EUR/USD ANALYSIS & TALKING POINTS

- EUR/USD is close to two month lows

- Interest rate prognoses are providing the US Dollar with a lot of support

- Some key Eurozone data are due this week

Recommended by David Cottle

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

EUR/USD is starting a new week close to two month lows, having slid pretty consistently through February.

That this may primarily be a ‘US Dollar strength story rather than a ‘Euro weakness’ one may offer Euro bulls a few crumbs of comfort, but they’ve still got work to do.

Commentary from the United States Federal Reserve has markets concerned that lower interest rates in the world’s largest economy remain a distant prospect and that, indeed, borrowing costs are likely to head higher yet unless inflation rolls over.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The US currency has reaped broad benefits from the view that its central bank has more ability and leeway to act against inflation. The Eurozone, meanwhile, has to contend with the differing needs of its twenty national economies some of which will find it hard to cope with even modest further rate rises.

Interest rate differentials are likely to dominate fundamental Euro trading this week, although a few key domestic data points are coming up, notably official Eurozone inflation figures. They’re due on Thursday and are expected to show the annualized core rate unchanged at 5.3%, even as headline inflation is tipped to relax a little.

There are other interesting data points due this week, from French inflation numbers to Germany retail sales and employment figures but, as a trading cue, the Eurozone’s CPI will top the bill by some margin. Expect any market impact from these to be fleeting, unless those inflation figures spring a major surprise.

EUR/USD Technical Analysis

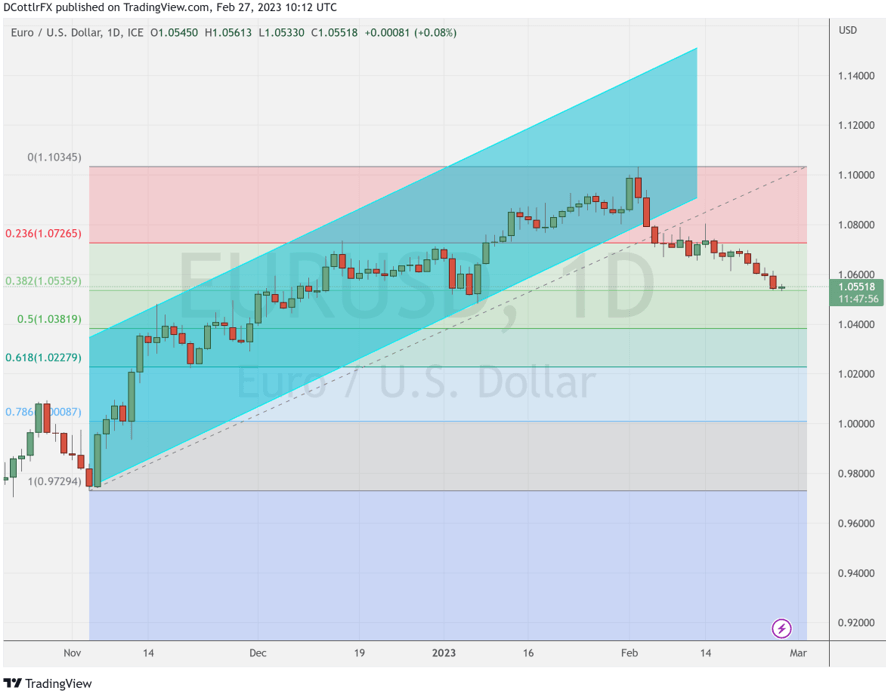

EUR/USD daily chart compiled using TradingView

EUR/USD slipped below the previously dominant uptrend channel from November 3’s lows way back on February 3. Weakness since has been very marked with only four rising days noted since.

The pair has also fallen through the first Fibonacci retracement of its rise up from those November lows to the ten-month peaks of February 2. However, the second, at 1.05359 now provides support. The market last bounced here on January 6, and that bounce proved a durable platform on the march higher. Euro bulls can’t hope for the same support this time, however.

The 200-day moving average lies uncomfortably close, at 1.0330, that’s likely to be a major target for the bears if current support is breached.

There might be some respite for the Euro in the near-term though, if only on the thesis that it might have suffered enough for now. According to IG’s sentiment indicator, 60% of traders are bullish at current levels, with only 40% now short of the pair.

–By David Cottle for DailyFX