GBP PRICE, CHARTS AND ANALYSIS:

Free Forecast on the GBP Below, Download Now

Recommended by Zain Vawda

Get Your Free GBP Forecast

Read More: EUR/GBP, GBP/USD Remain Rangebound as GBP Faces a Defining Week

GBP struggled this morning as UK retail sales disappointed in the face of a rainy and wet month of July. GBPUSD sliding some 40-pips toward the 1.2700 handle following the release while EURGBP finally catching a bid following 5 successive days of losses.

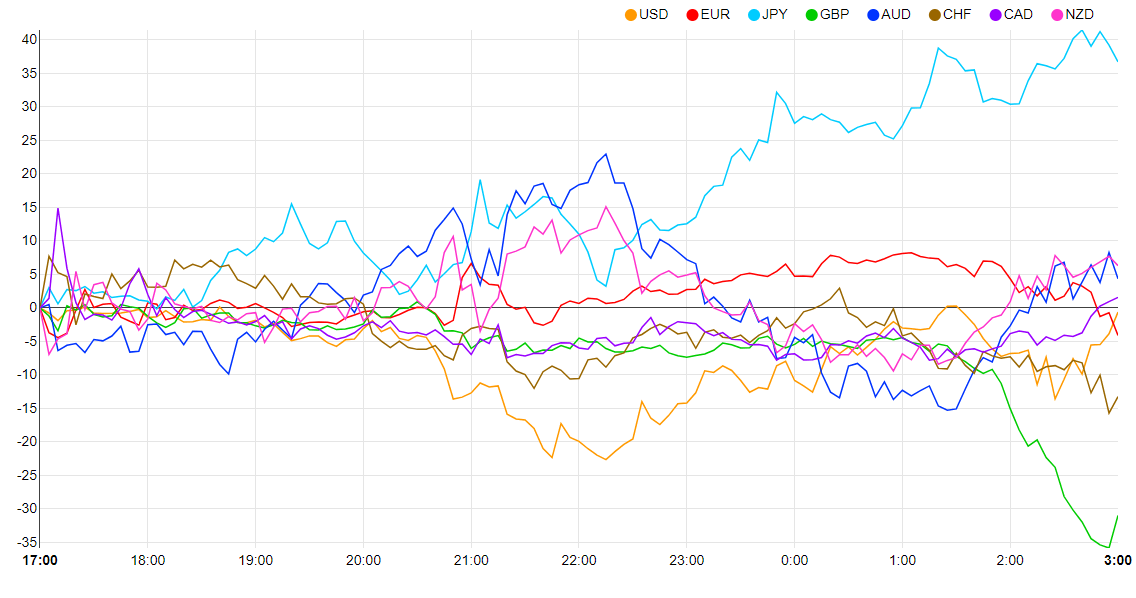

Currency Strength Chart: Strongest – JPY, Weakest – GBP.

