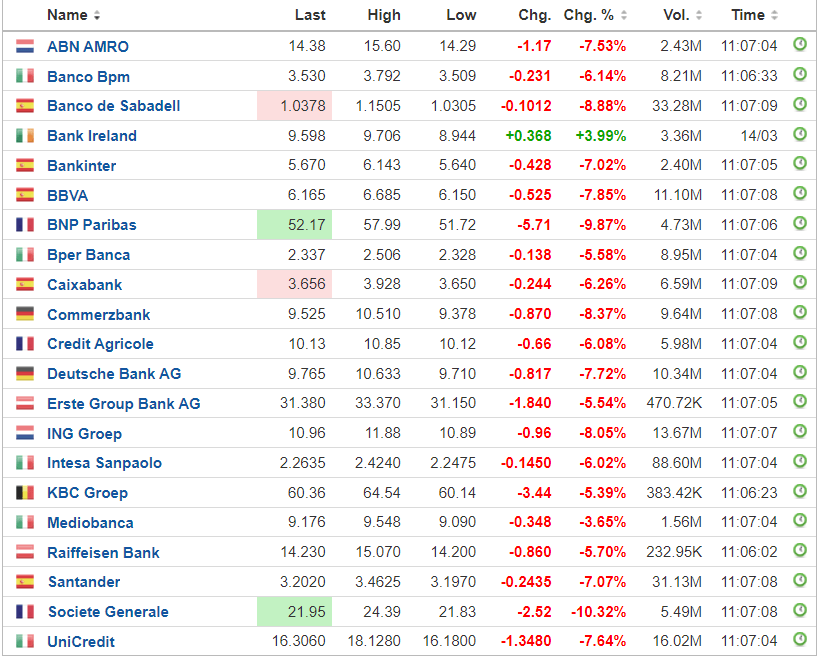

Euro Stoxx Banks Prices, Chart, and Analysis

- European bank stocks are mired in a sea of red.

- Credit Suisse (CS) slumps to a fresh record low.

Recommended by Nick Cawley

Traits of Successful Traders

After a brief respite on Tuesday when European banks printed nominal gains, a fresh wave of selling Wednesday has seen all constituents of the Euro Stoxx Bank Index register losses of between 6% and 10% (Bank Ireland not opened). The heavy selling can once again be attributed to fears that the recent collapse of both Silicon Valley Bank (SVB) and Signature Bank in the US – the 2nd and 3rd largest US bank defaults on record – may open up cracks in the European bank sector. The closure of SVB, due to losses on its bond portfolio, hammered global bank sentiment as fears that other banks’ fixed-income portfolios may also be heavily underwater.

