[ad_1]

Eurozone PMI Key Points:

- Flash Eurozone Composite Output Index at 50.2 (Dec: 49.3). 7-month high.

- Flash Eurozone Services PMI Activity Index at 50.7 (Nov: 49.8). 6-month high.

- Flash Eurozone Manufacturing PMI (3) at 48.8 (Dec: 47.8). 5-month high.

Recommended by Zain Vawda

Get The Latest Euro Forecast for Q1 2023

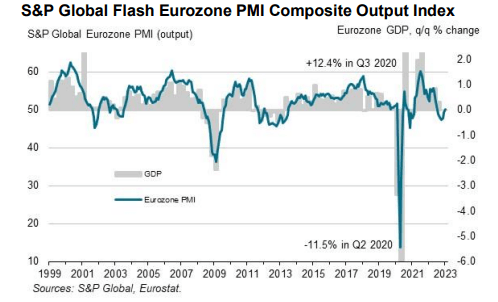

The seasonally adjusted S&P Global Eurozone PMI Composite Output Index is back above the 50 no-change level as it recorded an improvement for a third successive month. The data signaled the slowest decline since last July when activity levels first started shrinking. The decrease has now softened in each of the past two survey periods. Eurozone Services PMI Business Activity Index rose to 50.7 in January, its first rise since last July. Manufacturing PMI also improved registering the smallest drop in factory production since June last year.

Customize and filter live economic data via our DailyFX economic calendar

Growth was driven by technology (both IT services and equipment), as well as healthcare and pharmaceutical sectors, though industrial services also rebounded into growth territory. The return of growth output in the zone comes as optimism continues to improve as well with January recording the largest monthly increase in PMI business expectations since June 2020.

Some encouraging news regarding near-term prospects was also provided by the survey data on order books. Although new orders fell for a seventh straight month, the decline was the smallest recorded over this period. Average goods prices increased at a steeper rate than December, however this could be attributed to companies’ efforts to rebuild margins in the face of high energy and raw material costs as well as growing salaries and wages.

Recommended by Zain Vawda

How to Trade EUR/USD

The Euro Area showed resilience toward the end of 2022 with a host of positive data releases which so far seem to have spilled over into 2023. Earlier this morning we had GfK Consumer Confidence data from Germany which showed signs of further improvement despite missing estimates. ECB President Christine Lagarde spoke late yesterday reaffirming her belief for more rate hikes to reach the 2% inflation target. The hawkish rhetoric from ECB policymakers continues to underpin the Euro as optimism over the avoidance of a recession grows. I do think we will see some sort of recession, even a shallow one which may be confined to the smaller countries within the zone.

Market reaction

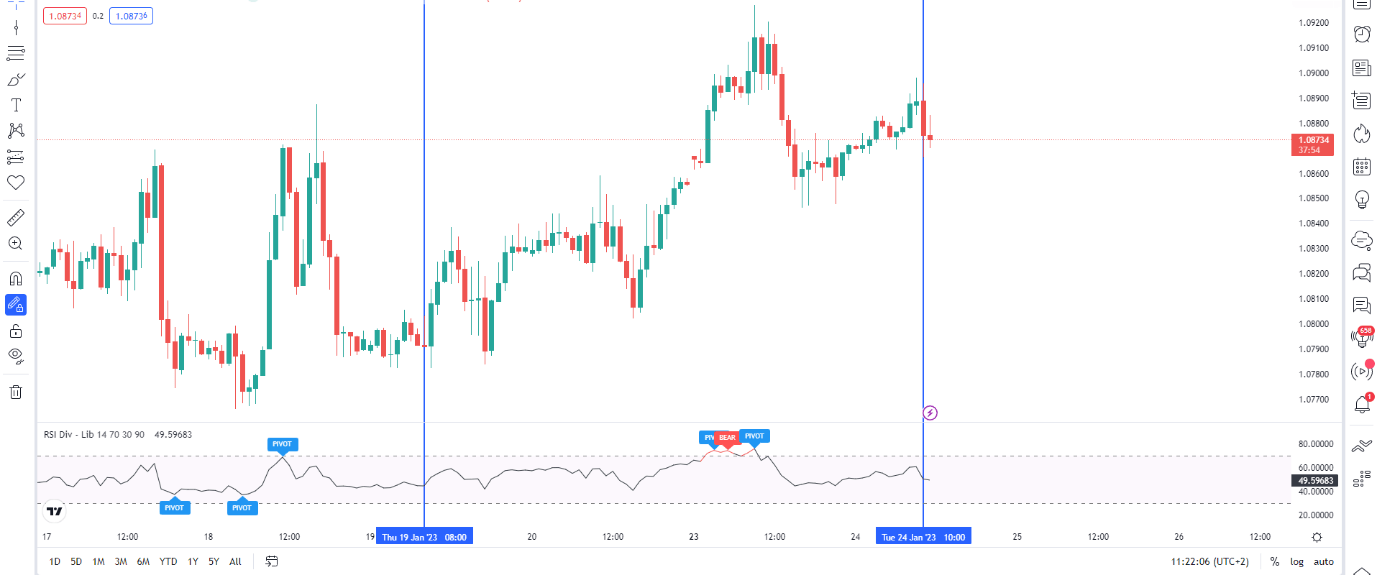

EUR/USD 1H Chart

Source: TradingView, prepared by Zain Vawda

The Initial reaction to the data saw EURUSD spike 25 pips higher before pushing down. On the daily timeframe we remain within the rising wedge pattern with the top of the wedge pattern resting around the 1.1000 area. The daily timeframe is beginning to show signs of a potential golden cross which could lead to a further push higher toward 1.10 with the RSI likely to have entered overbought territory by then.

IG CLIENT SENTIMENT: BEARISH

IG Client Sentiment Data (IGCS) shows that retail traders are currently SHORT on EUR/USD with 61% of traders currently holding short positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are SHORT suggests EUR/USD prices may continue to rise.

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]