Source: FinancialJuice

UK RETAIL SALES

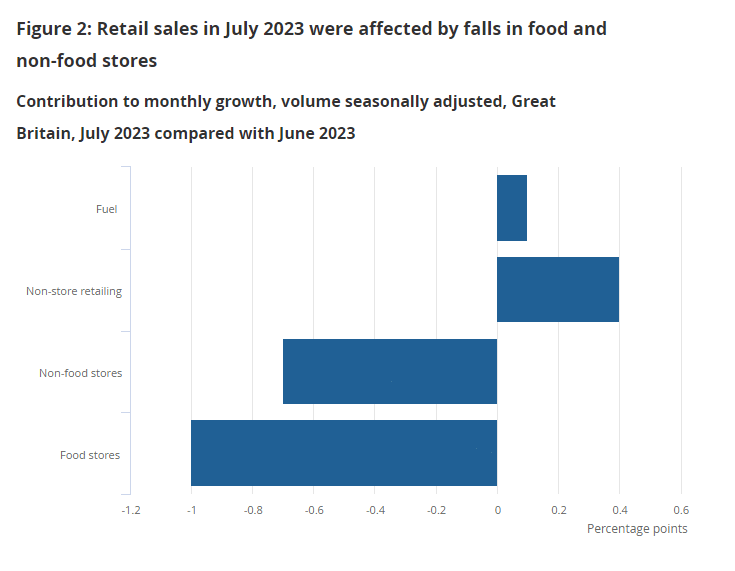

In a week that has largely served to cement a 25bps hike from the Bank of England thanks to earnings growth as well as hotter than expected inflation data, retail sales struggled. Part of this has been attributed to a terrible month of July in terms of weather, as heavy rain kept consumers at bay. Market forecasts had estimated a 0.5% drop in July, with official figures this morning showing a 1.2% drop-off. This print is more than double the forecast and could in part explain early session weakness for the Pound.

Looking more closely at the data and what surprised me was the drop in food store sales volumes which fell by 2.6% in July. Supermarkets reported that wet weather reduced clothing sales however food sales also fell back as the cost of living continues to affect consumers. Given markets are already pricing in another rate hike from the Bank of England (BoE) in September there could be more pain ahead for consumers who may to tighten their belts further. Another sign of the role the weather has played in the July data, online shopping numbers reached their highest level since February 2022 accounting for 27.4% of retail sales.

Source: Monthly Business Survey, Retail Sales Inquiry from the Office for National Statistics

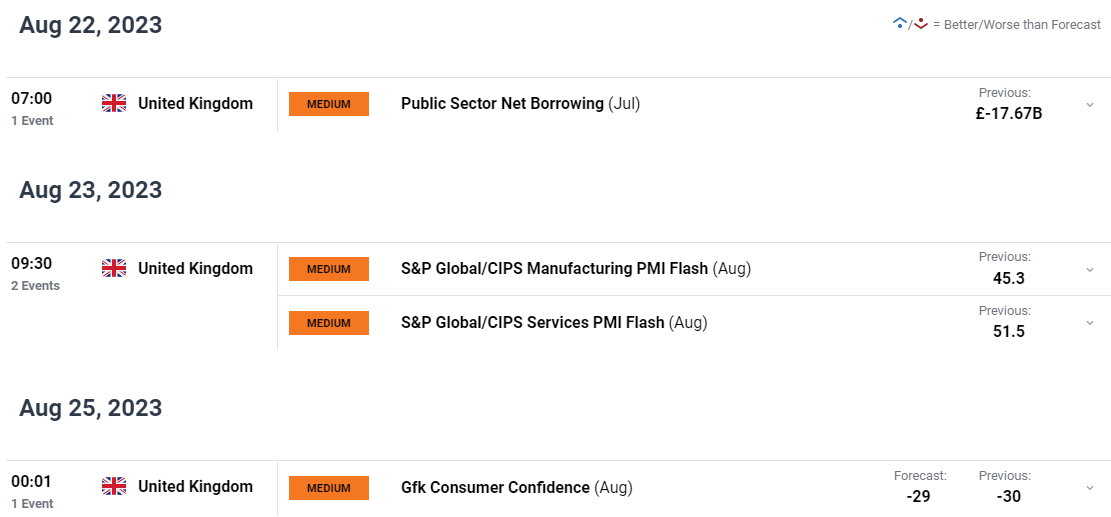

RISK EVENTS AHEAD

Over the next week or so we have a lack of high impact data events from the developed economies with markets attention likely to focus on China and developments around the property sector in the early part of the week. Thursday will see the beginning of the Jackson Hole Symposium which could cause spikes in volatility. Last year’s meeting didn’t disappoint, so will the Fed spring a surprise this time around?

