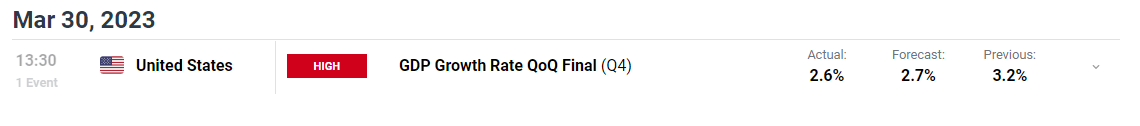

US Q4 GDP Dipped Slightly, US Economic data Remains Robust

The final version of US GDP for the fourth quarter of 2022 dipped slightly lower, from 2.7% to 2.6%, dropping from the Q3 print of 3.2%.

Customize and filter live economic data via our DailyFX economic calendar

However, despite the quarter-on-quarter drop in GDP, US fundamental data continues to surge forward. ISM services data remains in expansionary territory, earlier this week the Consumer Board’s consumer confidence survey beat estimates and jobs continue to be added to the economy ahead of next weeks non-farm payroll data for March.

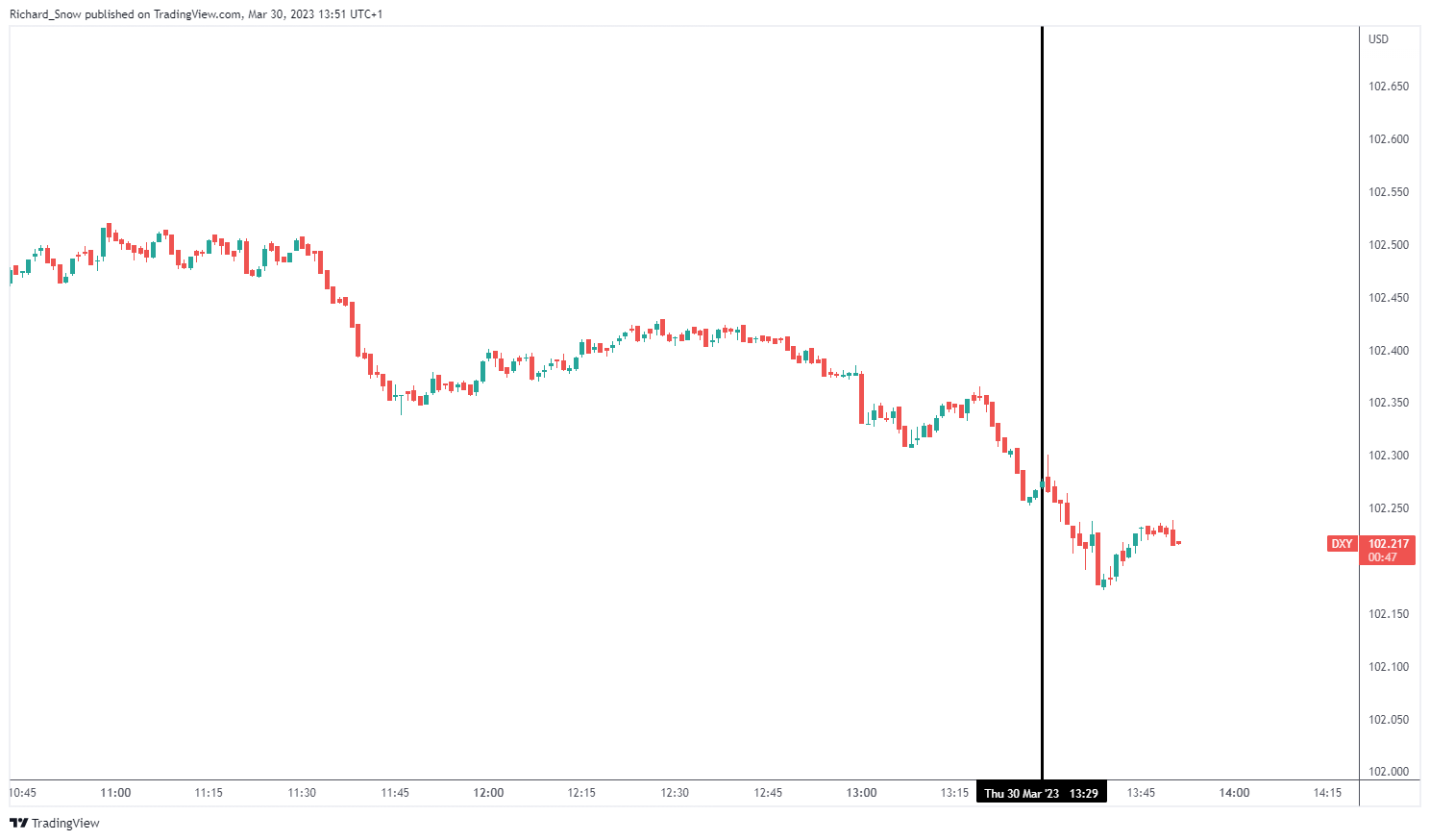

The dollar continues its slide as markets price in rate cuts in the second half of the year but also there has been a very palpable calm to financial markets this week in the wake of extraordinary measures taken by the Fed and Swiss National Bank to shore up confidence in the global banking sector. As such, markets appear to be leaning towards riskier assets like stocks, while an indication of future economic activity, oil, has also seen a sizeable rebound. Traditional safe-havens like gold and the dollar continue to see further easing.

The US Dollar Basket (DXY) – a benchmark of USD performance – dipped lower after the data release as markets continue to downplay the likelihood of further rate hikes.

US Dollar Basket (DXY) 1-Min Chart

Source: TradingView, prepared by Richard Snow

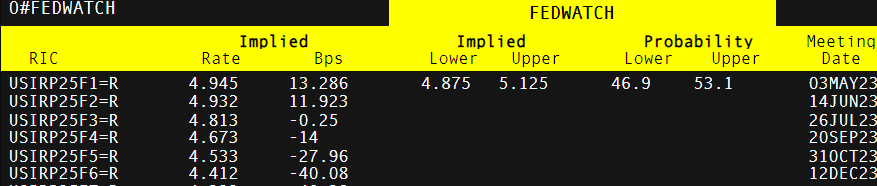

Market expectations of rate cuts have actually eased in the last week. Expectations of 75 basis points worth of cuts by year end has eased to 40 basis points. In contrast, the Fed foresees one more hike and only envisions rate cuts in 2024.

Implied Probabilities of US Fed Funds Rate

Source: Refinitiv, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX