[ad_1]

GBP/USD – Prices, Charts, and Analysis

- Retail sales improved in February, flash UK PMIs next.

- GBP/USD traders eye the US banking sector for signs of stress.

Recommended by Nick Cawley

How to Trade GBP/USD

Most Read: BoE Raise Rates by 25bps, Expecting Inflation to Cool, GBP Edges Higher

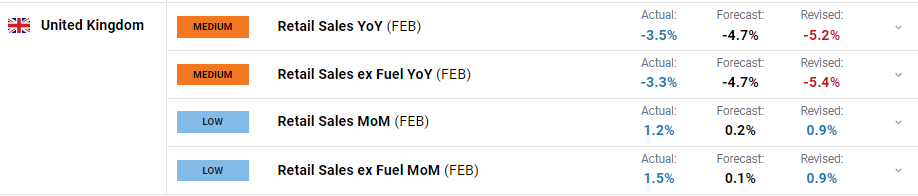

UK retail sales beat expectations in February on both a monthly and annual basis. According to the Office for National Statistics (ONS) retail sales volumes increased by 1.2% in February following a rise of 0.9% in January (upwardly revised from 0.5%). According to the ONS, non-food store sales rose by 2.4$ over the month, while food store sales rose by 0.9% ‘with some anecdotal evidence of reduced spending in restaurants and on takeaways because of cost-of-living pressures’.

The latest UK flash PMIs will be released shortly with the series expected to be flat to marginally higher compared to last month.

For all market-moving data releases and events, see the DailyFX Economic Calendar

GBP/USD continues to edge higher, driven mainly by US dollar weakness. While Sterling in itself is neutral, the US dollar has been moving lower over the recent weeks on expectations that the Fed will hit the pause button on further rate hikes. The recent bout of US banking turmoil and potential contagion is now being factored into the Fed’s thinking and may prevent Jerome Powell from tightening monetary policy further.

GBP/USD has moved around 450 pips higher over the last two weeks with any pullbacks seen as a buying opportunity. The pair broke above 1.2300 on Wednesday and Thursday but were unable to close and open above this level to allow GBP/USD to move higher. Today’s session is quiet so far so a break above yesterday’s multi-week high at 1.2344 is unlikely. Initial support is seen around 1.2200/1.2210.

GBP/USD Daily Price Chart – March 24, 2023

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 5% | -5% | -1% |

| Weekly | -10% | 10% | 0% |

Retail Trader Data is Mixed

Retail trader data show 43.70% of traders are net-long with the ratio of traders short to long at 1.29 to 1.The number of traders net-long is 5.07% higher than yesterday and 10.89% lower from last week, while the number of traders net-short is 0.52% higher than yesterday and 17.16% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

What is your view on the GBP/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]