For all market-moving economic releases and events, see the DailyFX Calendar

For a Full Breakdown on Trading Range Breakouts, Get Your Free Guide Below

Recommended by Zain Vawda

The Fundamentals of Breakout Trading

TECHNICAL OUTLOOK AND FINAL THOUGHTS

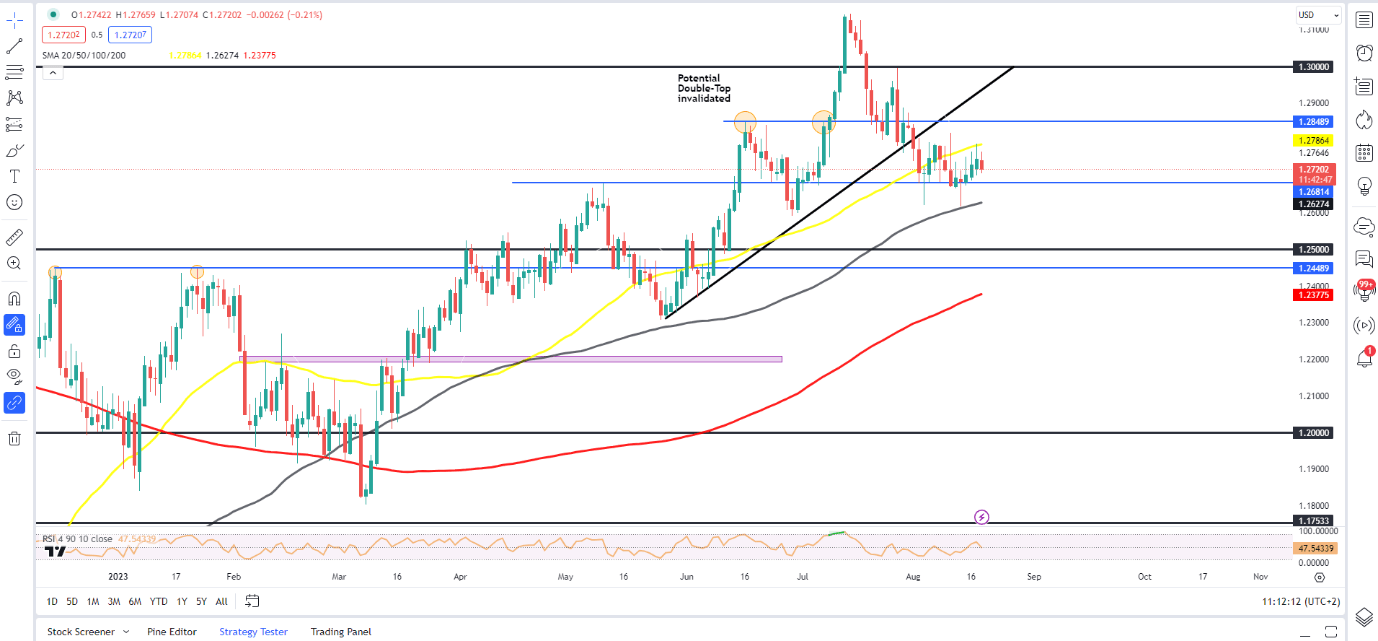

GBPUSD has been ticking lower since the fresh YTD high on July 13 as price remains compressed between the 1.2627 mark 100-day MA and the 50-day MA around the 1.26120 mark. Yesterday saw a retest of the 50-day MA as the GBP bulls returned but failed to close above once more as sentiment soured and rising treasury yields helped keep the Dollar supported.

A break and candle close above the 50-day MA faces resistance at the 1.2849 mark (June 16 swing high) before a retest of 1.3000 becomes a possibility. The 100-day MA serving as support at present with a break and candle close below finally opening up a potential retest of the psychological 1.2500 level.

Let’s take a look at what client sentiment is telling us with 54% of traders currently hold long positions. At DailyFX we typically take a contrarian view to crowd sentiment which means GBPUSD may continue lower following a brief bounce higher.

