[ad_1]

GBP/USD – Prices, Charts, and Analysis

- First Citizen to buy Silicon Valley Bank.

- Sterling steadies around 1.2250 against the US dollar.

Recommended by Nick Cawley

Trading Forex News: The Strategy

Most Read: British Pound Latest: GBP/USD Bullish Trend is Intact but Slowing Down

Financial markets received an early boost Monday after US bank First Citizen BancShares revealed that it had bought failed US lender Silicon Valley Bank. First Citizen bought around $72 billion of SVB’s assets and loans at a discount of $16.5 billion while the FDIC will hold around $90 billion of SVB’s assets.

The European banking sector pushed higher at the open on the SVB news but has given back most of that outperformance as we write.

European Bank Index Futures

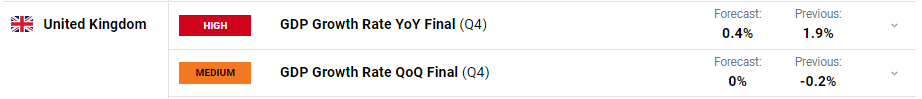

There is little in the way of UK data this week until Friday when the latest quarterly and annual GDP numbers are released. The UK is forecast to have grown by 0.4% annualized while no growth is expected on a Q/Q basis.

On the right-hand side of GBP/USD, the US dollar has a few more data releases this week with the latest look at US GDP on Thursday, and the Fed’s favored inflation reading core PCE released on Friday, the two standouts.

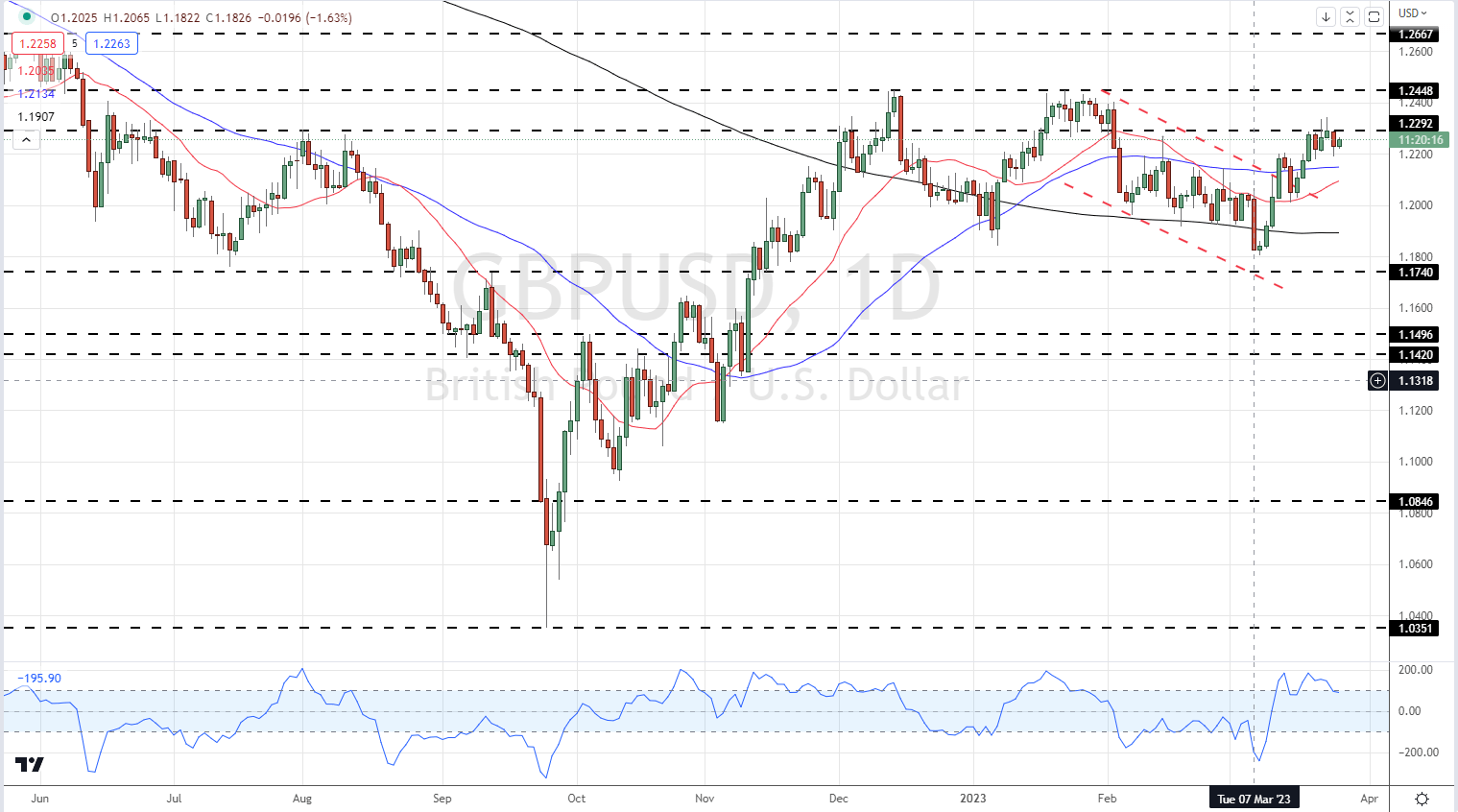

For all market-moving data releases and events, see the DailyFX Economic Calendar

GBP/USD is trading around the 1.2250 level, although today’s range is very tight. The recent pattern of higher highs has broken while the pattern of higher lows is just about in place. All three moving averages are supportive, while the CCI indicator is starting to move lower and out of extreme levels. The first level of resistance remains at 1.2292, ahead of 1.2300 and 1.2344, while there is a cluster of support between 1.2170 and 1.2210. Cable traders should wait for volatility to return to the pair before making a move.

GBP/USD Daily Price Chart – March 27, 2023

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 3% | 8% | 6% |

| Weekly | 4% | 1% | 2% |

Retail Trader Data is Mixed

Retail trader data show 48.89% of traders are net-long with the ratio of traders short to long at 1.05 to 1.The number of traders net-long is 2.64% higher than yesterday and 8.55% higher from last week, while the number of traders net-short is 3.60% higher than yesterday and 0.22% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

What is your view on the GBP/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]