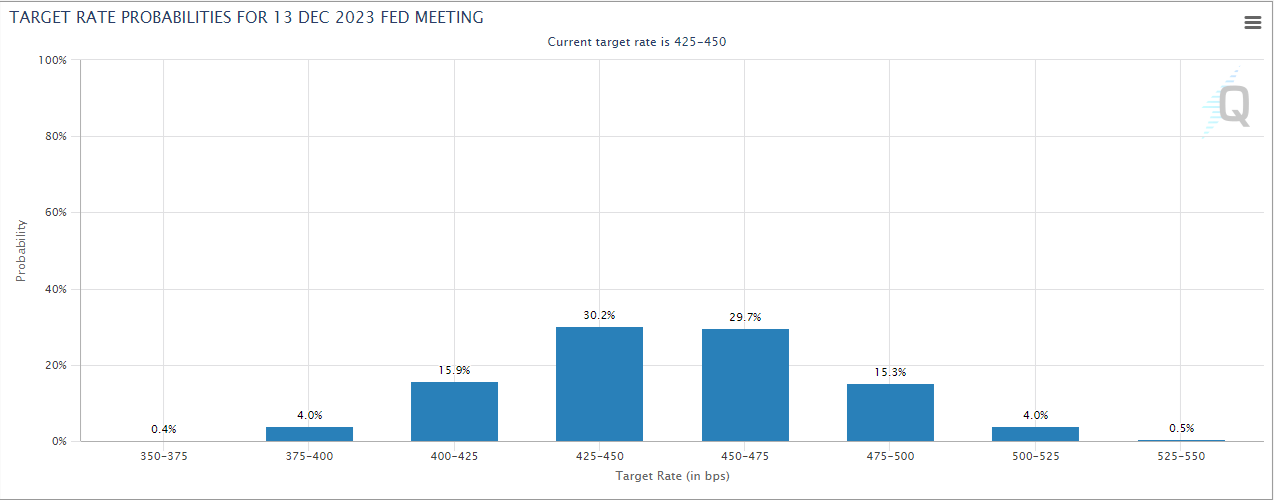

The US dollar remains in the doldrums with the greenback’s weakness seen across a range of US pairs. Financial markets are lowering their US rate hike expectations on an ongoing basis, taking US bond yields lower and the greenback with them. While various Federal Reserve members continue to talk of a terminal rate above 5% and no rate cuts in 2023, financial markets are pricing in a maximum Fed rate of 4.75% – 5.0% with a possible 25 basis point rate cut seen at the November and December Fed meetings.

While the US dollar remains under pressure from lower rate expectations, the Euro continues to be bolstered by the ECB’s insistence that rates will need to go higher to dampen ongoing price pressures. Influential ECB board member Isabel Schnabel recently told an International Symposium on Central Bank Independence that the ECB remains in a rate hike cycle and that rates must still rise ‘significantly’. With the Fed coming to the end of its rate hike cycle, and with the ECB still in full flow, rate differentials between the two will continue to favor Euro strength.

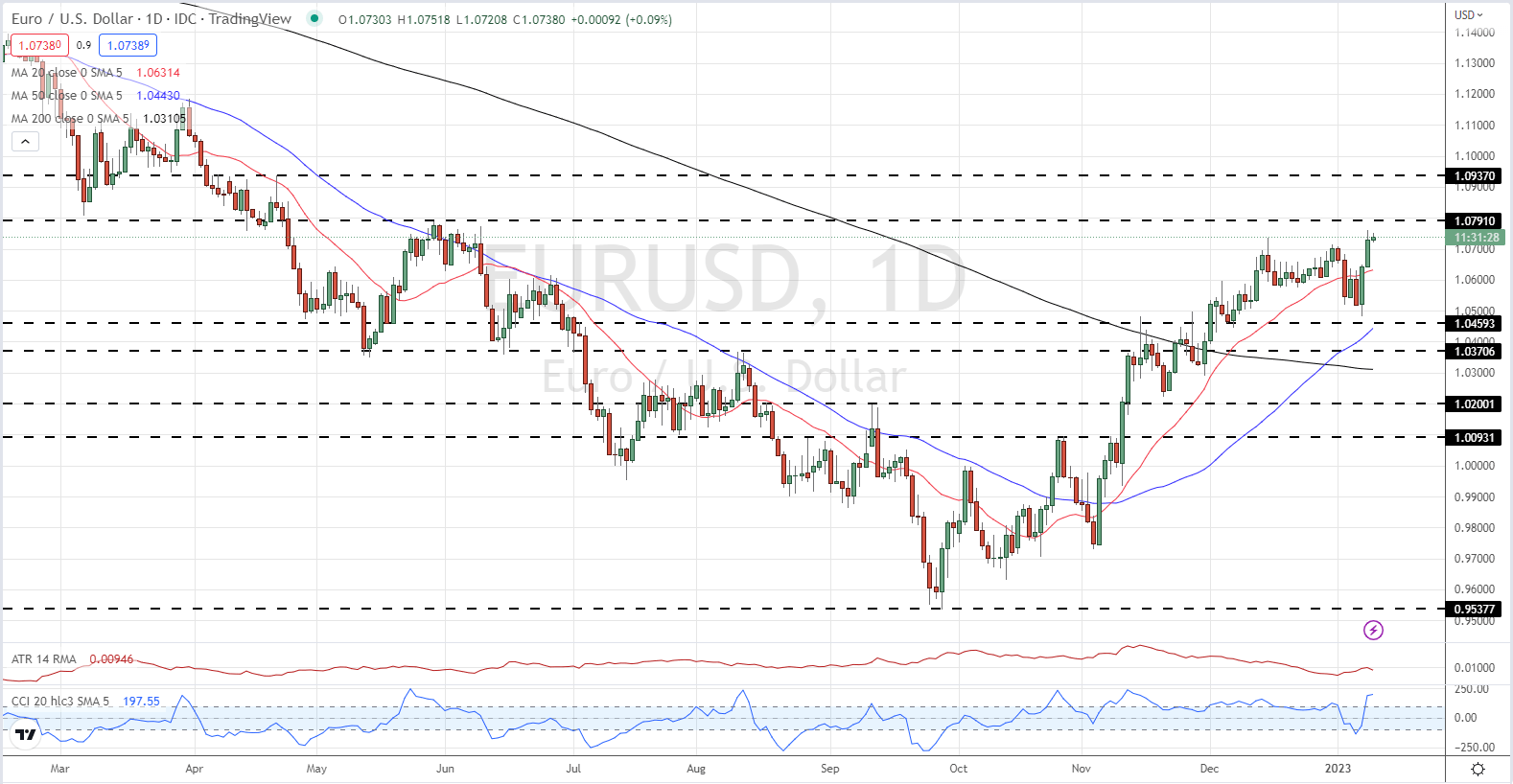

The daily EUR/USD chart shows the pair currently stalling at a fresh multi-month high after rallying around 250 pips over the last two days. EUR/USD is now at highs last seen in early-June 2022 and looks primed to test the May 30 high at 1.07870. Above here 1.09370 comes into view. The pair look overbought, using the CCI indicator which is at a two-month high.

EUR/USD Daily Price Chart – January 10, 2023

Charts via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 3% | 14% | 11% |

| Weekly | -30% | 56% | 13% |

Retail Traders Increase Net Short Positions

Retail trader data show 30.40% of traders are net-long with the ratio of traders short to long at 2.29 to 1.The number of traders net-long is 2.02% lower than yesterday and 25.16% lower from last week, while the number of traders net-short is 13.91% higher than yesterday and 28.37% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]