[ad_1]

GBP/USD Prices, Charts, and Analysis

- The Bank of England is expected to add another 50 basis points to borrowing costs this week

- The US Federal Reserve may only add 25

- But the Forex market will likely make sure before any big moves are made

GBP/USD traders can look forward to interest rate decisions from both sides of the currency pair this week, with the United States Federal Reserve and the Bank of England due to make their February moves on Wednesday and Thursday, respectively.

Perhaps the biggest question in the global foreign exchange market right now is how close the Fed might be to ending its cycle of rate increases. There’s broad consensus that we’re not there yet, however, and the markets are looking for a quarter-point increase this time around.

Meanwhile, the Bank of England is tipped to raise its own base rates by half a percentage point. That would take them to 4%, their highest point since the financial crisis of 2008, with more increases expected. However, there have been dissenting voices on the rate-setting Monetary Policy Committee and a smaller increase would seem to remain very much in play.

Still, Sterling has garnered some broad support from interest rate differentials since it troughed against the US unit in October of last year. It’s important to stress that this hasn’t necessarily been much of a confidence vote in Sterling’s home economy which continues to under-rev, plagued by inflation and post-Covid fallout. However, there is reportedly some hope that BoE Governor Andrew Bailey and his colleagues may now find the outlook at least a little less gloomy than it was at the end of last year.

Last year they warned of a prolonged recession as energy bills surged. However, official figures since have pointed to ongoing sluggish economic growth and a high degree of labor-market resilience.

GBP/USD remains quite well supported, having risen from the $1.10 mark to the $1.24 handle in the past three months or so. However the latter, psychological resistance level has yet to be conclusively broken through, and it seems probable that it will take delivery of that half-percentage-point rise to do the trick.

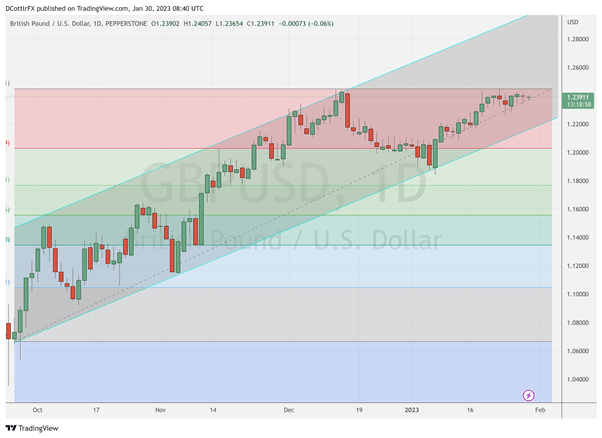

GBP/USD Technical Analysis

Chart Prepared by David Cottle Using TradingView

GBP/USD’s broad uptrend channel remains quite well respected but, for all that, hasn’t seen a convincing upside test since December 22 when the pair topped out at 1.24521.

The first Fibonacci retracement of its rise to that level from last October’s lows remains an important support, with very little appetite evident on the part of sterling bears to push it far below that point.

There’s plenty of room for upside before we get to the top of the current uptrend channel, however. That doesn’t come in until 1.29261 at this point and probably won’t be challenged anytime soon. However, the previous top might be, with this week’s interest rate decisions likely the catalyst. It will be fascinating to see whether the bulls can push matters durably above 1.25, something they’ve notably failed to do so far this year.

If they fail to do so this week, it could well be that the uptrend channel base comes back into play. That can be found at 1.21566. Admittedly that is well below the current market (GBP USD was at 1.23908 0845 GMT Monday). However,r it is much closer than that channel top.

IG’s own sentiment data suggest that progress could be hard won for the Pound in any event. More than 60% of respondents are in the bearish camp at current levels.

—By David Cottle for DailyFX

[ad_2]