German Dax Outlook:

- Dax 40 dips as bullish momentum fades – can bulls overcome the next technical barrier of resistance and drive prices back towards 15000?

- Equities continue to monitor changes in the fundamental backdrop ahead of US CPI while Dollar remains mixed.

- German Dax bullish above 14700

Recommended by Tammy Da Costa

Get Your Free Equities Forecast

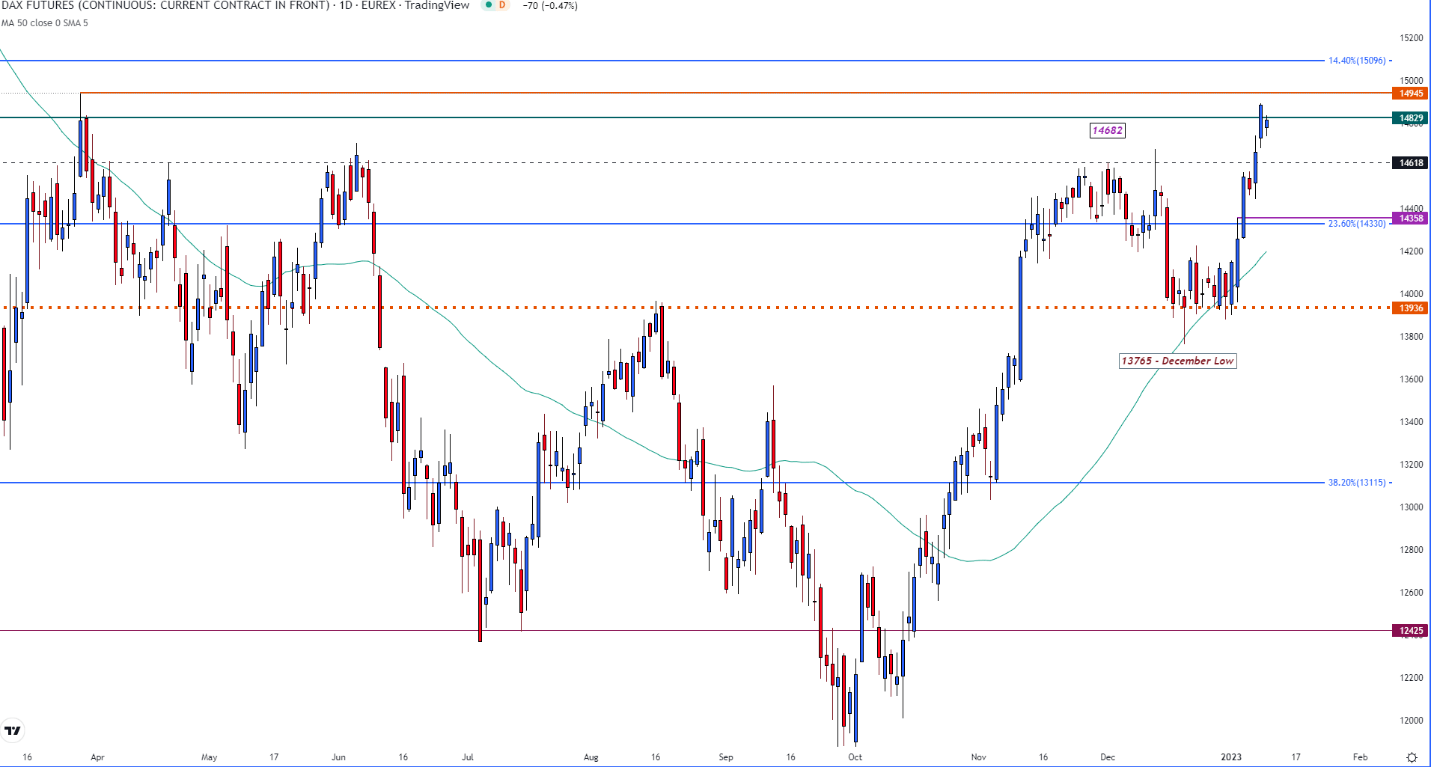

Equity futures have taken a breather ahead of tomorrow’s US CPI data as investors awaited Fed Chair Jerome Powell’s speech. With Friday’s equity rally driving Dax futures back above 14000, an extension of the upside move allowed bulls to drive prices higher before peaking at 14894.

Despite central banks reaffirming their intentions to continue to hike rates despite rising risks of a global recession, technical levels have provided an additional catalyst for price action.