Key Levels to Keep an Eye On:

Support levels:

- 1.2680

- 1.2620 (100-day MA)

- 1.2500

Resistance levels:

- 1.2780 (50-day MA)

- 1.2850

- 1.3000 (psychological level)

GBP/USD Daily Chart

Source: TradingView, Prepared by Zain Vawda

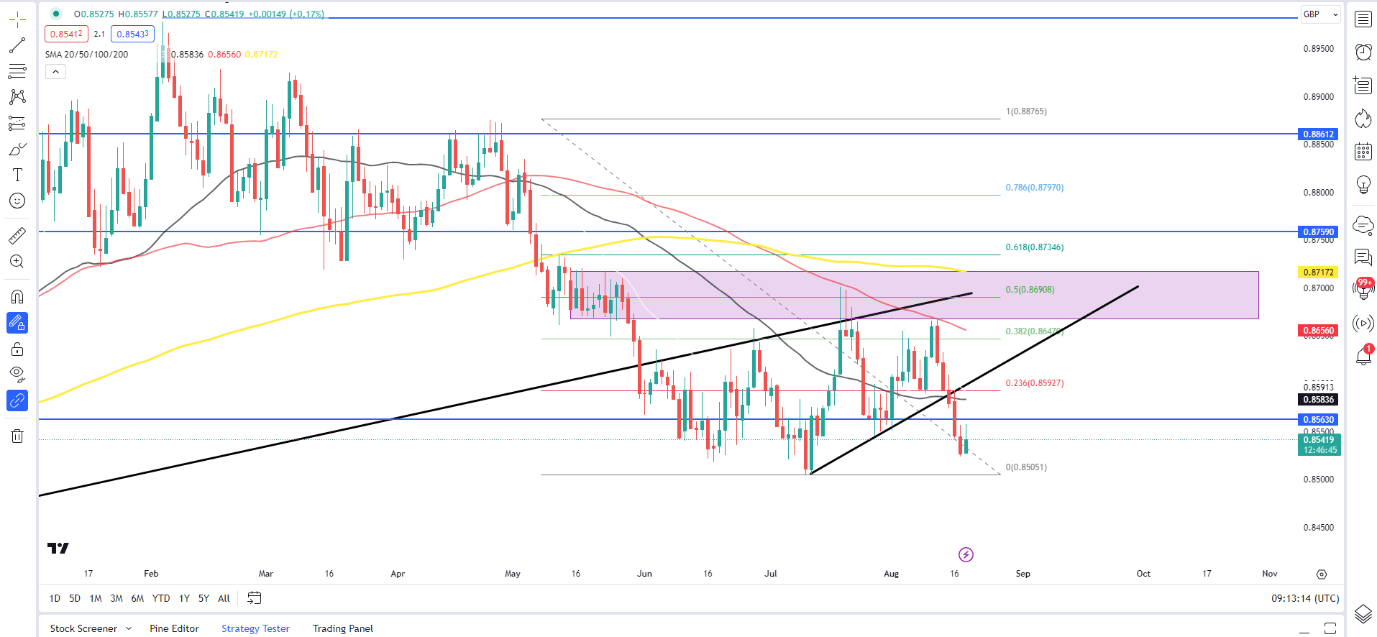

EURGBP

EURGBP has fallen sharply since my previous piece on the August 14 and likely sue to the expectations for further rate hikes from the BoE who are expected to remain on the hawkish end of the spectrum for longer.

EURGBP has broken out of the rising wedge pattern and dropped below the 50-day MA with a retest of recent lows appearing possible around the 0.8500 handle which may serve as a key area of support. At this stage I do not see the GBP having the legs for a push below the 0.8500 and believe we could be in for some consolidation between the 0.8500 and 0.8600 level over the next few days.

Key Levels to Keep an Eye On:

Support levels:

Resistance levels:

- 0.8563

- 0.8585 (50-day MA)

- 0.8647

EUR/GBP Daily Chart

Source: TradingView, Prepared by Zain Vawda

IG CLIENT SENTIMENT DATA

IG Retail Trader Sentiment shows that 72% of traders are currently NET LONG on EURGBP. The ratio of long to short is 2.57 to 1.

For a more in-depth look at EUR/GBP sentiment and the changes in long and short positioning, download the free guide below.

| Change in | Longs | Shorts | OI |

| Daily | 6% | -6% | 3% |

| Weekly | 41% | -44% | 1% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda