GBP/USD Prices, Analysis, and Charts

- GBP/USD saw its biggest fall for six weeks on Thursday

- Friday’s weak UK retail data saw it sliding further

- Gains made since September’s trough are under threat

Recommended by David Cottle

Trading Forex News: The Strategy

The British Pound looks set to end the week under severe pressure against the US Dollar, with feeble economic data on Friday stoking recession fears over its national economy.

Thursday’s 0.5% percentage point interest rate rise from the Bank of England took base rates to peaks not seen since 2008 (3.5%). But even that wasn’t enough to prevent the biggest daily fall for GBP/USD in six weeks, clearly underlining the pickle in which Sterling finds itself.

Markets interpreted the move as a ‘dovish’ rate hike, even though six of the nine Monetary Policy Committee members in London voted for it and one further member wanted more stringent action.

This split does not at face value suggest the Bank is inclined to hold off from raising rates further. To be sure Bank of England Governor Andrew Bailey stood out among central bankers in suggesting we might be seeing glimmers of hope that inflation could slacken. But even as he did so, he suggested that further rate hikes would still likely be appropriate given the tightness of local labor conditions. Still, the market delivered its verdict and the Pound duly fell.

On Friday came news that neither the World Cup or Black Friday bargains coaxed UK consumers to part with what little inflation has left in their wallets. Sales volumes fell 0.4% on the month in November, official figures showed, worse than the 0.3% slide expected. Market researchers GfK said consumer confidence was a little better this month, but still close to all-time lows.

There was slightly better news in December’s Purchasing Managers Index data. They showed the dominant service sector still in expansionary territory, if by a whisker, and a modestly less-awful month for manufacturing. Firms reported price pressures easing further from this year’s historic highs, which may count as another glimmer for Mr. Bailey. But the numbers do nothing to dispel fears that the UK is in recession, and they all weighed on Sterling in the London morning session.

The markets will now look ahead to PMI numbers out of the US, which will likely be the data highlight of the day.

Recommended by David Cottle

Introduction to Forex News Trading

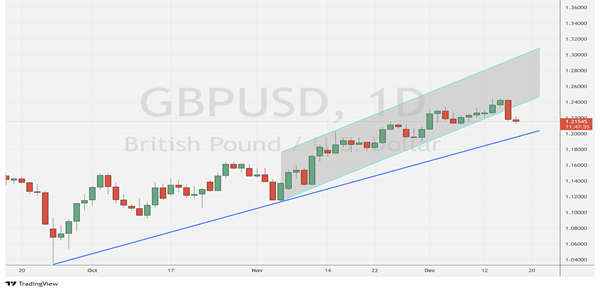

GBP/USD Technical Analysis

–Chart Prepared by David Cottle using TradingView

Thursday’s daily close saw GBP/USD fall convincingly below an upward trendline which had previously reined in the bears’ enthusiasm for five weeks. This puts clear downside pressure on the pair, with psychological support at 1.20 likely to prove enticing. Interestingly, a test of this support would now put the rising trendline from October 26’s low under pressure. October 26 saw lows not seen since 1985 and, although they are not under immediate threat, sterling bulls will need to defend November 3’s low of $1.1164 with everything they have to prevent a medium-term retest.

Closer to hand, the market’s 200-day moving average may provide some near-term support. It comes in at $1.2164 and is probably worth watching on a daily and weekly closing basis as Friday goes on.

–By David Cottle For DailyFX