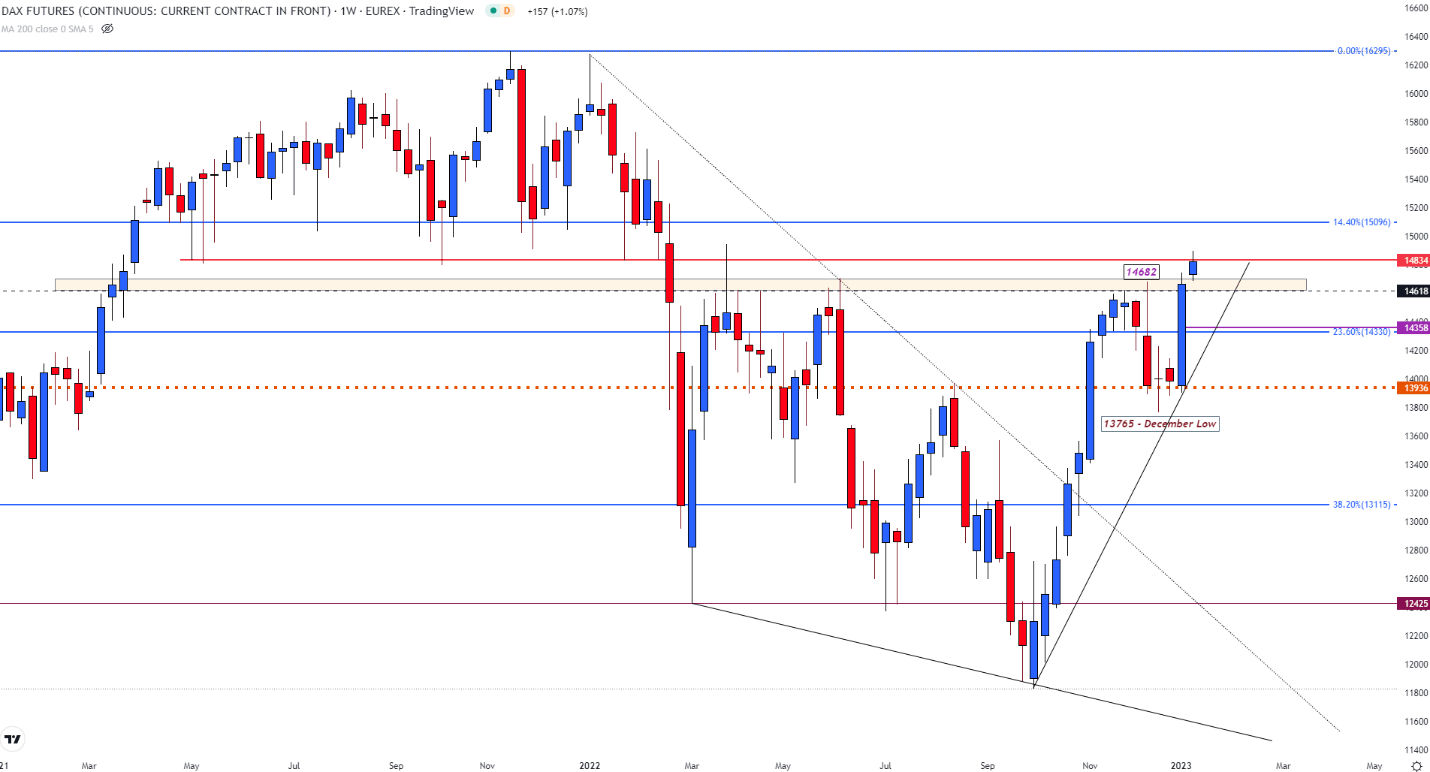

After rebounding off the October low of 11829, the performance-based Dax enjoyed nine-weeks of gains before stalling at the November high of 14618. With the formation of a doji candle on the weekly chart suggestive of indecision, the zone between 14618 and the December high of 14682 remains key for the imminent move.

Dax Futures Weekly Chart

Chart prepared by Tammy Da Costa using TradingView

While Dax futures dip below 14829, the 14700 and 14900 psychological levels continue to provide support and resistance for the short-term move. A hold above 14900 could then bring the March 2022 high back into play at 14945 opening the door for 15000.

Dax 40 Daily Chart

Chart prepared by Tammy Da Costa using TradingView

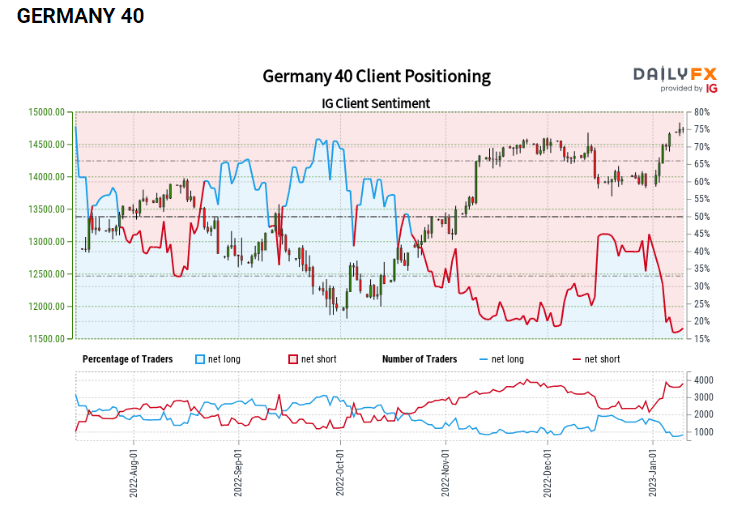

Dax Positioning Reaches Extremes – Bullish Sentiment Persists

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Germany 40 prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Germany 40-bullish contrarian trading bias.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707