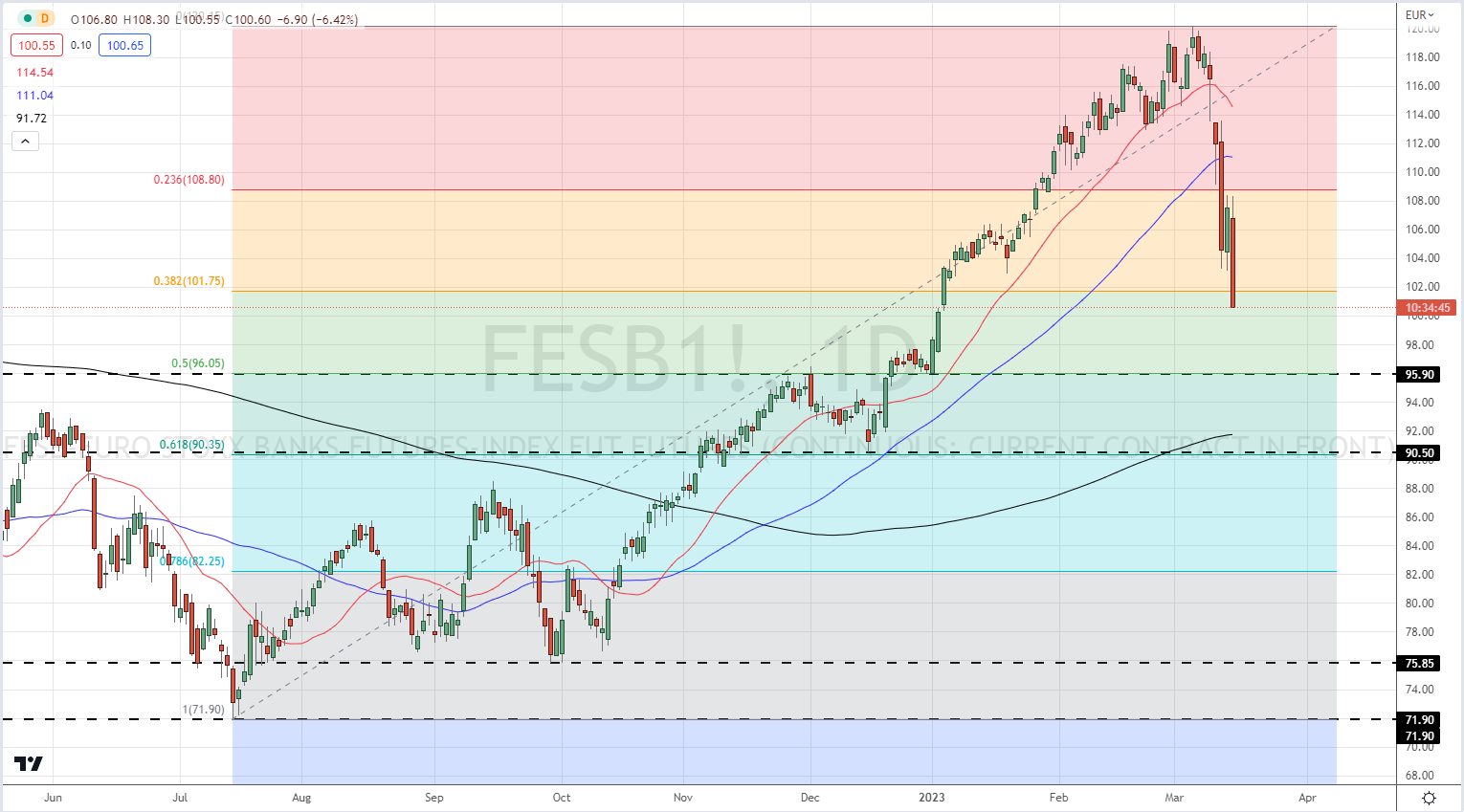

The Stoxx Banks Futures are now down nearly 16% over the last 10 days, convincingly breaking the strong uptrend that started in H2 2022. The daily chart has broken through the 38.2% Fibonacci retracement level and with little in the way of technical support left on the chart, the 50% Fibonacci level at 96.05 may soon be challenged.

Euro Stoxx Banks Futures Daily Chart – March 15, 2023

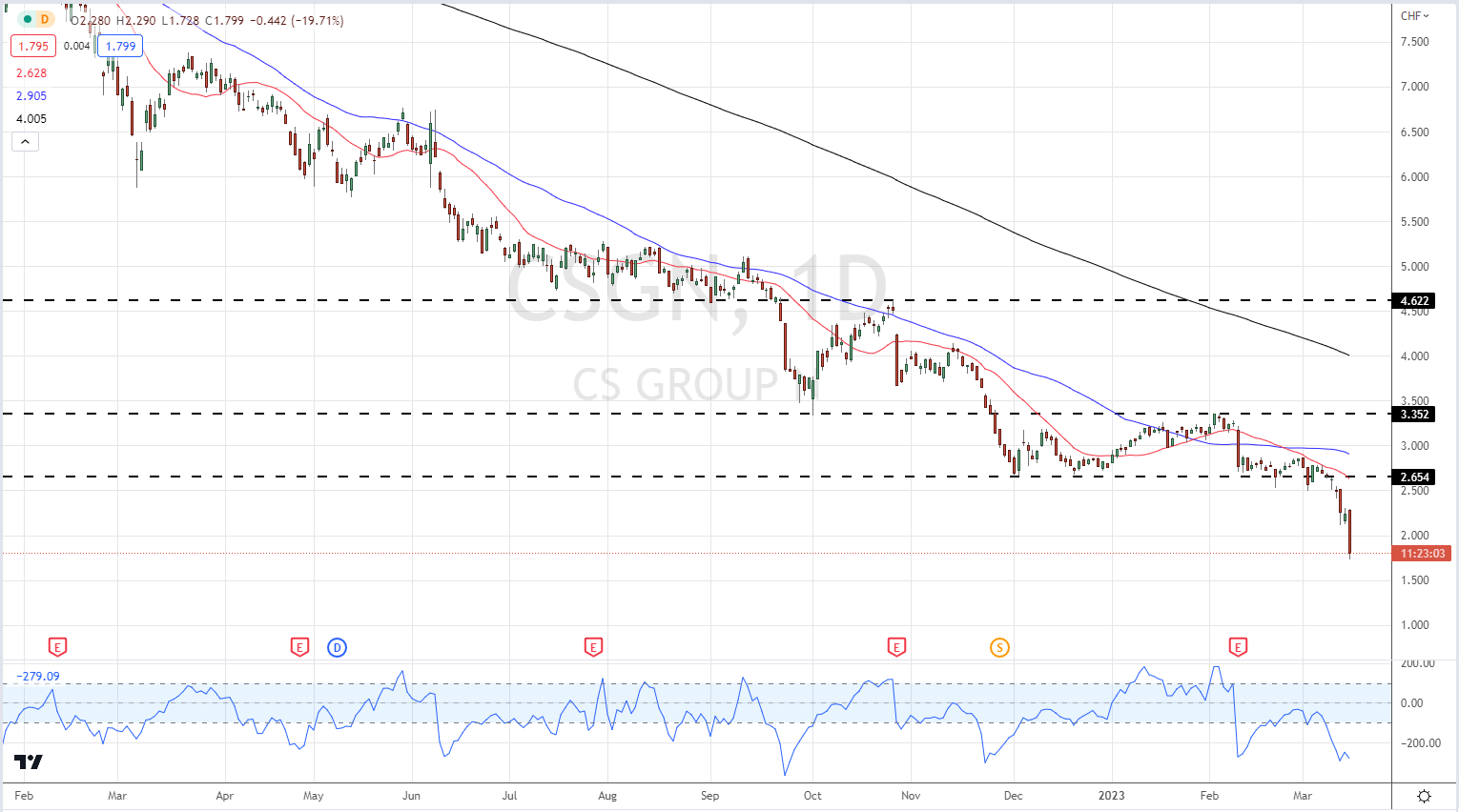

Credit Suisse (CS) continues to register heavy losses and today made another all-time low after losing 20% of its value in a few hours. Earlier in the session the bank’s largest investor, Saudi National Bank, said that it would not provide any further funds to the troubled lender, citing regulatory concerns. The Swiss bank filed its annual report yesterday – five days later than scheduled – and reported a full-year loss of EUR7.3 billion. In addition, CS said they had found ‘certain material weaknesses in our internal control over financial reporting in 2021 and 2022’.

Credit Suisse Daily Chart – March 15, 2023

What are your views on the European Bank Stocks – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.