[ad_1]

Euro, EUR/USD, US Dollar, Treasury Yields, USD/JPY, BoJ, Crude Oil, AUD/USD – Talking Points

- Euro support wilted after US Dollar resumed strengthening

- Treasury yields are looking to make new highs as debt markets slide

- If energy prices continue higher into the northern winter, will it send EUR/USD lower?

Recommended by Daniel McCarthy

Trading Forex News: The Strategy

The Euro is wallowing near the 4 month low seen overnight as the US Dollar strides forward after Treasury yields soared.

US$ 36 billion of corporate issuance flooded the market this week in the US, sinking debt markets and lifting yields across the Treasury curve.

The benchmark 10-year bond nudged 4.27% in the US session and remains near there going into Wednesday’s trading day after having looked at 4.06% last Friday.

The Japanese Yen clawed back some gains today after comments from Masato Kanda, Japan’s Vice Minister of Finance for International Affairs.

On speculative moves in foreign exchange, he said, “if these moves continue, the government will deal with them appropriately.”

Not long after his remark, BoJ board member Hajime Takata also spoke on Wednesday but did little to move the dial in regard to monetary policy. However he did reaffirm that the bank will be patient with any adjustment to monetary policy.

The Aussie Dollar has been a laggard over the last 24 hours even though GDP data there was slightly better than expected.

2Q quarter-on-quarter GDP came in at 0.4% in line with forecasts but the annual read was 2.1% to the end of June, above the anticipated 1.8%, revealing an upward revision to prior releases.

Crude oil has hit new highs after Saudi Arabia and Russia committed to maintain their production cuts through to the end of the year.

The WTI futures contract is above US$ 86.60 bbl while the Brent contract is near US$ 90 bbl. Spot gold is steady just below US$ 1,930 at the time of going to print.

The higher cost of borrowing and energy prices appeared to dent sentiment in the Wall Street session and APAC indices mostly followed the lead.

The notable exception has been Japan’s Nikkei 225 index which saw modest gains that have been attributed to the weaker Yen. Chinese indices remain under pressure despite massive gains from the property sector there today.

The Bank of Canada will be making a rates decision later today and the interest rate market and economists are looking for no change.

The full economic calendar can be viewed here.

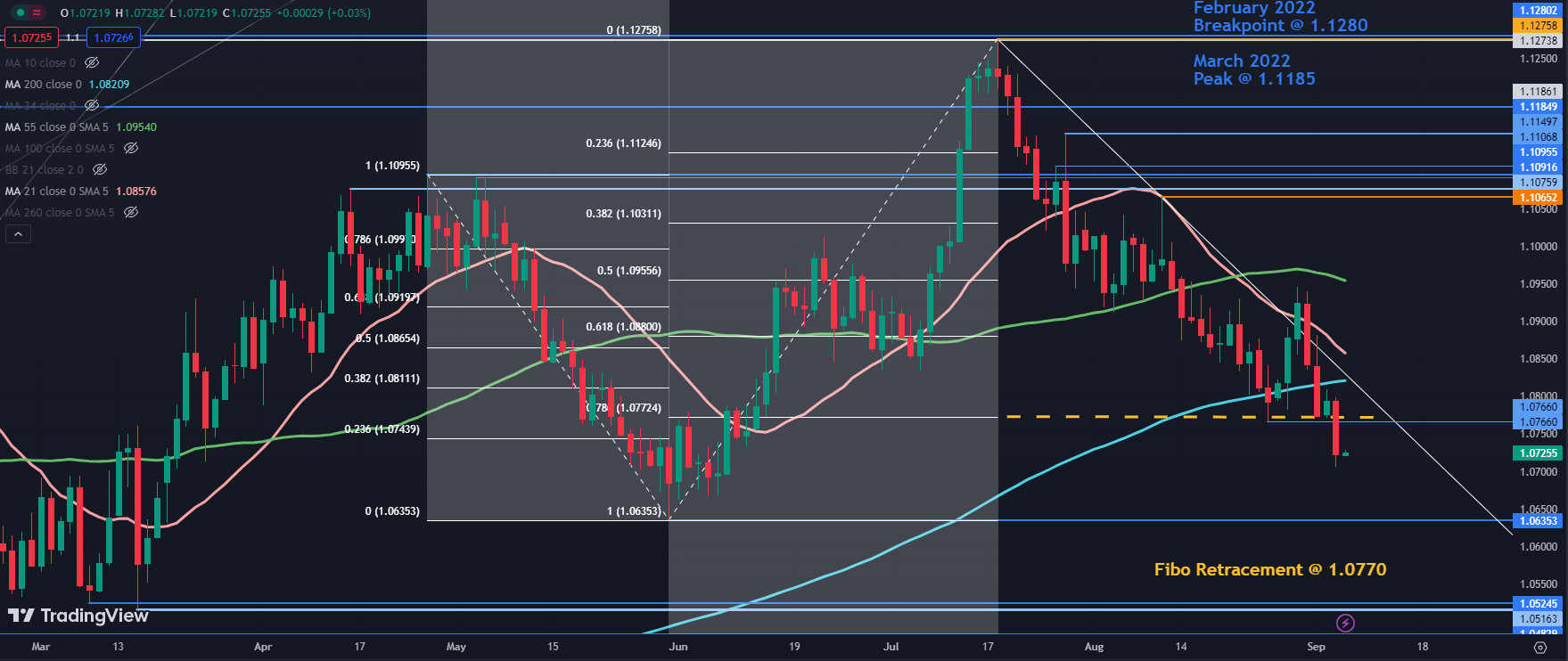

EUR/USD TECHNICAL ANALYSIS SNAPSHOT

EUR/USD broke below several support levels yesterday and those levels might offer resistance in the 1.0665 – 1.0670 area. Further up, resistance could be ahead of the prior peaks near 1.0950.

If it weres to break above there, it may see a test of potential resistance in the 1.1075 – 1.1095 area where several historical breakpoints reside and just ahead of the psychological level at 1.1100.

Further up, resistance could be at the breakpoint from the March 2022 high at 1.1185 or the recent peak at 1.1275, which coincides with two historical breakpoints.

Above those levels, resistance might be at the Fibonacci Extension of the move from 1.1095 to 1.0635 at 1.1380. Just above there are some more breakpoints in the 1.1385 – 95 area.

On the downside, support may lie near the previous lows at 1.0635 and 1.0520.

EUR/USD DAILY CHART

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

[ad_2]